JCPenney 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 11

Management’s Discussion and Analysis of Financial Condition and Results of Operations

LIFO gross margin increased 70 basis points as a percent of

sales, reflecting a better product mix, higher generic dispensing

rates in pharmacy and better control over shrinkage, despite

implementation of more competitive pricing. In addition, gross

margin for 2000 included inventory related charges of $104 mil-

lion, which represented incremental markdowns on discontinued

merchandise in order to reposition the merchandise mix and to

liquidate merchandise under the store closing plan. Gross margin

included LIFO charges of $47 million in 2001 and $55 million in

2000. LIFO charges in both years primarily reflect price inflation on

prescription drugs.

SG&A expenses improved by 140 basis points as a percentage

of sales, resulting primarily from an emphasis on cost manage-

ment and the leverage of increased sales. 2001 SG&A expenses

were lower in the following areas: information technology from

bringing the function back in-house, net advertising and pension

costs because Eckerd ceased participation in the JCPenney pen-

sion plan. Included in SG&A for 2001 was an $11 million gain for

pension curtailment and $5 million in transition costs related to

the in-sourcing of information technology. In 2000, SG&A includ-

ed $12 million of store closing activity costs.

Other Unallocated

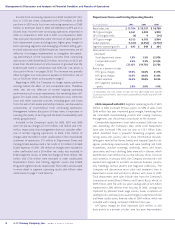

Other unallocated of $93 million, $46 million and $515 million

for 2002, 2001 and 2000, respectively, consists of real estate activi-

ties, investment transactions, asset impairments, unit closing

costs, which include remaining lease obligations, and other items

that are related to corporate initiatives or activities, which are not

allocated to an operating segment but are included in total

Company operating results.

Certain charges or credits recorded in other unallocated, such as

asset impairments, unit closings, gains on sale of real estate part-

nership interests, and centralized merchandising process (ACT)

costs, are not reflective of normal ongoing operations. These net

charges were $105 million, $42 million and $543 million in 2002,

2001 and 2000, respectively. Net charges are summarized below

and discussed in more detail in Note 16.

In 2002, charges of $105 million related primarily to asset

impairments and lease obligations for certain department stores

in the United States and Mexico and certain catalog and other

facilities. Impairments are the result of the Company’s on-going

process to evaluate the productivity of its asset base, as described

under “Valuation of Long-Lived and Intangible Assets, including

Goodwill” on page 5.

Net charges of $42 million in 2001 consisted of $63 million of

asset impairments and unit closing costs for catalog store closings,

underperforming department stores, outside stockrooms, third

party fulfillment operations and adjustments made to prior peri-

od restructuring reserves, $36 million of ACT costs, and $57 mil-

lion of real estate gains on the sale of two partnership interests.

In 2000, charges of $543 million were comprised of $488 million

related to asset impairments, PVOL and other unit closing costs, and

$55 million of ACT costs. The net charge of $488 million for asset

impairments, PVOL and other unit closing costs consisted of $206 mil-

lion of department store closings; $111 million of drugstore closings;

$91 million of asset impairments for department stores; drugstores

and a non-strategic business investment; $84 million related to con-

tract cancellations; $35 million of headcount reductions; a $13 million

gain on the sale of assets; and a $26 million net credit for adjustments

related to prior period restructuring reserves and other.

Net Interest Expense

Net interest expense totaled $388 million, $386 million and

$427 million in 2002, 2001 and 2000, respectively. The slight

increase in 2002 is related to the amortization of fees on the new

credit facility and lower returns on short-term investments, par-

tially offset by lower expense from reduced borrowing levels.

Interest expense declined in 2001 as a result of improved cash bal-

ances and the declines in average debt outstanding. Long-term

debt maturities totaled approximately $920 million and $250 mil-

lion in 2002 and 2001, respectively.

Income Taxes

The overall effective tax rates were 36.5%, 43.7% and (35.9%) for

2002, 2001 and 2000, respectively. The lower rate in 2002 is due to

recent changes in tax law related to the deductibility of dividends

paid to the Company’s savings plan and effects of adopting SFAS

No. 142 (amortization of goodwill) discussed in Note 1 on pages

25-26. In 2001, the tax rate increased due to a higher percentage

of non-deductible permanent book/tax differences, principally

goodwill, relative to income than in prior years. In 2000, due to the

loss from continuing operations, certain tax planning benefits

were not utilized, resulting in a lower tax benefit. Losses that

resulted from these benefits have been carried forward to future

years. Based on the short time periods for carryforwards in certain

states, valuation allowances of $97 million and $85 million in 2002

and 2001, respectively, have been established for those benefits

not expected to be realized.

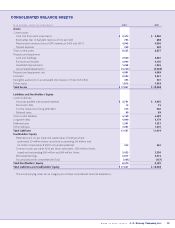

FINANCIAL CONDITION

Liquidity and Capital Resources

To support the Company’s previously stated turnaround ini-

tiatives, in 2001 management developed a long-term financing

strategy to strengthen the Company’s liquidity position. The pri-

mary goal of the Company’s strategy is to ensure financial flexi-

bility and access to capital over the turnaround timeframe. This

will allow adequate time to restore the profitability of the

Company’s businesses to competitive levels and to increase cap-

ital spending levels to fund both future growth at Eckerd and to

update the infrastructure of Department Stores and Catalog.

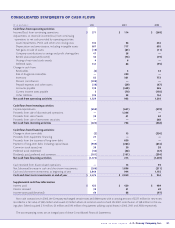

The Company’s financial condition and liquidity continued to

strengthen during 2002 and now provides increased resources to

accomplish its business objectives. Cash flow from operating activ-

ities was $1.3 billion in 2002 compared with $0.9 billion in 2001 and

$1.5 billion in 2000. Free cash flow, defined as cash flow from oper-

ating activities less dividends and capital expenditures net of pro-

ceeds from the sale of assets, exceeded $500 million for the year

compared to approximately $200 million of free cash flow gener-

ated in 2001. Free cash flow for 2002 exceeded plan primarily as a