JCPenney 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 33

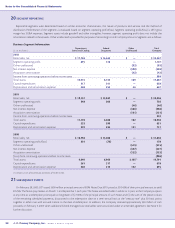

Notes to the Consolidated Financial Statements

15 RETIREMENT BENEFIT PLANS

The Company provides retirement and other post-retirement

benefits to substantially all employees (associates), except for

associates hired or rehired on or after January 1, 2002 who are

not eligible for retiree medical or dental coverage. These bene-

fits are an important part of the Company’s total compensation

and benefits program designed to attract and retain qualified

and talented associates. The Company’s retiree benefit plans

consist principally of a non-contributory pension plan, non-

contributory supplemental retirement and deferred compensa-

tion plans for certain management associates, a contributory

medical and dental plan, and a 401(k) and employee stock

ownership plan. Total Company expense/(income) for all retire-

ment-related benefit plans was $139 million, $34 million and

$(35) million in 2002, 2001 and 2000, respectively. These plans

are described in more detail below. See Management’s

Discussion and Analysis under Critical Accounting Policies on

pages 5-7 for additional discussion of the Company’s defined

benefit pension plan and Note 1 on page 23 for the Company’s

accounting policies regarding retirement-related benefits.

Defined Benefit Pension Plans — Funded

The Company and certain of its subsidiaries provide associates

who have completed at least 1,000 hours of service generally in a

12 consecutive month period and have attained age 21 with a

non-contributory pension plan. The plan is funded by Company

contributions to a trust fund, which is held for the sole benefit of

participants and beneficiaries. Participants generally become

100% vested in the plan after five years of employment or at age

65. Pension benefits are calculated based on an associate’s average

final pay, an average of the social security wage base, and the asso-

ciate’s credited service (up to 35 years), as defined in the plan doc-

ument. In 2001, the Company adopted an amendment to its pen-

sion to freeze benefits and participation for substantially all drug-

store associates effective July 31, 2001. In its place, Eckerd adopted

a new 401(k) plan which is discussed on page 35. The change in

the pension plan was accounted for as a curtailment gain in accor-

dance with SFAS No. 88, “Employers’ Accounting for Settlements

and Curtailments of Defined Benefit Pension Plans and for

Termination Benefits.” The reduction in the projected benefit

obligation of approximately $11 million was recorded in Eckerd

segment results for 2001 as a reduction of SG&A expenses.

The Company’s funding policy is to maintain a well funded

plan throughout all business and economic cycles. The primary

pension plan is well diversified with an asset allocation policy

that provides for a 70%, 20% and 10% mix of equities (U.S., non-

U.S. and private), fixed income (investment grade and high yield)

and real estate (private and public), respectively. Although no

additional funding was required under ERISA, the Company

made a voluntary contribution of $300 million, or $190 million

after tax, to its pension plan in October 2002. The assets of the

pension plan consist primarily of a balanced portfolio of equity

and debt securities managed by third party investment managers.

Supplemental Retirement Plans — Unfunded

The Company has unfunded supplemental retirement plans,

which provide retirement benefits to certain management asso-

ciates and other key employees. The primary plans are a

Supplemental Retirement Plan and a Benefit Restoration Plan.

Supplemental benefits are based on length of service and final

average compensation. The Benefit Restoration Plan is intended

to make up benefits that could not be paid by the qualified pen-

sion plan due to governmental limits on the amount of benefits

and the level of pay considered in the calculation of benefits. The

Supplemental Retirement Plan also offers participants who leave

the Company between ages 60 and 62 benefits equal to the esti-

mated social security benefits payable at age 62. Participation in

this plan is limited to associates who were profit-sharing man-

agement associates at the end of 1995. Also included in the

unfunded plans is a Voluntary Early Retirement Program, which

was offered in 1997 to management associates who were at least

age 55 with a minimum of 10 years of service and who elected to

take early retirement. Several other smaller plans and agreements

are also included.

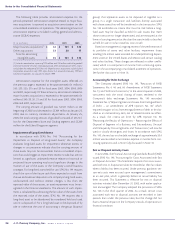

Net periodic pension cost for the defined benefit plans follows:

Pension Plans Expense/(Income)

($ in millions) 2002 2001 2000

Service costs $71$82$92

Interest costs 193 189 186

Projected return on assets (283) (348) (354)

Net amortization 40 3 (19)

Curtailment gain —(11) —

Net periodic pension

plans expense/(income) $21$ (85) $ (95)

Supplemental Plans Expense

($ in millions) 2002 2001 2000

Service costs $3$3$3

Interest costs 22 22 23

Projected return on assets ———

Net amortization 956

Net supplemental

plans expense $34$30$32