JCPenney 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 23

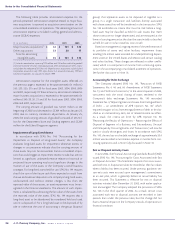

Notes to the Consolidated Financial Statements

generated by licensed departments are included as a component

of retail sales. Shipping and handling fees charged to customers

are also recorded as retail sales with related costs recorded as cost

of goods sold. An allowance has been established for estimated

merchandise returns.

In January 2002 the Company changed its policy to charge the

customer and record the sale when a catalog order is shipped to

a department store for customer pickup. Previously, revenue on a

shipment of a catalog order to a department store was recorded

when the customer picked up and paid for the merchandise.

Advertising

Advertising costs, which include newspaper, television, radio and

other media advertising, are expensed either as incurred or the first

time the advertising occurs, and were $1.1 billion, $947 million and

$967 million for 2002, 2001 and 2000, respectively. These totals

include catalog book costs of $260 million, $269 million and $312

million for 2002, 2001 and 2000, respectively. Catalog book prepa-

ration and printing costs, which are considered direct response

advertising, are charged to expense over the life of the catalog, not

to exceed eight months. Included in other assets are deferred cat-

alog book costs of $73 million as of January 25, 2003 and $86 mil-

lion as of January 26, 2002.

Vendor Allowances

The Company receives cash or allowances from merchandise

vendors as purchase price adjustments and in connection with

cooperative advertising programs. The Company has agreements

in place with each vendor setting forth the specific conditions for

each allowance or payment.

In accordance with EITF 02-16, “Accounting by a Reseller for

Cash Consideration Received from a Vendor,” the Company

records qualifying vendor reimbursements of costs incurred to

advertise a vendor’s products as a reduction of advertising

expense. Vendor allowances that relate to margin performance

not attained on the sale of certain merchandise are credited

directly to cost of goods sold in the period received. For other

vendor allowances, such as those based on purchase volumes,

inventory cost is reduced as required purchase levels are met.

Pre-Opening Expenses

Costs associated with the opening of new stores are expensed

in the period incurred.

Retirement-Related Benefits

The Company accounts for its defined benefit pension plans

and its non-pension post-retirement benefit plans using actuarial

models required by Statement of Financial Accounting Standards

(SFAS) No. 87, “Employers’ Accounting for Pensions,“ and SFAS

No. 106, “Employers’ Accounting for Postretirement Benefits

Other Than Pensions,” respectively. These models effectively

spread changes in asset values, the pension obligation and

assumption changes systematically and gradually over the

employee service periods. One of the principal components of

the net periodic pension calculation is the expected long-term

rate of return on plan assets. The required use of the expected

long-term rate of return on plan assets may result in recognized

pension income that is greater or less than the actual returns on

those plan assets in any given year. Over time, however, the

expected long-term returns are designed to approximate the

actual long-term returns, and therefore, result in a pattern of

income and expense that more closely matches the pattern of

services provided by employees. Differences between actual and

expected returns are recognized gradually in net periodic pension

expense or offset by future gains or losses.

The Company uses long-term historical actual return data, the

mix of investments that comprise plan assets and future esti-

mates of long-term investment returns by reference to external

sources to develop its expected return on plan assets.

The discount rate assumptions used for pension and non-

pension post-retirement benefit plan accounting reflect the rates

available on AA rated corporate bonds on October 31 of each

year. The rate of compensation increase is another significant

assumption used in the actuarial model for pension accounting

and is determined based upon the Company’s long-term plans

for such increases. For retiree medical plan accounting, the health

care cost trend rates do not have a material impact since dollar

limits have been placed on Company contributions.

Income Taxes

Income taxes are accounted for under the asset and liability

method. Deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabil-

ities and their respective tax bases and operating loss and tax

credit carryforwards. Deferred tax assets and liabilities are meas-

ured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are

expected to be recovered or settled. The effect on deferred tax

assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. A valua-

tion allowance is recorded to reduce the carrying amounts of

deferred tax assets unless it is more likely than not that such

assets will be realized.

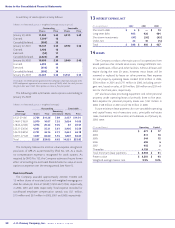

Earnings/(Loss) per Common Share

Basic EPS is computed by dividing net income/(loss) less divi-

dend requirements on the Series B ESOP Convertible Preferred

Stock, net of tax as applicable, by the weighted average number of

common shares outstanding for the period. Except when the

effect would be anti-dilutive, the diluted EPS calculation includes

the impact of restricted stock units and shares that could be

issued under outstanding stock options as well as common shares

that would result from the conversion of convertible debentures

and convertible preferred stock. In addition, the related interest on

convertible debentures (net of tax) and preferred stock dividends