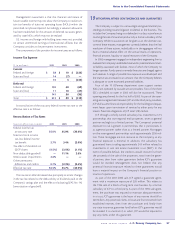

JCPenney 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 annual report J. C. Penney Company, Inc. 27

Notes to the Consolidated Financial Statements

Foreign Currency Translation

Financial statements of subsidiaries outside the U.S. are meas-

ured using the local currency as the functional currency. Assets

and liabilities for these subsidiaries are translated into U.S. dollars

at the exchange rates in effect at the balance sheet date, while

revenues and expenses are translated using average currency

rates during the reporting period. Adjustments from such trans-

lations are accumulated in the equity section of the consolidated

balance sheet under the caption, “Accumulated other compre-

hensive (loss).”

Effect of New Accounting Standards

Emerging Issues Task Force (EITF) Issue No. 02-16, “Accounting

by a Reseller for Cash Consideration Received from a Vendor,”

becomes effective for the Company in fiscal 2003. The consensus

reached on this issue was that cash consideration received from

a vendor is presumed to be a reduction of the cost of merchan-

dise and should be recorded as a reduction of cost of goods sold

unless the consideration is for either (1) payment for assets or

services and therefore revenue, or (2) a reimbursement of costs

incurred to advertise the vendor’s products, and therefore, a

reduction of advertising expense. The Company’s current

accounting for funds received from vendors is consistent with

that proposed under EITF 02-16; therefore, this issue will not

have a material effect on the Company’s consolidated financial

statements.

In November 2002, the FASB issued FASB Interpretation No. 45

(FIN 45), “Guarantor’s Accounting and Disclosure Requirements

for Guarantees, Including Guarantees of Indebtedness of Others.”

Disclosures related to this interpretation are effective for 2002

annual reports, and the accounting requirements are effective for

guarantees entered into or modified after December 31, 2002, and

require all guarantees and indemnifications within its scope to be

recorded at fair value as liabilities, and the maximum possible loss

to the Company under these guarantees and indemnifications to

be disclosed. Current year disclosures related to guarantees are

included in Note 19. Adoption of FIN 45 did not have a material

impact on the Company’s consolidated financial statements.

In December 2002, the FASB issued SFAS No. 148, “Accounting

for Stock-Based Compensation Costs – Transition and Disclosure.”

This statement amends SFAS No. 123 and provides alternative

methods of transition for an entity that voluntarily changes to

the fair value-based method of accounting for stock-based com-

pensation. It also requires additional disclosures about the

effects on reported net income of an entity’s accounting policy

with respect to stock-based employee compensation. As dis-

cussed under accounting for stock options on page 15, the

Company accounts for stock-based compensation in accor-

dance with APB 25 and has adopted the disclosure-only alterna-

tive of SFAS No. 123. The Company adopted the disclosure pro-

visions of SFAS No. 148 for fiscal 2002.

On January 17, 2003, FIN 46, “Consolidation of Variable

Interest Entities, an interpretation of ARB 51,” was issued. The

primary objective of FIN 46 is to provide guidance on the iden-

tification and consolidation of variable interest entities, or VIEs,

which are entities for which control is achieved through means

other than through voting rights. The provisions of FIN 46 are

required to be adopted by the Company in fiscal 2003. The

Company does not expect the adoption of FIN 46 to have a

material impact on its financial position, results of operations or

cash flows.

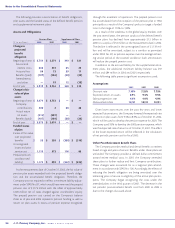

2DISCONTINUED OPERATIONS

In June 2001, JCP closed on the sale of its Direct Marketing

Services (DMS) business and received cash of approximately $1.3

billion ($1.1 billion after tax). Upon completion of the transaction,

the loss was increased from the original estimate by $16 million,

from $296 million to $312 million. The $296 million was reflected

in the 2000 consolidated financial statements as the estimated net

loss on the sale. The additional net loss of $16 million was reflect-

ed in 2001 as a loss on the sale of discontinued operations.

During 2002, new federal income tax regulations were issued

that entitled the Company to additional tax benefits on the

transaction from increased capital loss deductions. The Internal

Revenue Service reviewed this transaction and concurred with

the Company’s treatment of the capital loss amounts based

on the new regulations. The Internal Revenue Service and the

Company entered into an agreement confirming this treatment.

The $34 million reduction of the tax liability from the original tax

provision on the sale is presented as a gain on the sale of discon-

tinued operations in the accompanying 2002 consolidated state-

ment of operations.

Concurrent with the closing, JCP entered into a 15-year

strategic marketing arrangement with AEGON, N. V. whereby

JCP will receive cash payments based on the marketing and sale

of various financial and membership services products to

JCPenney customers.

DMS net revenues were $553 million and $1,164 million for

2001 and 2000, respectively.

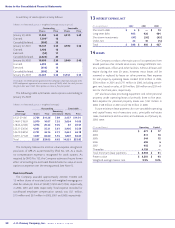

3EARNINGS PER SHARE

The following potential shares of common stock and their

effects on income were excluded from the diluted EPS calcula-

tions because the effect would be anti-dilutive:

• At January 25, 2003, January 26, 2002 and January 27, 2001,

options to purchase 9 million, 9 million and 18 million shares

of common stock at prices ranging from $21 to $71, $23 to

$71 and $9 to $71 per share, respectively, were excluded

from the 2002, 2001 and 2000 calculations, respectively.