Honda 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

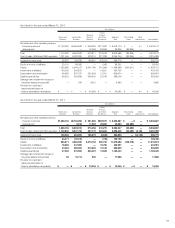

Yen (millions)

2010 2011

Non-financial Non-financial

services Finance Reconciling services Finance Reconciling

Years ended March 31, 2010 and 2011 businesses subsidiaries items Consolidated businesses subsidiaries items Consolidated

Cash flows from operating activities:

Net income ¥ 176,370 ¥ 106,241 ¥ — ¥ 282,611 ¥ 456,181 ¥107,296 ¥ — ¥ 563,477

Adjustments to reconcile net

income to net cash provided

by operating activities:

Depreciation 399,221 230,453 — 629,674 349,834 213,805 — 563,639

Deferred income taxes 20,622 35,984 — 56,606 28,691 101,489 — 130,180

Equity in income of affiliates (93,282) — — (93,282) (139,756) — — (139,756)

Dividends from affiliates 140,901 — — 140,901 98,182 — — 98,182

Gain on sales of investments

in affiliates — — — — (46,756) — — (46,756)

Impairment loss on investments

in securities 603 — — 603 2,133 — — 2,133

Damaged and impairment loss on

long-lived assets and goodwill 548 3,312 — 3,860 16,833 835 — 17,668

Loss (gain) on derivative

instruments, net (6,683) (31,070) — (37,753) 670 (8,458) — (7,788)

Decrease (increase) in trade

accounts and notes receivable (67,982) 63,763 (2,691) (6,910) 26,837 12,413 (550) 38,700

Decrease (increase) in inventories 352,994 — — 352,994 (33,676) — — (33,676)

Increase (decrease) in trade

accounts and notes payable 153,440 — (2,095) 151,345 (50,618) — (4,713) (55,331)

Other, net 22,892 28,393 12,278 63,563 (73,797) 13,342 620 (59,835)

Net cash provided by (used in)

operating activities 1,099,644 437,076 7,492 1,544,212 634,758 440,722 (4,643) 1,070,837

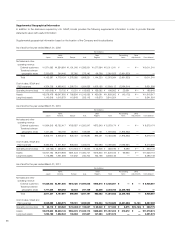

Cash flows from investing activities:

Decrease (increase) in investments

and advances 106,565 (5,878) (121,852) (21,165) (41,730) 4,951 16,865 (19,914)

Proceeds from sales of investments

in affiliates — — — — 71,073 — — 71,073

Capital expenditures (389,747) (2,315) — (392,062) (316,472) (2,071) — (318,543)

Proceeds from sales of property,

plant and equipment 24,132 340 — 24,472 24,089 636 — 24,725

Decrease (increase) in finance

subsidiaries–receivables — 87,571 4,350 91,921 — (90,859) (7,717) (98,576)

Purchase of operating lease assets — (544,027) — (544,027) — (798,420) — (798,420)

Proceeds from sales of operating

lease assets — 245,110 — 245,110 — 408,265 — 408,265

Net cash used in

investing activities (259,050) (219,199) (117,502) (595,751) (263,040) (477,498) 9,148 (731,390)

Cash flows from financing activities:

Increase (decrease) in short-term

debt, net (458,642) (304,264) 113,265 (649,641) 11,270 107,495 (5,096) 113,669

Proceeds from long-term debt 115,120 1,023,804 (6,702) 1,132,222 18,174 786,399 (5,053) 799,520

Repayment of long-term debt (25,285) (941,995) 3,447 (963,833) (27,539) (848,511) 5,644 (870,406)

Dividends paid (61,696) — — (61,696) (92,170) — — (92,170)

Dividends paid to

noncontrolling interests (16,278) — — (16,278) (16,232) — — (16,232)

Sales (purchase) of treasury stock, net (18) — — (18) (34,797) — — (34,797)

Net cash provided by (used in)

financing activities (446,799) (222,455) 110,010 (559,244) (141,294) 45,383 (4,505) (100,416)

Effect of exchange rate changes

on cash and cash equivalents 38,786 1,530 — 40,316 (78,757) (1,152) — (79,909)

Net change in cash and

cash equivalents 432,581 (3,048) — 429,533 151,667 7,455 — 159,122

Cash and cash equivalents at

beginning of period 668,114 22,255 — 690,369 1,100,695 19,207 — 1,119,902

Cash and cash equivalents

at end of period ¥1,100,695 ¥ 19,207 ¥ — ¥1,119,902 ¥1,252,362 ¥ 26,662 ¥ — ¥1,279,024

Notes:

1. Non-financial services businesses lend to finance subsidiaries. These cash flows are included in the decrease (increase) in investments and advances, increase (decrease) in short-term

debt, proceeds from long-term debt, and repayment of long-term debt. The amount of the loans to finance subsidiaries is a ¥121,852 million decrease for the fiscal year ended March

31, 2010, and a ¥16,865 million increase for the fiscal year ended March 31, 2011, respectively.

2. Decrease (increase) in trade accounts and notes receivable for finance subsidiaries is due to the reclassification of finance subsidiaries–receivables which relate to sales of inventory in

the unaudited consolidated statements of cash flows presented above.

71

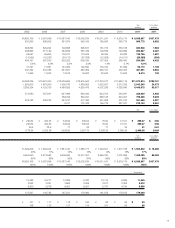

Consolidated Statements of Cash Flows Divided into

Non-Financial Services Businesses and Finance Subsidiaries