JCPenney 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report36

Notes to the Consolidated Financial Statements

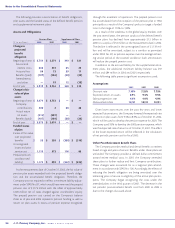

impairments, severance and other exit costs. Store assets consist

primarily of furniture and fixtures, and buildings and improvements.

Asset impairment charges were determined in accordance with

SFAS No. 121 and represented the excess of the carrying value of

the assets over their estimated fair value. The store closing plans

anticipated that the Company would remain liable for all future

lease payments. The PVOL was calculated, net of assumed sublease

income, using discount rates ranging from 5.2% to 7.0%. A reserve

was established for PVOL based on an average of three to six years

of lease payments or a negotiated termination fee.

During 2000, the Company evaluated its investments in long-

lived assets to be held and used in operations on an individual

store basis, and determined that, based on historical operating

results and updated operating projections, asset carrying values on

13 stores were not supported by projected undiscounted cash

flows. Accordingly, an impairment charge was recorded to write

down the carrying value of store assets to their estimated fair value,

which was determined based on projected discounted cash flows.

Other restructuring costs in 2000 included costs related to the

termination of Eckerd’s contract with its primary third party infor-

mation technology service provider and the remaining lease pay-

ments associated with the termination of a computer hardware

contract, headcount reductions, an asset impairment on Eckerd’s

web site development initiative and the gain on the sale of a note

receivable associated with the divestiture of certain drugstore loca-

tions pursuant to a Federal Trade Commission agreement.

ACT (Accelerating Change Together) was a fundamental

rebuilding of the department store process and organization, cre-

ating a centralized buying organization. ACT required process and

organizational restructuring throughout the company’s corporate

and field structure for department stores. Incremental ACT costs

over the two-year transition period (2000-2001) totaled $91 mil-

lion. Including $20 million of capitalized hardware and software

costs, total ACT expenditures were $111 million. Beginning in

2002, costs associated with centralized merchandising resulting

from the ACT initiative are included in segment operating results

for Department Stores and Catalog.

Gains in 2001 of $57 million were recorded primarily on the sale

of two real estate partnership interests.

Real estate activities include operating income for the

Company’s real estate subsidiary and gains or losses on the sale of

facilities that are no longer used in Company operations.

The Company incurred operating losses related to third party

fulfillment operations that were discontinued in 2002.

Losses and expenses related to receivables sold as part of the

Eckerd receivables securitization are recorded in other unallocat-

ed. See Note 5 for more information about the securitization of

Eckerd receivables.

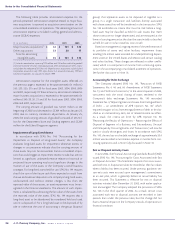

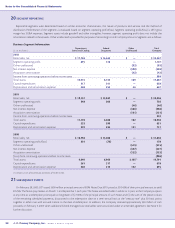

17 ROLLFORWARD OF RESTRUCTURING RESERVES

The following table presents the 2002 activity and balances of

the reserves established in connection with the Company’s

restructuring initiatives:

Balance Cash Other Balance

($ in millions) 1/26/02 Payments Adjustments 1/25/03

PVOL $ 164 $ (58) $ 5 $ 111

Severance 1(1) — —

Contract

cancellations 9(5) (2) 2

Tot al $ 174 $ (64) $ 3 $ 113

The current portion of the reserve is $37 million and $55 mil-

lion for 2002 and 2001, respectively, and is included in accounts

payable and accrued expenses. Costs are being charged against

the reserves as incurred. Imputed interest expense associated

with the discounting of these lease obligations is included in

other unallocated. Reserves are reviewed for adequacy on a peri-

odic basis and are adjusted as appropriate. The balance of the

reserves relates principally to the future lease obligations for both

department stores and drugstores closed as part of restructuring

programs in prior years. Most of the remaining cash payments

are expected to be made by the end of 2005.

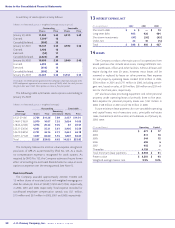

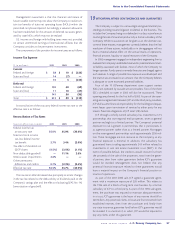

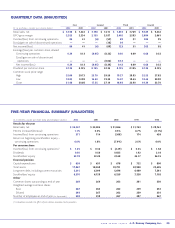

18 TAXES

Deferred tax assets and liabilities reflected in the Company’s con-

solidated balance sheet as of January 25, 2003 were measured using

enacted tax rates expected to apply to taxable income in the years

in which those temporary differences are expected to be recovered

or settled. The major components of deferred tax assets/(liabilities)

as of January 25, 2003 and January 26, 2002 were as follows:

($ in millions) 2002 2001

Deferred tax assets

Pension and other retiree obligations $ 248 $ 248

Workers’ compensation/general liability 136 127

Accrued vacation pay 68 65

Closed unit reserves 42 44

State taxes and net operating losses 210 190

Other(1) 115 160

Total deferred tax assets 819 834

Less valuation allowance (97) (85)

Net deferred tax assets $ 722 $ 749

Deferred tax liability

Depreciation and amortization (1,135) (1,067)

Prepaid pension (446) (340)

Leveraged leases (287) (297)

Inventories (154) (151)

Other(2) (171) (224)

Total deferred tax (liabilities) (2,193) (2,079)

Net deferred tax (liabilities) $ (1,471) $ (1,330)

(1) Includes certain accrued items not deductible for tax purposes until paid, such as

deferred compensation and severance benefits. Also includes certain deferred income

items currently recognized for tax purposes.

(2) Includes deferred tax items related to prepaid expenses, property taxes and origi-

nal issue discount.