Home Depot 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

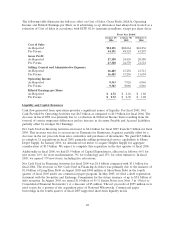

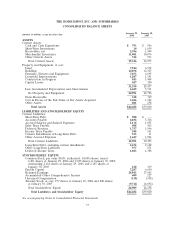

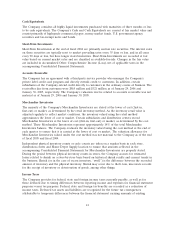

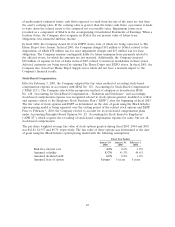

THE HOME DEPOT, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

January 29, January 30,

amounts in millions, except per share data 2006 2005

ASSETS

Current Assets:

Cash and Cash Equivalents $ 793 $ 506

Short-Term Investments 14 1,659

Receivables, net 2,396 1,499

Merchandise Inventories 11,401 10,076

Other Current Assets 742 533

Total Current Assets 15,346 14,273

Property and Equipment, at cost:

Land 7,924 6,932

Buildings 14,056 12,325

Furniture, Fixtures and Equipment 7,073 6,195

Leasehold Improvements 1,207 1,191

Construction in Progress 843 1,404

Capital Leases 427 390

31,530 28,437

Less Accumulated Depreciation and Amortization 6,629 5,711

Net Property and Equipment 24,901 22,726

Notes Receivable 348 369

Cost in Excess of the Fair Value of Net Assets Acquired 3,286 1,394

Other Assets 601 258

Total Assets $44,482 $39,020

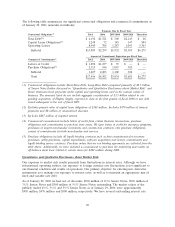

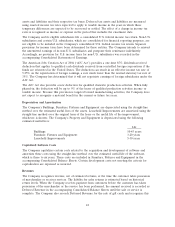

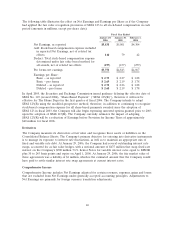

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities:

Short-Term Debt $ 900 $—

Accounts Payable 6,032 5,766

Accrued Salaries and Related Expenses 1,176 1,055

Sales Taxes Payable 488 412

Deferred Revenue 1,757 1,546

Income Taxes Payable 388 161

Current Installments of Long-Term Debt 513 11

Other Accrued Expenses 1,647 1,504

Total Current Liabilities 12,901 10,455

Long-Term Debt, excluding current installments 2,672 2,148

Other Long-Term Liabilities 977 871

Deferred Income Taxes 1,023 1,388

STOCKHOLDERS’ EQUITY

Common Stock, par value $0.05; authorized: 10,000 shares; issued

2,401 shares at January 29, 2006 and 2,385 shares at January 30, 2005;

outstanding 2,124 shares at January 29, 2006 and 2,185 shares at

January 30, 2005 120 119

Paid-In Capital 7,287 6,650

Retained Earnings 28,943 23,962

Accumulated Other Comprehensive Income 409 227

Unearned Compensation (138) (108)

Treasury Stock, at cost, 277 shares at January 29, 2006 and 200 shares

at January 30, 2005 (9,712) (6,692)

Total Stockholders’ Equity 26,909 24,158

Total Liabilities and Stockholders’ Equity $44,482 $39,020

See accompanying Notes to Consolidated Financial Statements.

37