JCPenney 2002 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 7

Management’s Discussion and Analysis of Financial Condition and Results of Operations

pension plan. Over this time frame, actual investment return on

plan assets has generated a significant portion of the $5 billion in

pension plan total value, defined as $2.1 billion in cumulative

benefit payments to retired associates plus $2.9 billion in plan

assets at year-end 2002. In effect, the Company’s cumulative cash

contributions over this time frame represent 13% of the plan’s

total value (i.e., $650 million as a percent of $5 billion). The

remainder of the plan’s total value has been essentially generated

by the actual investment returns since inception. The Company

targets to maintain its portion of the pension plan’s total value to

a level of 20% or less, primarily through its funding policy and

asset mix strategy. Targeting the Company’s portion of the pen-

sion plan’s total value at this level is important since cash contri-

butions to the plan utilize capital resources from investors and

have an associated cost of capital.

The Company made cash contributions to the primary plan

annually during the 1966-1983 period in order to provide an asset

base to support the accelerating liability growth in the early years

of the plan. Over the 1984-2002 period the Company made cash

contributions to the plan in five years (1993-1996 and 2002), and

no contributions in the other 14 years due to maintaining a well-

funded plan and the actual investment return on plan assets.

The pension plan’s ERISA actuarial funding liability at year-end

2002 was characterized by approximately 3% annual growth.

Cash benefits paid to retirees were about 6% of plan assets in

2002. This resulted in a total annual liability requirement for the

plan of about 9%. The composition of this annual liability

requirement reflects the Company’s associate demographics in

terms of length of service, compensation and age. In contrast,

during the 1966-1983 period, or the plan’s early years, the liabili-

ty characteristics of the plan reflected a higher annual liability

growth rate and a lower cash benefit payment to retirees.

The pension plan’s asset allocation strategy is designed to mit-

igate this annual liability requirement and result in a cost effective

level of pension expense and cash contributions over time to the

Company as discussed above. In effect, the plan’s asset allocation

strategy needs to produce an average return on assets of approx-

imately 9% or higher in order to eliminate cash contributions to

the plan on a sustainable long-term basis, given the plan’s current

annual liability requirement and funded position. This was the

case during most of the 1984-2002 period as discussed above. In

periods of significant capital market declines, such as 2001 and

2002, the plan’s surplus is utilized first to mitigate the annual lia-

bility requirement, and then the Company’s available cash

resources are utilized to restore the plan’s funded ratio to a tar-

geted level. As discussed below, this was the case in 2002.

Even with the market declines in recent years, the Company’s

pension plan remains in an adequately funded position. Although

no additional funding was required under ERISA, the Company

made a discretionary contribution of $300 million, or $190 million

after tax, to its pension plan in October 2002.

While the Company does not expect to be required to make a

contribution in 2003 under ERISA, it may decide to do so depending

principally on the current and expected funded position of the plan.

Discontinued Operations

In June 2001, JCP closed the sale of its J. C. Penney Direct

Marketing Services, Inc. (DMS) assets, including its J. C. Penney Life

Insurance subsidiaries and related businesses, to a U.S. subsidiary

of AEGON, N.V. (AEGON). JCP received cash at closing of approx-

imately $1.3 billion ($1.1 billion after tax).

DMS was reflected as a discontinued operation in the 2000

Annual Report with an estimated net loss on the sale of $296 mil-

lion. The transaction closed earlier than anticipated in 2001; there-

fore, the income from DMS operations was for a shorter time

period than originally estimated. As a result, the loss on the sale

was adjusted upward by $16 million. This amount was reflected in

2001 as a loss on the sale of discontinued operations.

The Company recorded a $34 million gain in 2002 that is

reported as discontinued operations. This gain primarily relates to

additional capital loss deductions that the Company is entitled to

as a result of a 2002 tax regulation change. The final federal tax lia-

bility on the transaction was determined in an agreement

between the Company and the Internal Revenue Service.

The Company’s financial statements, accompanying notes and

other information provided in this Annual Report reflect DMS as

a discontinued operation for all periods presented.

Concurrent with the closing, JCP entered into a 15-year strate-

gic licensing and marketing services arrangement with AEGON

designed to offer an expanded range of financial and membership

services products to JCPenney customers. Over the term of this

arrangement, the Company will receive fee income related to the

marketing and sale of certain financial products and membership

services. Such amounts will be recognized as earned in the

Company’s financial statements.

Consolidated Results of Operations

The following discussion and analysis, consistent with all other

financial data throughout this Annual Report, focuses on the

results of operations and financial condition from the Company’s

continuing operations.

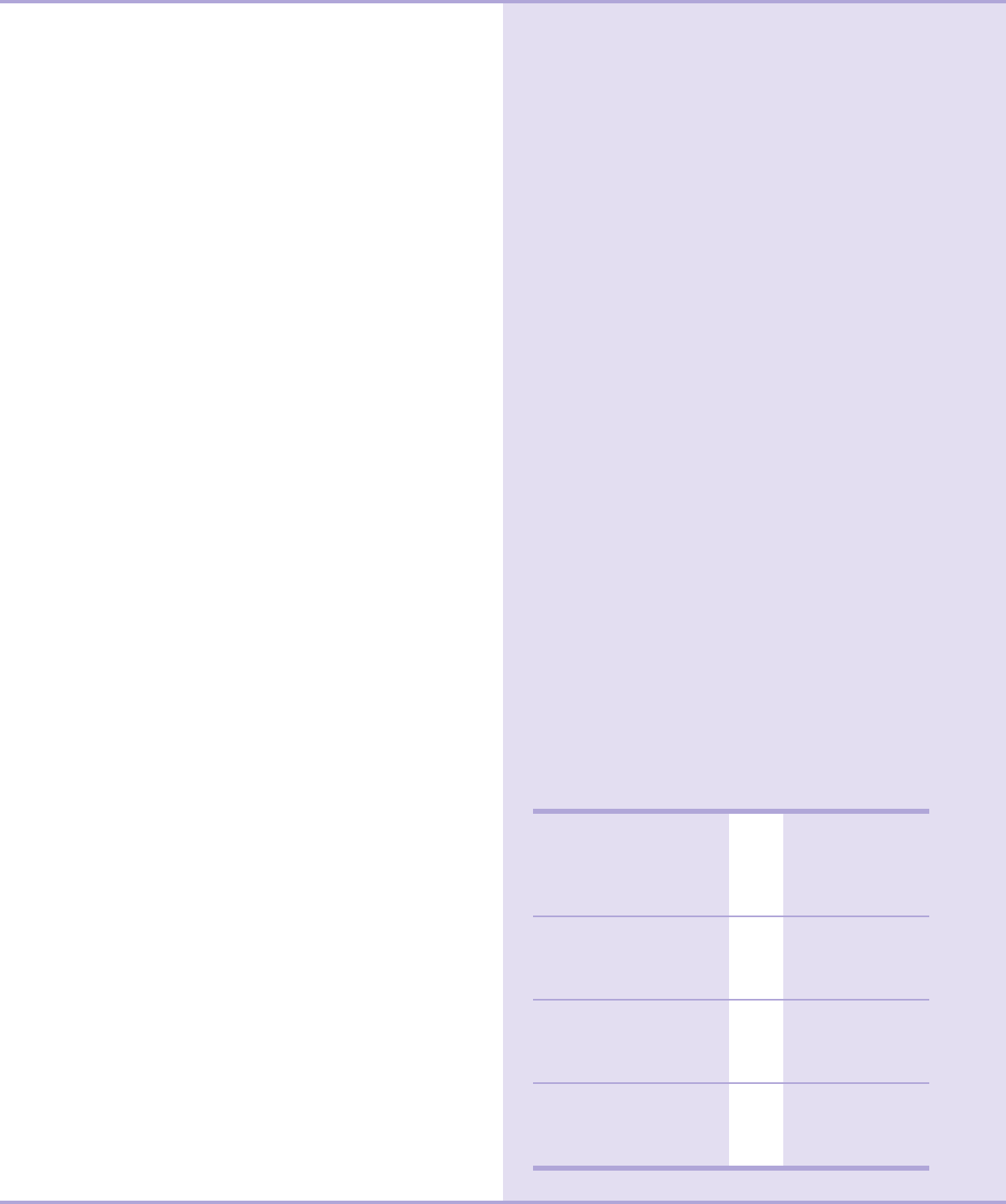

($ in millions, except EPS) 2002 2001 2000

Segment operating

profit/(loss)

Department Stores

and Catalog $ 695 $ 548 $ 254

Eckerd Drugstores 412 208 (76)

Tot al segm ents 1,107 756 178

Other unallocated (93) (46) (515)

Net interest expense (388) (386) (427)

Acquisition amortization (42) (121) (122)

Income/(loss) from

continuing operations

before income taxes 584 203 (886)

Income taxes 213 89 (318)

Income/(loss) from

continuing operations $ 371 $ 114 $ (568)

Earnings/(loss) per share

from continuing operations $ 1.25 $ 0.32 $ (2.29)