JCPenney 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 15

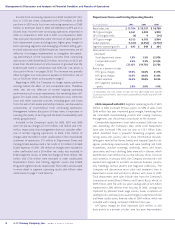

Management’s Discussion and Analysis of Financial Condition and Results of Operations

• For Department Stores and Catalog the primary initiatives

have been to improve the merchandise assortments to more

fashionable items at value prices, support the offerings with

compelling marketing programs, improve the visual appeal of

the store environment and catalogs, reduce the expense

structure to more competitive levels, and concentrate on

placing the right people in the right jobs.

• At Eckerd, the focus has been on developing a strong man-

agement team, better product offerings, more competitive

pricing levels for general merchandise, reconfiguring drug-

stores to a more productive format and offering additional

convenient locations.

The Company believes that these initiatives will be the drivers

of its primary goal to strengthen and grow the customer franchise

after experiencing a period of deteriorating performance from

1995 to 2000. Management is focused on strengthening the

Company's value proposition with its customers.

While results have been positive for the most recent two years

and indicate that the Company is on track in achieving its finan-

cial targets, the turnaround is complex and the Company will face

continued challenges in the execution of its strategic initiatives.

An important factor in the Company’s turnaround is the ability

of department stores to operate under a centralized merchandis-

ing model. Under this model, professionals have been added to the

merchandising team with experience in buying centrally.

Additionally, certain information technology systems have been

developed, and others are in various stages of development, to

plan merchandise assortments, allocate inventory and stock stores,

better track sales trends to enable prompt replenishment and

manage pricing. To efficiently handle inventory flow the Company

is in the final stages of rolling out centralized logistics store support

centers. The effectiveness of these systems and processes as well as

their timely integration is an important component of the

Company’s ability to have the right inventory in the “right place, at

the right time, and at the right price.”

Another important factor in the Company’s turnaround is

the ability of Eckerd drugstores to continue to grow its drug-

store business and to maintain pharmacy margins, which are

under continued pressure, as managed care organizations and

other third party plans continue to seek cost containment. A

key component to growing the drugstore base is to have a

more competitive store-opening program and to complete the

remodeling and relocation program, which is designed to con-

vert existing stores to the reconfigured format that is more pro-

ductive and efficient.

The Company’s business is subject to other risk factors, both

internal and external, that may impact future operating and finan-

cial performance, such as the ability to anticipate fashion trends,

customer preferences and other fashion-related factors, attract or

retain customers in a highly competitive retail environment,

attract and retain key executives or other personnel, attract and

retain a sufficient number of qualified pharmacists, continue to

generate cash flow and obtain adequate financing. The Company

has in place an experienced management team that has estab-

lished programs and policies to manage and minimize those risks.

Accounting for Stock Options

The Company has a stock option program for approximately

2,000 executives and senior management. Over the past several

years, the Company’s annual net stock option grants (stock

options granted during the year, less any forfeitures or termina-

tions) under this program have averaged about 1.5% of outstand-

ing shares, including the common stock equivalent of preferred

shares. On January 25, 2003, options to purchase 22.3 million shares

of common stock, representing about 8% of total shares, were out-

standing, of which 14.6 million were exercisable. Of the exercisable

options, only 42% were “in-the-money” or had an exercise price

below the closing end-of-year stock price of $19.39. See Note 12 for

more details about the Company's stock option program.

The Company follows Accounting Principles Board Opinion No.

25, “Accounting for Stock Issued to Employees,” (APB 25) which

does not require expense recognition for stock options granted

when the exercise price of the option equals, or exceeds, the fair

market value of the common stock on the date of grant. See Note

1 on page 24 for further information about the Company’s stock

option accounting policy.

The Company evaluated its accounting for stock options during

2002, and elected to retain APB 25 accounting for several important

reasons. The Company believes that stock options are equity capi-

tal transactions, which increase the number of shares outstanding

when exercised, resulting in dilution of EPS and equity per share.

Since they increase the number of shares outstanding, the dilutive

effect of options is captured in the EPS calculation, and inclusion of

an expense for stock options in the statement of operations would

effectively result in a double charge to EPS. The cost of stock

options would be a non-cash expense that would not result in the

use of any operating resources and does not change the Company’s

equity balance. Additionally, before stock options are exercised, the

Company assumes they are exercised (to the extent they are dilu-

tive) for the diluted EPS calculation. Finally, the current stock-option

pricing models do not factor in significant limitations of employee

stock options such as vesting requirements, forfeiture provisions,

retention periods and nontransferability. Standard option-pricing

models were developed to value options traded in the marketplace,

and overstate the value of employee stock options.

The FASB is currently reviewing the accounting for stock

options, and may require the use of the fair value method pre-

scribed by SFAS No. 123, “Accounting for Stock-Based

Compensation.” In addition, the International Accounting

Standards Board has already issued a draft of accounting rules that

require the expensing of stock options, and the FASB is working

to align U.S. accounting with international standards. The

Company intends to continue its current accounting, which is no

expense recognition for stock options in the statement of opera-

tions, until the FASB clarifies stock option accounting for all U.S.

companies. See discussion of SFAS No. 148 under the new

accounting pronouncements section that follows.

New Accounting Pronouncements

FASB’s Emerging Issues Task Force (EITF) Issue No. 02-16,

“Accounting by a Reseller for Cash Consideration Received from a