JCPenney 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report8

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Income from continuing operations in 2002 totaled $371 mil-

lion, or $1.25 per share, compared with $114 million, or $0.32

per share in 2001 and a loss from continuing operations of $568

million, or $2.29 per share in 2000. All references to EPS are on a

diluted basis. Income from continuing operations improved in

2002 as compared to 2001 and in 2001 as compared to 2000.

Year-over-year improvements were the result of sales growth in

both department stores and drugstores, higher gross margin in

both operating segments and leveraging of Eckerd selling, gen-

eral and administrative (SG&A) expenses. Improvements are all

reflective of strategies implemented to strengthen the operat-

ing performance of the businesses. Income from continuing

operations in 2002 benefited $72 million, net of tax, or $0.27 per

share from the elimination of amortization of goodwill and the

Eckerd trade name in compliance with SFAS No. 142, which is

discussed in Note 1 on pages 25-26. This increase was partially

offset by higher non-cash pension expense of $59 million, net of

tax, or $0.20 per share, as discussed on page 6.

Beginning in 2002, the Company no longer reports proforma

earnings before the effect of non-comparable items. Therefore,

items that are not reflective of normal ongoing operating

performance such as asset impairments, the remaining lease obli-

gation for closed stores, involuntary termination costs, other exit

costs and other corporate activities, including gains and losses

from the sale of real estate partnership interests, are discussed as

components of income/(loss) from continuing operations.

Management believes discussion of these items is important in

assessing the quality of earnings and the level of sustainability and

trends going forward.

Included in the Company’s results for 2002, 2001 and 2000

were net pre-tax charges of $119 million, $36 million and $751

million, respectively, that management does not consider reflec-

tive of normal ongoing operations. In 2002, $105 million of

charges were recorded in other unallocated in the consolidated

statement of operations, $17 million in Department Stores and

Catalog SG&A expenses and a net credit of $3 million in Eckerd

SG&A expenses. In 2001, $42 million of charges were included in

other unallocated and a $6 million net credit was recorded in

Eckerd segment results. In 2000, net charges of $543 million, $92

million and $116 million were recorded in other unallocated,

Department Stores and Catalog segment results and Eckerd

Drugstore segment results, respectively. These items are discussed

in more detail in segment operating results that follow, other

unallocated on page 11 and Note 16.

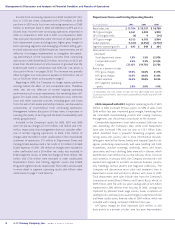

Department Stores and Catalog Operating Results

($ in millions) 2002 2001 2000

Retail sales, net $ 17,704 $ 18,157 $ 18,758

FIFO gross margin 6,361 6,093 5,978

LIFO (charge)/credit (6) 9 (14)

LIFO gross margin 6,355 6,102 5,964

SG&A expenses (5,660) (5,554) (5,710)

Segment operating profit $ 695 $ 548 $ 254

Sales percent increase/

(decrease):

Total department stores 1.9% 1.5% (2.9)%

Comparable stores(1) 2.6% 3.3% (2.4)%

Catalog (22.0)% (19.7)% (2.7)%

Ratios as a percent of sales:

FIFO gross margin 35.9% 33.6% 31.9%

LIFO gross margin 35.9% 33.6% 31.8%

SG&A expenses 32.0% 30.6% 30.4%

LIFO segment operating

profit 3.9% 3.0% 1.4%

(1) Comparable store sales include the sales of stores after having been open for

12 consecutive fiscal months. Stores become comparable on the first day of the 13th

fiscal month.

2002 compared with 2001. Segment operating profit of $695

million in 2002 increased 90 basis points to 3.9% of sales, from

$548 million last year. Improved gross margin, benefiting from

the centralized merchandising process and catalog inventory

management, was the primary contributor to the increase.

Comparable department store sales increased 2.6% over last

year, exceeding the Company’s plan, while total department

store sales increased 1.9% over last year to $15.1 billion. Sales,

which benefited from a powerful marketing program, were

strong across the country and in most merchandise divisions.

Sales gains were led by Home, Jewelry and Apparel. Specific cat-

egories performing exceptionally well were bedding and bath,

housewares, window coverings, diamonds, men’s and misses

sportswear, and boys’ clothing. Sales were soft in dresses, which

experienced lower demand across the industry, shoes, furniture

and cosmetics. In January 2003, the Company announced it will

expand and upgrade its women’s accessories business, particu-

larly handbags, fashion jewelry and fragrance collections. The

Company will discontinue most color and treatment lines in

department stores and will end its alliance with Avon in 2003.

Total department store sales include sales from the Company’s

international stores (Brazil, Mexico and Puerto Rico), which, at

$499 million, were flat with last year. Catalog sales of $2.6 billion

represented a 22% decline from last year. In 2002, catalog was

impacted by planned lower page counts, lower circulation of

catalog books, previously discussed changes to payment policies

and fewer outlet stores. Internet sales of $381 million, which are

included with catalog, increased 17.8% from last year.

LIFO gross margin for 2002 improved $253 million, or 230

basis points as a percent of sales, over last year. Improvement