Home Depot 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

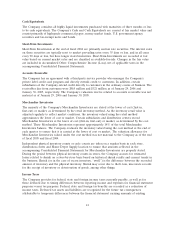

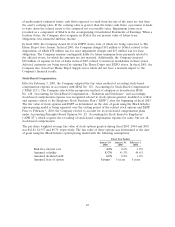

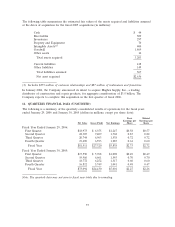

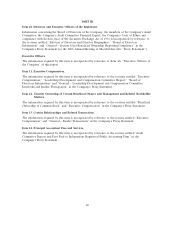

The reconciliation of the Provision for Income Taxes at the federal statutory rate of 35% to the actual

tax expense for the applicable fiscal years is as follows (amounts in millions):

Fiscal Year Ended

January 29, January 30, February 1,

2006 2005 2004

Income taxes at federal statutory rate $3,249 $2,769 $2,395

State income taxes, net of federal income

tax benefit 279 215 217

Foreign rate differences (10) (17) (29)

Change in valuation allowance (23) (31) —

Other, net (51) (25) (44)

Total $3,444 $2,911 $2,539

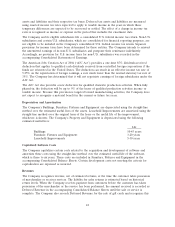

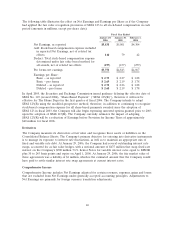

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets

and deferred tax liabilities as of January 29, 2006 and January 30, 2005, were as follows (amounts in

millions):

January 29, January 30,

2006 2005

Current:

Deferred Tax Assets:

Accrued self-insurance liabilities $ 220 $ 106

Other accrued liabilities 278 202

Other 28 —

Current Deferred Tax Assets 526 308

Deferred Tax Liabilities:

Accelerated inventory deduction (271) (234)

Other (17) (25)

Current Deferred Tax Liabilities (288) (259)

Current Deferred Tax Assets, net 238 49

Noncurrent:

Deferred Tax Assets:

Accrued self-insurance liabilities 277 79

Other accrued liabilities 35 11

Net operating losses 63 41

Valuation allowance —(23)

Noncurrent Deferred Tax Assets 375 108

Deferred Tax Liabilities:

Property and equipment (1,160) (1,425)

Goodwill and other intangibles (209) (33)

Other —(8)

Noncurrent Deferred Tax Liabilities (1,369) (1,466)

Noncurrent Deferred Tax Liabilities, net (994) (1,358)

Net Deferred Tax Liabilities $ (756) $(1,309)

50