JCPenney 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 29

Notes to the Consolidated Financial Statements

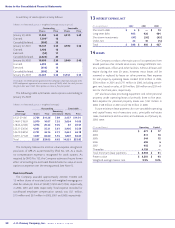

4CASH AND SHORT-TERM INVESTMENTS

Restricted short-term investment balances of $86 million and

$114 million for 2002 and 2001, respectively, were included in the

total cash and short-term investment balances of $2,474 million

and $2,840 million for the same periods. Restricted balances are

pledged as collateral for import letters of credit not included in

the bank credit facility and for a portion of casualty insurance

program liabilities. Cash and short-term investments on the con-

solidated balance sheet include $6 million of cash for both 2002

and 2001.

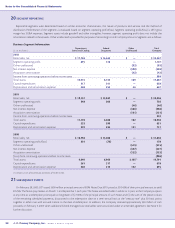

5ECKERD RECEIVABLES SECURITIZATION

In May 2001, Eckerd securitized certain managed care receiv-

ables by forming a bankruptcy-remote special purpose entity,

ECR Receivables, Inc. (ECR), which in turn entered into a three-

year revolving receivables purchase facility agreement with an

unrelated entity, Three Rivers Funding Corporation (TRFC), an

asset-backed commercial paper conduit sponsored by Mellon

Financial Corporation. Effective February 3, 2003, Bryant Park

Funding LLC (Bryant Park) and HSBC Bank USA were added as

purchasers. Under the facility, Eckerd sells to ECR, on a contin-

uous basis, all of its managed care receivables. ECR then sells to

TRFC or Bryant Park an undivided interest in all eligible receiv-

ables while maintaining a subordinated interest, in the form of

overcollateralization, in a portion of the receivables. JCP,

through Eckerd, received cash proceeds of $200 million in May

2001 from the sale. On February 3, 2003, approximately $50

million of cash proceeds was received. Eckerd has agreed to

continue servicing the sold receivables at market rates; accord-

ingly, no servicing asset or liability has been recorded.

As of January 25, 2003, securitized managed care receivables

totaled $324 million, of which the subordinated retained interest

was $124 million. The portion of the receivables in which third

parties have an undivided ownership interest qualifies as a sale

under the provisions of SFAS No. 140, “Accounting for Transfers

and Servicing of Financial Assets and Extinguishment of

Liabilities,” and has been reflected as a reduction of receivables

in the accompanying consolidated balance sheets. Losses and

expenses related to receivables sold under this agreement in 2002

and 2001 totaled $4 million and $5 million, respectively, and are

included in other unallocated.

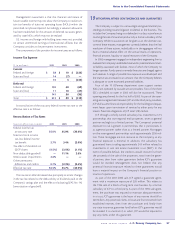

6 FAIR VALUE OF FINANCIAL INSTRUMENTS

The following methods and assumptions were used in esti-

mating the fair values of financial instruments:

Cash and Short-Term Investments

The carrying amount approximates fair value because of the

short maturity of these instruments.

Short-Term and Long-Term Debt

Carrying value approximates fair value for short-term debt. The

fair value of long-term debt, excluding capital leases, is estimated

by obtaining quotes from brokers or is based on current rates

offered for similar debt. At January 25, 2003, long-term debt,

including current maturities, had a carrying value of $5.2 billion

and a fair value of $4.9 billion. At January 26, 2002, long-term debt,

including current maturities, had a carrying value of $6.1 billion

and a fair value of $5.4 billion.

Concentrations of Credit Risk

The Company has no significant concentrations of credit risk.

7OTHER ASSETS

($ in millions) 2002 2001

Prepaid pension $ 1,172 $ 892

Capitalized software, net 228 229

Leveraged lease investments 131 132

Real estate investments 106 104

Deferred catalog book costs 73 86

Debt issuance costs, net 46 43

Other 59 48

Tot al $ 1,815 $ 1,534

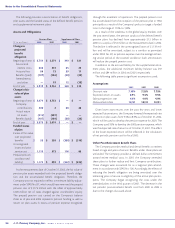

8ACCOUNTS PAYABLE AND ACCRUED EXPENSES

($ in millions) 2002 2001

Accounts payable, primarily trade $ 1,792 $ 1,551

Accrued salaries, vacation and bonus 570 541

Advertising payables 187 136

Customer gift cards/certificates 173 161

Pharmacy payables 131 69

Taxes payable 123 158

Interest payable 122 137

Workers’ compensation and

general liability insurance 99 102

Rent payable 91 90

Restructuring reserves 37 55

Common dividends payable 34 34

Other(1) 432 431

Tot al $ 3,791 $ 3,465

(1) Other includes various components that are individually insignificant such as

general accrued expenses related to operations and fixed asset accruals. Also includ-

ed in other is $3 million at year-end 2002 and $4 million at year-end 2001, which

represents the remaining balance of a $20 million reserve that was originally estab-

lished as part of the Company’s sale of its proprietary credit card receivables to

General Electric Capital Corporation in 1999. This reserve was established to cover

potential bad debts on certain types of accounts.