JCPenney 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report34

Notes to the Consolidated Financial Statements

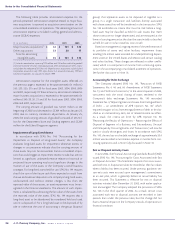

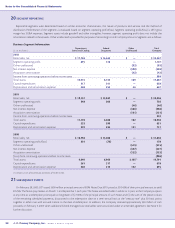

The following provides a reconciliation of benefit obligations,

plan assets and the funded status of the defined benefit pension

and supplemental retirement plans:

Assets and Obligations

Pension Plans Supplemental Plans

($ in millions) 2002 2001 2002 2001

Change in

projected

benefit

obligation

Beginning of year $ 2,754 $ 2,574 $ 310 $ 321

Service and

interest costs 264 272 25 25

Actuarial loss 88 73 39 11

Benefits (paid) (187) (184) (28) (28)

Amendments

and other —19 12 (19)

End of year $ 2,919 $ 2,754 $ 358 $ 310

Change in fair

value of plan

assets

Beginning of year $ 3,074 $ 3,753 $—$—

Company

contributions 300 228 28

Actual return

on assets (215) (497) ——

Benefits (paid) (187) (184) (28) (28)

End of year $ 2,972 $ 3,074 $—$—

Funded status

of plan

Excess of fair value

over projected

benefits $53$ 320 $ (358) $ (310)

Unrecognized

losses and prior

service cost 1,119 572 116 85

Prepaid pension

cost/(accrued

liability) $ 1,172 $ 892 $ (242) $ (225)

At the measurement date of October 31, 2002, the fair value of

pension plan assets exceeded both the projected benefit obliga-

tion and the accumulated benefit obligation. Therefore, the

Company was not required to reflect a minimum liability adjust-

ment under SFAS No. 87, which would have removed the prepaid

pension cost of $1,172 million with the offset of approximately

$700 million net of taxes charged against stockholders’ equity.

The prepaid pension cost carried on the Company’s balance

sheet as of year-end 2002 represents pension funding as well as

return on plan assets in excess of pension expense recognized

through the statement of operations. The prepaid pension cost

has accumulated from the inception of the pension plan in 1966

principally as a result of the Company’s policy to target a funded

ratio in the range of 110% to 130%.

As a result of the weakness in the global equity markets over

the past several years, the pension surplus of the defined benefit

pension plans has declined from approximately $1.2 billion in

2000 to a surplus of $53 million at the measurement date in 2002.

The decline is reflected in the unrecognized losses of $1,119 mil-

lion and will be amortized, subject to a corridor as permitted

under SFAS No. 87, as pension expense over the average remain-

ing service period of the covered workforce. Such amortization

will reduce the prepaid pension cost.

In addition to the accrued liability for the supplemental retire-

ment plans, the additional minimum liability balance was $97

million and $84 million in 2002 and 2001, respectively.

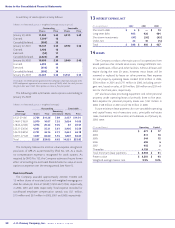

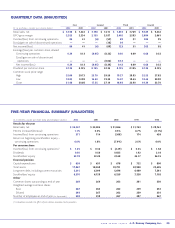

The following table presents significant assumptions used:

Assumptions

2002 2001 2000

Discount rate 7.10% 7.25% 7.75%

Expected return on assets 8.9% 9.5% 9.5%

Salary progression rate 4.0% 4.0% 4.0%

Measurement date 10/31 10/31 10/31

Given lower asset returns over the past few years and lower

expected future returns, the Company lowered the expected rate

of return on plan assets from 9.5% to 8.9% as of October 31, 2002,

which will be used to develop the pension expense for 2003. The

Company used 9.5% to develop the 2002 pension expense, which

was the expected rate of return as of October 31, 2001. The effect

of the lower expected return will be reflected in the calculation

of net periodic pension cost for fiscal 2003.

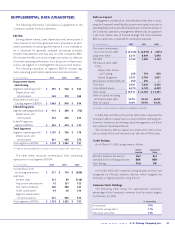

Other Post-Retirement Benefit Plans

The Company provides medical and dental benefits to retirees

based on age and years of service. Benefits under these plans are

unfunded. The Company provides a defined dollar commitment

toward retiree medical costs. In 2001, the Company amended

these plans to further reduce and limit Company contributions.

These changes were accounted for as a negative plan amend-

ment in accordance with SFAS No. 106. Accordingly, the effects of

reducing the benefit obligation are being amortized over the

remaining years of service to eligibility of the active plan partici-

pants. The Company began recognizing the costs under the

amended plans in the third quarter of 2001. The decrease in the

net periodic post-retirement benefit cost from 2000 to 2002 is

due to the changes discussed above.