JCPenney 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

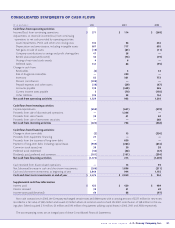

J. C. Penney Company, Inc. 2002 annual report12

Management’s Discussion and Analysis of Financial Condition and Results of Operations

result of better operating performance, inventory and working

capital management, and lower than planned capital expenditures.

At year-end 2002, cash and short-term investments were

approximately $2.5 billion, representing approximately 46% of the

$5.4 billion of outstanding long-term debt including $200 million

for the securitization of Eckerd managed care receivables. The

Company’s liquidity was strengthened, including paying off

approximately $920 million of long-term debt that matured dur-

ing 2002 and contributing $300 million ($190 million after tax) to

the Company’s pension plan in the fourth quarter of 2002. In

October 2002, the Company’s strong liquidity position was rec-

ognized by Moody’s Investors Service, which assigned the

Company its highest liquidity rating (SGL-1). The Company’s liq-

uidity position was further strengthened in February 2003 with

the completion of two transactions. First, on February 3, 2003,

the Company raised approximately $50 million by securitizing

additional Eckerd managed care receivables (See Note 5). Second,

on February 28, 2003, the Company issued $600 million principal

amount of unsecured Notes Due 2010 at an effective rate of

8.125%. See further discussion of subsequent events in Note 21.

During 2002, the Company completed two transactions that

were part of its long-term financing strategy. First, in May 2002, JCP

and J.C. Penney Company, Inc. executed a new three-year $1.5 bil-

lion revolving credit agreement (credit facility), which replaced a

$1.5 billion bank revolving credit facility and a $630 million letter of

credit facility. Indebtedness incurred under the credit facility is col-

lateralized by all eligible domestic department store and catalog

inventory, as defined in the credit facility agreement. This credit

facility provides JCP with an additional source of liquidity for work-

ing capital needs and letter of credit support. No borrowings have

been made under this credit facility, other than the issuance of

trade and stand-by letters of credit, which totaled $206 million as

of year-end 2002. The Company was in compliance with all finan-

cial covenants of the credit facility as of January 25, 2003.

Second, in August 2002, the Company completed a debt

exchange in which certain bondholders tendered $227.2 million

principal amount of three existing debt issues in exchange for new

9.0% Notes Due 2012 with a principal amount of approximately

$230.2 million. Bondholders exchanged $79.4 million principal

amount of JCP’s 6.125% Notes Due 2003, $67.0 million principal

amount of its 7.375% Notes Due 2004 and $80.8 million principal

amount of its 6.9% Debentures Due 2026. This transaction effec-

tively extended the maturity on amounts represented by the

exchanged notes and strengthened the Company’s liquidity.

In 2001, the Company issued $650 million principal amount of

subordinated convertible debentures. Additionally, the Company

securitized certain Eckerd managed care receivables, which generat-

ed cash proceeds of $200 million.

The Company’s liquidity is enhanced by the fact that the cur-

rent debt portfolio and material lease agreements do not contain

any provisions that could trigger early payments, acceleration or

collateral support in the event of adverse changes in the

Company’s financial condition.

The Company has two debenture series that contain put options.

In each case, the investor may elect to have the debenture redeemed

at par prior to its stated maturity date. The 6.9% Notes Due 2026,

principal amount $119 million, may be redeemed on August 15,

2003. The 7.4% Debentures Due 2037, principal amount $400 mil-

lion, may be redeemed on April 1, 2005. For planning purposes, and

in the contractual obligations table on page 14, the Company

assumes the debenture holders will exercise their put options.

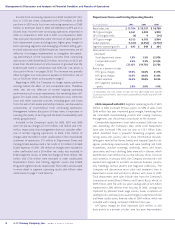

Capital Expenditures

Capital expenditures, including capitalized software costs and

intangible assets, such as Eckerd prescription file acquisitions,

during the past three years are as follows:

($ in millions) 2002 2001 2000

Department Stores and

Catalog $ 317 $ 332 $ 361

Eckerd Drugstores 341 299 317

Tot al $ 658 $ 631 $ 678

Capital expenditures were approximately $200 million below

the original plan for 2002 due to the deferral of certain department

store technology projects as well as increased lease financing avail-

able for new Eckerd drugstores. Major capital investments in 2002

for department stores included the implementation of the SSC dis-

tribution network and in-store centralized checkouts, store mod-

ernizations and renewals and store technology improvements.

2002 capital investments in Eckerd were made primarily to contin-

ue the drugstore reconfiguration program, which was rolled out to

an additional 800 drugstores in 2002. This program includes new

and relocated stores, as well as stores in freestanding locations.

Management expects 2003 capital expenditures to be in the

range of $0.9 billion to $1.1 billion, including approximately $100

million for deferred projects from 2002. 2003 capital expenditures

will be about evenly split between Department Stores and Catalog,

and Eckerd. Department Store and Catalog capital investments will

be primarily for department store renovations and upgrades, com-

pletion of the SSC distribution network and technology enhance-

ments. The majority of Eckerd capital spending in 2003 will be for

the expansion of new and relocated stores, remodeling and recon-

figuration of existing stores and new technology. In 2003, Eckerd

expects to remodel 550 stores, open or relocate an additional 250

stores, so that by the end of 2003, 80% of the total drugstore port-

folio will be operating in the new reconfigured format.

Cash Flow and Financing Outlook

As of the end of 2002, the Company’s long-term financing strate-

gy remains on track. Two consecutive years of positive results and

stronger than expected free cash flow in 2002 have increased the

cash and short-term investment balance to approximately $2.5 billion

as of year end. In effect, the cash investment balance is comprised of

$1.3 billion of positive free cash flow over the 2000 to 2002 period and

$1.1 billion in after-tax proceeds from the 2001 sale of DMS.

With the Company’s current credit ratings and increased volatility

in the capital markets generally, management believes a strong cash

and liquidity position is an important part of its long-term financing

strategy during the remaining years of the turnaround plan. Going