JCPenney 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 31

Notes to the Consolidated Financial Statements

notes issued pursuant to this exchange are not subject to transfer

restrictions, and carry identical terms as the outstanding notes for

which they were exchanged.

11 CAPITAL STOCK

The Company had 48,510 stockholders of record as of January

25, 2003. On a combined basis, the Company’s savings plans,

including the Company’s employee stock ownership plan

(ESOP), held 47 million shares of common stock or 16.8% of the

Company’s common shares after giving effect to the conversion

of preferred stock.

Preferred Stock

The Company has authorized 25 million shares of preferred

stock; 554,426 and 604,278 shares of Series B ESOP Convertible

Preferred Stock were issued and outstanding as of January 25,

2003 and January 26, 2002, respectively. Each share is convert-

ible into 20 shares of the Company’s common stock at a guar-

anteed minimum price of $30 per common share. Dividends

are cumulative and are payable semi-annually at an annual rate

of $2.37 per common share equivalent, a yield of 7.9%. Shares

may be redeemed at the option of the Company or the ESOP

under certain circumstances. The redemption price may be

satisfied in cash or common stock or a combination of both, at

the Company’s sole discretion.

Preferred Stock Purchase Rights

In January 2002, in connection with the Holding Company for-

mation, the Board of Directors issued one preferred stock pur-

chase right on each outstanding and future share of common

stock. JCP’s then-existing rights plan, which was established in

March 1999 with terms substantially similar to those of the

Company’s 2002 plan, was simultaneously amended so that it

expired. The new rights entitle the holder to purchase, for each

right held, 1/1000 of a share of Series A Junior Participating

Preferred Stock at a price of $140. The rights are exercisable by the

holder upon the occurrence of certain events and are

redeemable by the Company under certain circumstances as

described by the rights agreement. The rights agreement con-

tains a three-year independent director evaluation (TIDE) provi-

sion. This TIDE feature provides that a committee of the

Company’s independent directors will review the rights agree-

ment at least every three years and, if they deem it appropriate,

may recommend to the Board a modification or termination of

the rights agreement.

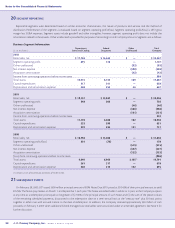

12 STOCK-BASED COMPENSATION

In May 2001, JCP’s stockholders approved a new 2001 Equity

Compensation Plan (2001 Plan), which initially reserved 16 million

shares of common stock for issuance, plus 1.2 million shares

reserved but not subject to awards under the Company’s 1997 and

2000 equity plans. The 2001 Plan provides for grants to associates

of options to purchase the Company’s common stock, stock

awards or stock appreciation rights. No future grants will be made

under the 1997 and 2000 plans. At January 25, 2003, 13.1 million

shares of stock were available for future grants. Stock options and

awards typically vest over performance periods ranging from one

to five years. The number of option shares is fixed at the grant date,

and the exercise price of stock options is generally set at the mar-

ket price on the date of the grant. The 2001 Plan does not permit

stock options below grant date market value. Options have a max-

imum term of 10 years. Over the past several years, the Company’s

net stock option grants (stock options granted during the year, less

any forfeitures or terminations) have averaged about 1.5% of total

outstanding stock. The 2001 Plan also provides for grants of stock

awards and stock options to outside members of the Board of

Directors. Stock options acquired by such directors are not trans-

ferable until a director terminates service.

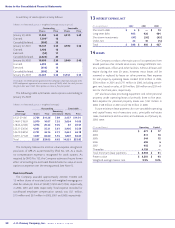

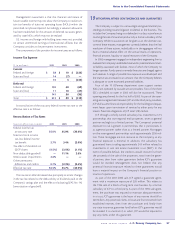

Stock Options

At January 25, 2003, options to purchase 22.3 million shares of common stock were outstanding. If all options were exercised, common

shares outstanding (including common equivalents of outstanding preferred stock) would increase by 8%. At the end of 2002, 14.6 million,

or 65% of the 22.3 million outstanding options, were exercisable. Of those, only 42% were “in-the-money” or had an exercise price below the

closing price of $19.39 on January 25, 2003, as shown in the following schedule:

(shares in thousands, price is weighted average exercise price)

Exercisable Unexercisable Total

Shares % Price Shares % Price Shares % Price

In-the-money 6,118 42% $15.43 2,627 34% $15.64 8,745 39% $15.50

Out-of-the-money(1) 8,433 58% $45.43 5,089 66% $20.82 13,522 61% $36.17

Total options outstanding 14,551 100% $32.82 7,716 100% $19.06 22,267 100% $28.05

(1) Out-of-the-money options are those with an exercise price equal to or above the closing price of $19.39 at the end of 2002.