JCPenney 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 2002 annual report32

Notes to the Consolidated Financial Statements

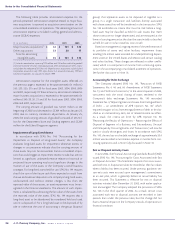

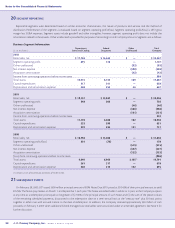

A summary of stock option activity follows:

(shares in thousands, price is weighted average exercise price)

Outstanding Exercisable

Shares Price Shares Price

January 29, 2000 11,832 $ 43 6,913 $ 48

Granted 7,294(1) 16

Canceled/forfeited (959) 35

January 27, 2001 18,167 $ 33 6,592 $ 48

Granted 3,402 16

Exercised (56) 17

Canceled/forfeited (2,823) 29

January 26, 2002 18,690 $ 30 5,840 $ 48

Granted 4,993 20

Exercised (610) 15

Canceled/forfeited (806) 38

January 25, 2003 22,267 $ 28 14,551 $ 33

(1) Includes 3.5 million options granted to the Company’s chairman pursuant to his

2000 employment agreement at an exercise price of $16.06, while the stock price on

the grant date was $13.63. These options vest over a five-year period.

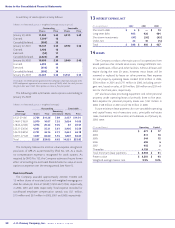

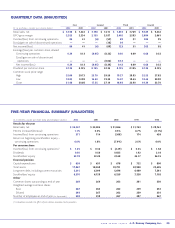

The following table summarizes stock options outstanding at

January 25, 2003:

(shares in thousands, price is weighted average)

Outstanding Exercisable

Exercise Remaining

price range Shares Price term (years) Shares Price

$9.32-$14.66 2,764 $14.26 7.89 2,457 $14.54

$14.87-$18.29 5,970 16.07 7.35 3,654 16.03

$18.44-$24.80 4,974 20.32 9.05 87 20.57

$25.31-$36.06 4,051 35.31 5.61 3,905 35.59

$36.19-$48.50 2,701 46.14 2.73 2,641 46.18

$50.91-$71.28 1,807 66.60 3.35 1,807 66.60

Tot al 22,267 $28.05 6.62 14,551 $32.82

The Company follows the intrinsic value expense recognition

provisions of APB 25 as permitted by SFAS No. 123. As a result,

no compensation expense is recognized for stock options. As

required by SFAS No. 123, the Company estimates the pro forma

effect of recording the estimated Black-Scholes fair value of stock

options as expense over the vesting period (see Note 1).

Restricted Stock

The Company awarded approximately 227,000, 133,000 and

1.5 million shares of restricted stock with weighted-average grant-

date fair values per share of $20.09, $15.94 and $13.60, respectively,

in 2002, 2001 and 2000, respectively. Total expense recorded for

stock-based employee compensation awards was $5.1 million,

$7.5 million and $6.1 million in 2002, 2001 and 2000, respectively.

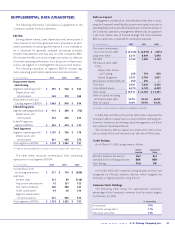

13 INTEREST EXPENSE, NET

($ in millions) 2002 2001 2000

Short-term debt $4$—$13

Long-term debt 403 426 464

Short-term investments (41) (50) (45)

Other, net 22 10 (5)

Tot al $ 388 $ 386 $ 427

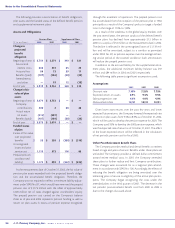

14 LEASES

The Company conducts the major part of its operations from

leased premises that include retail stores, catalog fulfillment cen-

ters, warehouses, offices and other facilities. Almost all leases will

expire during the next 20 years; however, most leases will be

renewed or replaced by leases on other premises. Rent expense

for real property operating leases totaled $734 million in 2002,

$705 million in 2001 and $711 million in 2000, including contin-

gent rent, based on sales, of $59 million, $58 million and $59 mil-

lion for the three years, respectively.

JCP also leases data processing equipment and other personal

property under operating leases of primarily three to five years.

Rent expense for personal property leases was $147 million in

2002, $128 million in 2001 and $152 million in 2000.

Future minimum lease payments for non-cancelable operating

and capital leases, net of executory costs, principally real estate

taxes, maintenance and insurance, and subleases, as of January 25,

2003, were:

($ in millions) Operating Capital

2003 $ 671 $ 17

2004 611 16

2005 544 12

2006 494 4

2007 455 2

Thereafter 4,128 —

Total minimum lease payments $ 6,903 $ 51

Present value $ 3,581 $ 43

Weighted average interest rate 9.9% 9.2%