Home Depot 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

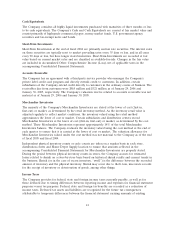

Foreign Currency Translation

Assets and Liabilities denominated in a foreign currency are translated into U.S. dollars at the current

rate of exchange on the last day of the reporting period. Revenues and Expenses are generally

translated at a daily exchange rate and equity transactions are translated using the actual rate on the

day of the transaction.

Segment Information

The Company operates within a single operating segment within North America. Net Sales for Canada

and Mexico were $5.3 billion, $4.2 billion and $3.4 billion during fiscal 2005, 2004 and 2003,

respectively. Long-lived assets in Canada and Mexico totaled $2.2 billion and $1.7 billion as of

January 29, 2006 and January 30, 2005, respectively.

Reclassifications

Certain amounts in prior fiscal years have been reclassified to conform with the presentation adopted

in the current fiscal year.

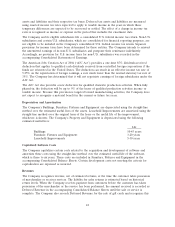

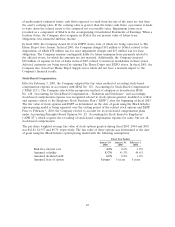

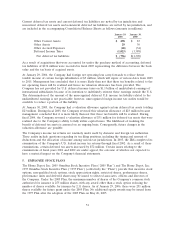

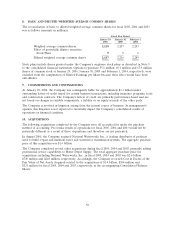

2. INTANGIBLE ASSETS

The Company’s intangible assets at the end of fiscal 2005 and fiscal 2004, which are included in Other

Assets in the accompanying Consolidated Balance Sheets, consisted of the following (amounts in

millions):

January 29, January 30,

2006 2005

Customer relationships $283 $10

Trademarks and franchises 92 2

Other 58 13

Less accumulated amortization (35) (7)

Total $398 $18

Amortization expense related to intangible assets was $29 million and $4 million for fiscal 2005 and

fiscal 2004, respectively. Estimated future amortization expense for intangible assets recorded as of

January 29, 2006 is $60 million, $59 million, $55 million, $52 million and $48 million for fiscal 2006

through fiscal 2010, respectively.

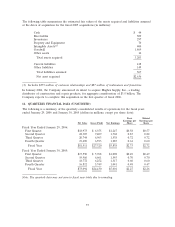

3. DEBT

As of January 29, 2006, the Company had $900 million of Short-Term Debt outstanding under its

commercial paper program. In the fourth quarter of fiscal 2005, the Company increased the maximum

capacity for borrowing under its commercial paper program to $2.5 billion as well as increased the

related back-up credit facility with a consortium of banks to $2.0 billion. Since the initial borrowing on

January 17, 2006, the maximum amount outstanding under the commercial paper program was

$900 million and the weighted average interest rate was 4.3%. The credit facility, which expires in

December 2010, contains various restrictions, none of which is expected to materially impact the

Company’s liquidity or capital resources.

47