JCPenney 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 35

Notes to the Consolidated Financial Statements

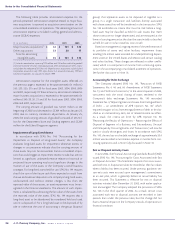

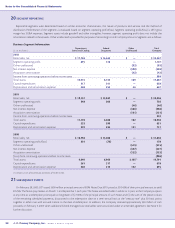

The net periodic post-retirement benefit cost follows:

Post-Retirement Benefit Cost

($ in millions) 2002 2001 2000

Service costs $3$4$3

Interest costs 16 24 26

Net amortization (16) (8) (4)

Net periodic post-

retirement benefit cost $3$20$25

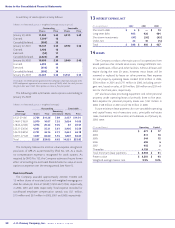

A reconciliation of the benefit obligation follows:

Benefit Obligation

($ in millions) 2002 2001

Accumulated benefit obligation $ 193 $ 235

Net unrecognized losses

and prior service cost 111 80

Net medical and dental liability $ 304 $ 315

The Company’s post-retirement benefit plans were amended

in 2001 to reduce the per capita dollar amount of the benefit

costs that would be paid by the Company. Thus, changes in the

assumed or actual health care cost trend rates do not materially

affect the accumulated post-retirement benefit obligation or the

Company’s annual expense. Company-provided costs for retirees

over age 80 on January 1, 2002 do still increase by up to 5% per

year. The Company has assumed that the full 5% increase will be

granted in each future year.

Defined Contribution Plans

The Company’s Savings, Profit-Sharing and Stock Ownership Plan

is a defined contribution plan available to all eligible associates of

JCP and certain subsidiaries. Additionally, the Company has a Mirror

Plan, which is offered to certain management associates. Associates

who have completed at least 1,000 hours of service within an eligi-

bility period (generally 12 consecutive months) and have attained

age 21 are eligible to participate in the plan. Vesting of Company

contributions occurs over a five-year period. The Company con-

tributes to the plan an amount equal to 4.5% of the Company’s

available profits, which totaled $27 million and $10 million in 2002

and 2001, respectively. Additionally, discretionary matching contri-

butions of Company stock were made totaling $20 million and $48

million in 2002 and 2001, respectively. Associates have the option of

reinvesting matching contributions made in Company stock into a

variety of investment options, primarily mutual funds.

Effective January 1, 2002, Eckerd adopted a new 401(k) plan for all

eligible drugstore associates. Account balances for Eckerd associates

who were participants in the Company’s Savings, Profit Sharing and

Stock Ownership Plan were transferred to the new plan. Eckerd pro-

vides eligible drugstore associates with a guaranteed match of $1.50

for each $1.00 contributed on the first 2% of pay and a $1.00 for $1.00

match on the next 1% of pay, and Eckerd contributions vest imme-

diately. Eckerd matching contributions were $31 million in 2002.

Total Company expense for defined contribution plans for

2002, 2001 and 2000 was $81 million, $69 million and $3 million,

respectively.

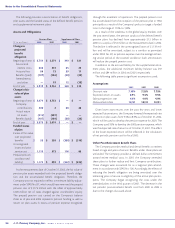

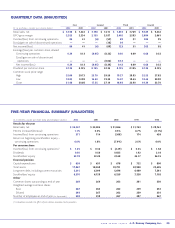

16 OTHER UNALLOCATED

Other unallocated contains items that are related to corporate

initiatives or activities, which are not allocated to an operating

segment and consisted of the following:

($ in millions) 2002 2001 2000

Asset impairments,

PVOL and other

unit closing costs $ 105 $ 63 $ 488

Centralized merchandising

process (ACT) costs —36 55

Gains from sale of real estate

partnership interests —(57) —

Real estate activities (41) (31) (42)

Third party fulfillment losses 10 19 —

Eckerd receivables financing 45—

Other 15 11 14

Tot al $93$ 46 $ 515

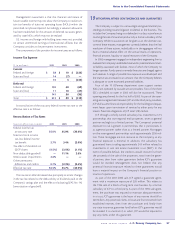

The Company recorded charges of $105 million in 2002 related

primarily to asset impairments and PVOL for certain department

stores in the United States and Mexico and certain catalog and

other facilities. The impairment charges resulted from the

Company’s ongoing process to evaluate the productivity of its

asset base.

The Company recorded charges of $63 million in 2001, compris-

ing asset impairments and PVOL, and included $21 million of

restructuring charges that principally represented adjustments to

the 2000 store closing plan and a modification to include two addi-

tional units.

In 2000, the Company recorded restructuring charges of $488

million, which included a major store closing plan (2000 plan) for

both department stores and drugstores. The major actions com-

prising the plan to close stores consisted of the identification of

stores that did not meet the Company’s profit objectives, establish-

ment of closing dates (to coincide with termination rights and/or

other trigger dates contained in leases, if applicable) and notifica-

tion of affected parties (e.g., employees, landlords and community

representatives) in accordance with the Company’s store closing

procedures. These closings were over and above normal store clo-

sures within a given year. Substantially all of the stores were leased,

and the Company is not responsible for the disposal of property,

other than fixtures, which for the most part was abandoned.

As part of the 2000 plan, including the 2001 modification, the

Company closed a total of 94 underperforming JCPenney stores

and 279 drugstores. Store closing costs included PVOL, asset