JCPenney 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 25

Notes to the Consolidated Financial Statements

2002, the internal cost inflation/deflation rates were used to cal-

culate the LIFO adjustment to ending inventory. The change

resulted in a LIFO provision for 2002 of $6 million versus a credit

of $17 million under the old method. For 2002, net income, basic

EPS and diluted EPS were lower by $14 million, $0.06 and $0.05,

respectively, as a result of this change. The cumulative effect of the

accounting change and pro forma amounts for periods prior to

2002 are not determinable because cost data is not available to

calculate internal indices for years prior to 2002.

In the Eckerd Drugstore segment, pharmaceutical and general

merchandise warehouse inventories are valued at the lower of

LIFO cost or market. General merchandise at retail drugstore

locations is valued using a modified retail method. Eckerd utilizes

internally developed price indices based on cost to estimate the

effects of inflation on inventories.

The total Company LIFO charges included in cost of sales were

$26 million, $38 million and $69 million in 2002, 2001 and 2000,

respectively. If the first-in, first-out or “FIFO” method of invento-

ry valuation had been used instead of the LIFO method, inven-

tories would have been $403 million and $377 million higher at

January 25, 2003 and January 26, 2002, respectively.

Property and Equipment

Property and equipment is stated at cost less accumulated

depreciation. Depreciation is provided principally by the straight-

line method over the estimated useful lives of the related assets,

generally three to 20 years for furniture and equipment and 50

years for buildings. Leasehold improvements are amortized over

the shorter of the estimated useful lives of the improvements or

the term of the lease.

Routine maintenance and repairs are expensed when incurred.

Major replacements and improvements are capitalized. The cost

of assets sold or retired and the related accumulated depreciation

or amortization are removed from the accounts, with any result-

ing gain or loss included in net income.

Capitalized Software Costs

Costs associated with the acquisition or development of soft-

ware for internal use are capitalized and amortized over the

expected useful life of the software, generally between three

and seven years.

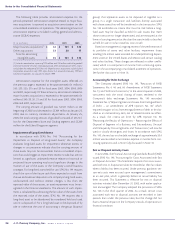

Goodwill and Other Intangible Assets

Effective January 27, 2002, the Company adopted SFAS

No. 142, “Goodwill and Other Intangible Assets.” Upon adoption,

the Company ceased amortization of goodwill and other

indefinite-lived intangible assets, primarily the Eckerd trade name.

These assets are now subject to an impairment test on an annual

basis, or when there is reason to believe that their values have

been diminished or impaired. Additionally, a transitional impair-

ment test was required as of the adoption date. These impair-

ment tests were performed on each business of the Company

where goodwill is recorded. The net carrying value of goodwill and

the Eckerd trade name was $2,643 million as of January 26, 2002.

The Company completed the transitional impairment test on the

Eckerd trade name in the first quarter of 2002 and the transition-

al goodwill impairment test in the second quarter of 2002 and

determined that there was no evidence of impairment.

In the fourth quarter of 2002, the Company completed its

annual impairment analysis and determined that there was no evi-

dence of impairment. The fair value of the Company’s identified

reporting units was estimated using the expected present value of

corresponding future cash flows and market values of comparable

businesses where available. Other intangible assets with estimable

useful lives will continue to be amortized over those lives.

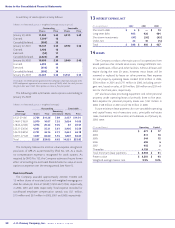

The following table sets forth the condensed consolidated pro

forma results of operations as if SFAS No. 142 had been in effect

for all years presented:

($ in millions, except EPS) 2002 2001 2000

Reported net income/(loss) $ 405 $ 98 $ (705)

Goodwill and trade name

amortization, net of tax —72 72

Adjusted net income/(loss) $ 405 $ 170 $ (633)

Basic EPS:

Reported net income/(loss) $ 1.41 $ 0.26 $ (2.81)

Goodwill and trade name

amortization, net of tax —0.27 0.27

Adjusted net income/(loss) $ 1.41 $ 0.53 $ (2.54)

Diluted EPS:

Reported net income/(loss) $ 1.37 $ 0.26 $ (2.81)

Goodwill and trade name

amortization, net of tax —0.27 0.27

Adjusted net income/(loss) $ 1.37 $ 0.53 $ (2.54)

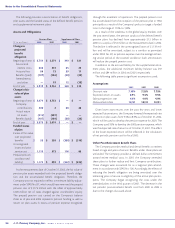

Intangible assets consisted of the following:

($ in millions) 2002 2001

Amortizing intangible assets:

Prescription files $ 289 $ 258

Less accumulated amortization 157 121

Prescription files, net 132 137

Favorable lease rights 205 204

Less accumulated amortization 165 136

Favorable lease rights, net 40 68

Carrying amount of amortizing

intangible assets 172 205

Non-amortizing intangible assets

Eckerd trade name(1) 322 322

Total intangible assets $ 494 $ 527

(1) Eckerd trade name is net of accumulated amortization of $47 million for year-

end 2001.