Home Depot 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In February 2005 and August 2005, our Board of Directors authorized an additional $2.0 billion and

$1.0 billion, respectively, in our share repurchase program, bringing the total authorization by our

Board of Directors since inception of the program in 2002 to $11.0 billion as of January 29, 2006.

Pursuant to this authorization, we have repurchased approximately 277 million shares of our common

stock for a total of $9.7 billion as of January 29, 2006. During fiscal 2005, we repurchased

approximately 76 million shares of our common stock for $3.0 billion and during fiscal 2004 we

repurchased 84 million shares of our common stock for $3.1 billion. As of January 29, 2006,

approximately $1.3 billion remained under our previously authorized share repurchase program.

Subsequent to the end of fiscal 2005, our Board of Directors authorized an additional $1.0 billion

bringing the total authorization since the inception of the share repurchase program to $12.0 billion.

During fiscal 2005, we also increased dividends paid by 19.2% to $857 million from $719 million in

fiscal 2004.

We have a commercial paper program that allows for borrowings up to a maximum of $2.5 billion. In

connection with the program, we have a back-up credit facility with a consortium of banks for

borrowings up to $2.0 billion. As of January 29, 2006, there was $900 million outstanding under the

program. We expect to repay this amount during the first quarter of 2006. The credit facility, which

expires in December 2010, contains various restrictions, none of which is expected to impact our

liquidity or capital resources.

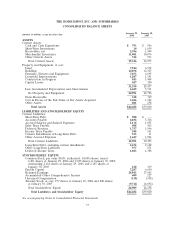

We use capital and operating leases to finance a portion of our real estate, including our stores,

distribution centers and store support centers. The net present value of capital lease obligations is

reflected in our Consolidated Balance Sheets in Long-Term Debt. In accordance with generally

accepted accounting principles, the operating leases are not reflected in our Consolidated Balance

Sheets. As of the end of fiscal 2005, our long-term debt-to-equity ratio was 9.9% compared to 8.9% at

the end of fiscal 2004. This increase reflects the net increase in Long-Term Debt as a result of the

August 2005 issuance of 45⁄8% Senior Notes due August 15, 2010.

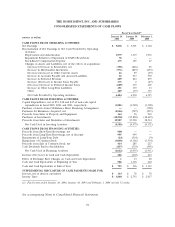

As of January 29, 2006, we had $807 million in Cash and Short-Term Investments. We believe that our

current cash position and cash flow generated from operations should be sufficient to enable us to

complete our capital expenditure programs and any required long-term debt payments through the next

several fiscal years. In addition, we have funds available from the $2.5 billion commercial paper

program and the ability to obtain alternative sources of financing for future acquisitions and other

requirements. In March 2006, we used the remaining availability under our shelf registration statement

to issue $1.0 billion of 5.20% Senior Notes due March 1, 2011 and $3.0 billion of 5.40% Senior Notes

due March 1, 2016. We intend to use the proceeds to fund our pending acquisition of Hughes Supply

and to refinance our $500 million of 53⁄8% Senior Notes due April 1, 2006.

29