JCPenney 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report24

Notes to the Consolidated Financial Statements

(net of tax) are added back to income, since these would not be

paid if the debentures or preferred stock were converted to com-

mon stock.

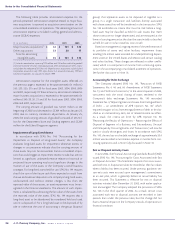

Stock-Based Compensation

The Company has a stock-based compensation plan, which is

discussed more fully in Note 12. The Company accounts for the

plan under the recognition and measurement principles of

Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees” (APB 25), and related Interpretations.

No stock-based employee compensation cost is reflected in net

income for stock options, as all options granted under the plan

had an exercise price equal to the market value of the underly-

ing common stock on the date of grant. Compensation expense

for restricted stock awards with pro rata vesting is recorded on a

straight-line basis over the vesting period, which typically ranges

from one to five years.

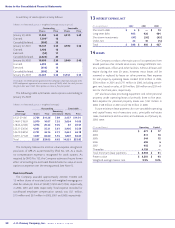

The following table illustrates the effect on net income and EPS

as if the Company had applied the fair value recognition provisions

of SFAS No. 123, “Accounting for Stock-Based Compensation,” to

stock options.

($ in millions, except EPS) 2002 2001 2000

Net income/(loss), as

reported $ 405 $ 98 $ (705)

Add: Stock-based employee

compensation expense

included in reported net

income, net of related tax

effects 354

Deduct: Total stock-based

employee compensation

expense determined under

fair value method for all

awards, net of related

tax effects (23) (24) (14)

Pro forma net income $ 385 $ 79 $ (715)

Earnings per share:

Basic—as reported $ 1.41 $ 0.26 $ (2.81)

Basic—pro forma $ 1.34 $ 0.19 $ (2.86)

Diluted—as reported $ 1.37 $ 0.26 $ (2.81)

Diluted—pro forma $ 1.30 $ 0.19 $ (2.86)

The Company used the Black-Scholes option-pricing model to

estimate the grant date fair value of its stock option grants for

the periods presented above. The following Black-Scholes

assumptions were used to estimate the grant date fair value of

stock options:

Option Assumptions 2002 2001 2000

Dividend yield 3.9% 4.2% 4.2%

Expected volatility 40.0% 40.2% 35.2%

Risk-free interest rate 4.7% 4.8% 6.2%

Expected option term 7 years 5 years 5 years

Weighted-average fair value

of options at grant date $ 6.32 $ 4.36 $ 3.78

Cash and Short-Term Investments

All highly liquid investments with original maturities of three

months or less are considered to be short-term investments. The

short-term investments consist primarily of euro-dollar time

deposits and money market funds and are stated at cost, which

approximates fair market value. See Note 4 for a discussion of

restricted short-term investment balances.

Receivables, Net

Receivables of the Eckerd retail managed care operations, mail

order and pharmacy benefit management operations were $338

million and $341 million as of year-end 2002 and 2001, respectively.

See Note 5 for discussion of Eckerd securitization of certain man-

aged care receivables. Renner credit card receivables were $66 mil-

lion and $80 million as of year-end 2002 and 2001, respectively. Also

included in this classification are notes and miscellaneous receiv-

ables. A summary of the allowance for bad debts is as follows:

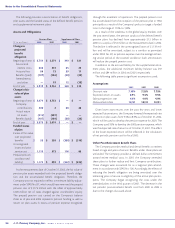

($ in millions) 2002 2001 2000

Balance at beginning of year $27$30$20

Additions, charged to costs

and expenses 32 29 33

Deductions of write-offs, less

recoveries (45) (32) (23)

Balance at end of year $14$27 $ 30

Merchandise Inventories

Inventories for Department Stores and Catalog are valued pri-

marily at the lower of cost (using the last-in, first-out or “LIFO”

method) or market, determined by the retail method for depart-

ment stores and average cost for catalog. The lower of cost or

market is determined on an aggregate basis for similar types of

merchandise. To estimate the effects of inflation/deflation on end-

ing inventory, an internal index is calculated using cost data. Prior

to 2002, the internal index was based on the changes in initial

retail prices from the beginning to the end of the fiscal year at the

merchandise item level. Initial retail pricing is influenced by such

factors as: changes in pricing strategies, competitive pricing and

changes in styles and fashion, particularly in the apparel lines of

merchandise. These factors affect the measurement of price

changes, making it difficult to estimate inflation/deflation rates.

Beginning in 2002, Department Stores and Catalog changed the

basis of the internal index to measure inflation/deflation rates on

vendor, or supplier cost. Vendor cost results in a more accurate

measurement of inflation/deflation rates used to adjust ending

inventory cost under the LIFO method of inventory valuation. For