Home Depot 2005 Annual Report Download - page 70

Download and view the complete annual report

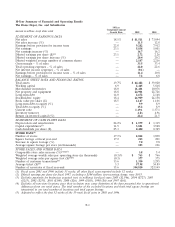

Please find page 70 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12. SUBSEQUENT EVENTS

On March 24, 2006, the Company issued $1.0 billion of 5.20% Senior Notes due March 1, 2011 at a

discount of $1 million and $3.0 billion of 5.40% Senior Notes due March 1, 2016 at a discount of

$15 million. Interest on these senior notes is due semi-annually on March 1 and September 1, of each

year.

Additionally in March 2006, the Company entered into forward starting interest rate swap agreements

with a notional amount of $2.0 billion accounted for as a cash flow hedge to hedge interest rate

fluctuations in anticipation of the issuance of the 5.40% Senior Notes due March 1, 2016. Upon

issuance of the 5.40% Senior Notes due March 1, 2016, the Company settled its forward starting

interest rate swap agreements and recorded a $19 million decrease to Accumulated Other

Comprehensive Income, which will be amortized to interest expense over the life of the 5.40% Senior

Notes due March 1, 2016.

58