JCPenney 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report30

Notes to the Consolidated Financial Statements

9SHORT-TERM DEBT

The Company’s Brazilian subsidiary, Renner, had short-term debt

outstanding of $13 million at January 25, 2003 and $15 million at

January 26, 2002.

In May 2002, JCP and J. C. Penney Company, Inc. entered into a

three-year, $1.5 billion revolving bank line of credit (credit facility)

with a syndicate of banks with JPMorgan Chase Bank as adminis-

trative agent. This credit facility replaced a $1.5 billion facility that

was scheduled to expire in November 2002 and a $630 million let-

ter of credit facility. The credit facility may be used for general cor-

porate purposes, including the issuance of letters of credit. No bor-

rowings, other than the issuance of trade and standby letters of

credit, which totaled $206 million as of the end of 2002, have been

made under this credit facility.

Key terms of this credit facility include a financial performance

covenant, which consists of a maximum ratio of total debt to con-

solidated EBITDA (as defined in the credit agreement) as measured

on a trailing four quarters basis, calculated at the end of each fiscal

quarter. In addition, the amount of outstanding indebtedness

under the agreement is subject to a limitation based on the value

of collateral to total indebtedness, as defined in the credit facility

agreement. At January 25, 2003, the Company was in compliance

with all financial covenants of the credit agreement.

Any indebtedness incurred by JCP under the credit facility is col-

lateralized by all eligible domestic department store and catalog

inventory, as defined in the credit facility agreement, which can be

released as performance improvements are achieved and credit

ratings by the rating agencies improve. Pricing is tiered based on

the corporate credit ratings for JCP by Moody’s and Standard &

Poor’s. Obligations under the credit facility are guaranteed by

J. C. Penney Company, Inc. and JCP Real Estate Holdings, Inc., which

is a wholly owned subsidiary of JCP.

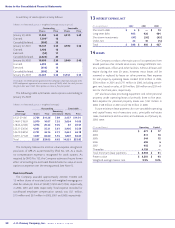

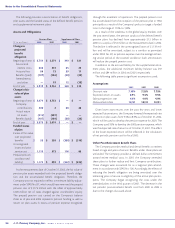

10 LONG-TERM DEBT

($ in millions) 2002 2001

Issue

6.125% to 9.0% Notes, due 2002 to 2097 $ 1,928 $ 2,625

7.125% to 8.125% Debentures,

due 2016 to 2037 1,525 1,525

6.5% to 7.05% Medium-term notes,

due 2002 to 2015 493 700

5.0% Convertible subordinated

notes, due 2008 650 650

8.25% to 9.75% Sinking fund

debentures, due 2021 to 2022 392 405

6.0% Original issue discount

debentures, due 2006 156 146

6.35% to 7.33% Equipment

financing notes, due 2007 25 —

Total notes and debentures 5,169 6,051

Capital lease obligations and other 46 48

Less: current maturities (275) (920)

Total long-term debt $ 4,940 $ 5,179

Two of the Company’s debenture series contain put options where

the investor may elect to have the debenture redeemed at par prior

to its stated maturity date. These include the 6.9% Notes Due 2026,

principal amount $119 million, which may be redeemed August 15,

2003 and the 7.4% Debentures Due 2037, principal amount $400 mil-

lion, which may be redeemed April 1, 2005. Assuming debenture

holders exercise their repayment options, required principal payments

on long-term debt and notes payable over the next five years, exclud-

ing capital lease obligations, are (in millions) $394 in 2003, $238 in 2004,

$624 in 2005, $187 in 2006, $554 in 2007 and $3,172 thereafter.

During 2002, $920 million principal amount of notes matured and

was paid. During 2001, $250 million principal amount of notes

matured and was paid.

The $650 million of 5% Convertible Subordinated Notes Due

2008 were issued in October 2001. These notes are convertible at

any time prior to maturity, unless previously redeemed, at the

option of the holders into shares of the Company’s common

stock at a conversion price of $28.50 per share, subject to certain

adjustments. The notes are subordinated to the Company’s sen-

ior indebtedness. The notes will not be subordinated to JCP’s

trade payables or other general creditors of JCP. The notes are

structurally subordinated to all indebtedness and other liabilities

of the Company and its subsidiaries. JCP may redeem the notes

on or after October 20, 2004.

In 2002, JCP borrowed approximately $27 million from Lombard

US Equipment Finance Corporation in three separate notes to

finance the purchase of equipment for certain department store

support centers. The notes, which are secured by the equipment

being purchased, mature in 2007, bear interest at rates from 6.35% to

7.33% and are payable in monthly installments. Principal payments

of $2 million were made during 2002, resulting in a year-end 2002

balance of $25 million.

See Note 21 for discussion regarding issuance in February 2003 of

$600 million principal amount of 8% Notes Due 2010.

Debt Exchange

JCP issued, pursuant to a private placement, 9.0% Notes Due

2012 with an aggregate principal amount of $230.2 million and a

fair value of approximately $225 million in exchange for $227.2

million of old notes tendered in response to a June 2002

exchange offer. Approximately $79.4 million principal amount of

6.125% Notes Due 2003, $67.0 million principal amount of

7.375% Notes Due 2004 and $80.8 million principal amount of

6.9% Debentures Due 2026 were tendered in response to the

exchange offer. The Company paid total consent fees of $2.2 mil-

lion for such tendered notes. In accordance with SFAS No. 145,

the net loss of approximately $0.4 million was recorded in inter-

est expense in income from continuing operations for the year.

No amendments were made to the indentures governing the

old notes.

The Company subsequently filed a registration statement with

the Securities and Exchange Commission in order to offer to

exchange registered notes for the $230.2 million of notes that were

issued in the prior private placement exchange. The registered