JCPenney 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report38

Notes to the Consolidated Financial Statements

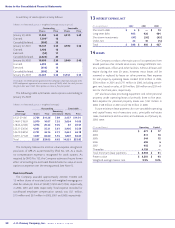

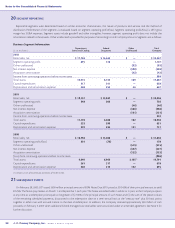

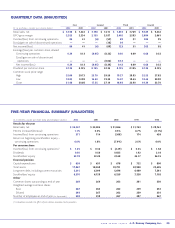

20 SEGMENT REPORTING

Reportable segments were determined based on similar economic characteristics, the nature of products and services and the method of

distribution. Performance of the segments is evaluated based on segment operating profit/(loss). Segment operating profit/(loss) is LIFO gross

margin less SG&A expenses. Segment assets include goodwill and other intangibles; however, segment operating profit does not include the

amortization related to these assets. Other unallocated is provided for purposes of reconciling to total Company amounts. Segments are as follows:

Business Segment Information

Department Eckerd Other Total

($ in millions) Stores and Catalog Drugstores Unallocated Company

2002

Retail sales, net $ 17,704 $ 14,643 $ — $ 32,347

Segment operating profit 695 412 — 1,107

Other unallocated (93) (93)

Net interest expense (388) (388)

Acquisition amortization (42) (42)

Income from continuing operations before income taxes 584

Total assets 10,974 6,724 169 17,867

Capital expenditures 317 341 — 658

Depreciation and amortization expense 368 253 46 667

2001

Retail sales, net $ 18,157 $ 13,847 $ — $ 32,004

Segment operating profit 548 208 — 756

Other unallocated (46) (46)

Net interest expense (386) (386)

Acquisition amortization (121) (121)

Income from continuing operations before income taxes 203

Total assets 11,178 6,688 182 18,048

Capital expenditures 332 299 — 631

Depreciation and amortization expense 370 226 121 717

2000

Retail sales, net $ 18,758 $ 13,088 $ — $ 31,846

Segment operating profit/(loss) 254 (76) — 178

Other unallocated (515) (515)

Net interest expense (427) (427)

Acquisition amortization (122) (122)

(Loss) from continuing operations before income taxes (886)

Total assets 9,640 6,966 3,185(1) 19,791

Capital expenditures 361 317 — 678

Depreciation and amortization expense 360 213 122 695

(1) Includes assets of discontinued operations of $3,027 million.

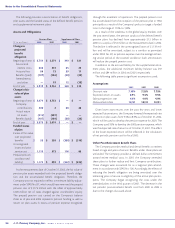

21 SUBSEQUENT EVENTS

On February 28, 2003, JCP issued $600 million principal amount of 8.0% Notes Due 2010 priced at 99.342% of their principal amount to yield

8.125%. The Notes pay interest on March 1 and September 1 each year. The Notes are redeemable in whole or in part, at the Company’s option

at any time, at a redemption price equal to the greater of (i) 100% of the principal amount of such Notes and (ii) the sum of the present values

of the remaining scheduled payments, discounted to the redemption date on a semi-annual basis at the “treasury rate” plus 50 basis points

together in either case with accrued interest to the date of redemption. In addition, the Company received approximately $50 million of cash

proceeds on February 3, 2003 when additional Eckerd managed care receivables were securitized under an amended agreement. See Note 5 for

further discussion.