Honda 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Standards Update (ASU) 2009-16 “Accounting for Transfers of

Financial Assets”, and ASU 2009-17 “Improvements to Financial

Reporting by Enterprises Involved with Variable Interest Entities”,

effective April 1, 2010. Upon the adoption of these standards, we

consolidated all trusts as of April 1, 2010. As a result, we have no

off-balance sheet arrangements in the fiscal year ended March 31,

2011. Information about ASU 2009-16 and 2009-17 is described in

note (1)(c) and information about variable interest entities and

securitizations is described in note (4) to the accompanying

consolidated financial statements.

Guarantee

At March 31, 2011, we guaranteed ¥30.3 billion of employee bank

loans for their housing costs. If an employee defaults on his/her loan

payments, we are required to perform under the guarantee. The

undiscounted maximum amount of our obligation to make future

payments in the event of defaults is ¥30.3 billion. As of March 31,

2011, no amount was accrued for any estimated losses under the

obligations, as it was probable that the employees would be able to

make all scheduled payments.

a special-purpose entity, which is established for the limited purpose

of buying and re-transfer finance receivables. Our finance subsidiaries

remain as a servicer of the finance receivables and are paid a

servicing fee for our services. The special-purpose entity transfers

the receivables to a trust which is newly structured for each

securitization or bank conduit, which issues asset-backed securities

or commercial paper, respectively, to investors. Our finance

subsidiaries retain certain subordinated interests in the transferred

receivables in the form of subordinated certificates, servicing assets

and residual interests in certain cash reserves provided as credit

enhancements for investors. Our finance subsidiaries apply

significant assumptions regarding prepayments, credit losses and

average interest rates in estimating expected cash flows from the

trust or bank conduit, which affect the recoverability of our retained

interests in the transferred finance receivables. We periodically

evaluate these assumptions and adjust them, if appropriate, to

reflect the performance of the finance receivables.

We have not consolidated certain trusts since these trusts meet

the definitions of a former qualifying special-purpose entity before

the fiscal year ended March 31, 2011. We adopted Accounting

Tabular Disclosure of Contractual Obligations

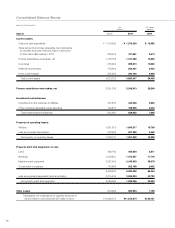

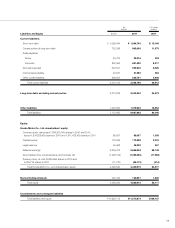

The following table shows our contractual obligations at March 31, 2011:

Yen (millions)

Payments due by period

Total Less than 1 year 1-3 years 3-5 years After 5 years

Long-term debt ¥3,005,695 ¥ 962,455 ¥1,369,943 ¥555,551 ¥117,746

Operating leases 102,783 19,100 24,370 15,115 44,198

Purchase commitments*1 28,466 28,466 — — —

Interest payments*2 218,226 92,907 97,696 25,112 2,511

Contributions to defined benefit pension plans*3 92,815 92,815 — — —

Total ¥3,447,985 ¥1,195,743 ¥1,492,009 ¥595,778 ¥164,445

*1 Honda had commitments for purchases of property, plant and equipment at March 31, 2011.

*2 To estimate the schedule of interest payments, the Company utilized the balances and average interest rates of borrowings and debts and derivative instruments as of March 31, 2011.

*3 Since contributions beyond the next fiscal year are not currently determinable, contributions to defined benefit pension plans reflect only contributions expected for the next fiscal year.

If our estimates of unrecognized tax benefits and potential tax

benefits are not representative of actual outcomes, our consolidated

financial statements could be materially affected in the period of

settlement or when the statutes of limitations expire, as we treat

these events as discrete items in the period of resolution. Since it is

difficult to estimate actual payment in the future related to our

uncertain tax positions, unrecognized tax benefits totaled ¥46,265

million are not represented in the table above.

At March 31, 2011, we had no material capital lease obligations

or long-term liabilities reflected on our balance sheet under U.S.

GAAP other than those set forth in the table above.

Trend Information

The Great East Japan Earthquake

The Great East Japan Earthquake occurred on March 11, 2011 and

the nuclear power plant disaster has caused and will continue to

cause significant damage to the Japanese economy. Honda’s

business sites, such as Honda’s R&D subsidiaries located in Tochigi

Prefecture, were heavily damaged. As a result, certain property,

plant and equipment and inventories were damaged. On March 11,

2011, Honda temporarily suspended production and R&D activities

at its sites located in Japan due to the effects of this disaster, which

includes a shortage of parts supplies and damage on property, plant

and equipment.

49