Home Depot 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

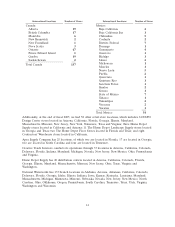

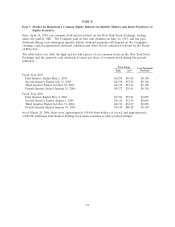

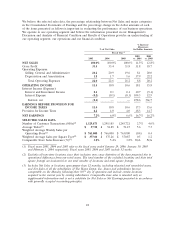

We believe the selected sales data, the percentage relationship between Net Sales and major categories

in the Consolidated Statements of Earnings and the percentage change in the dollar amounts of each

of the items presented as follows is important in evaluating the performance of our business operations.

We operate in one operating segment and believe the information presented in our Management’s

Discussion and Analysis of Financial Condition and Results of Operations provides an understanding of

our operating segment, our operations and our financial condition.

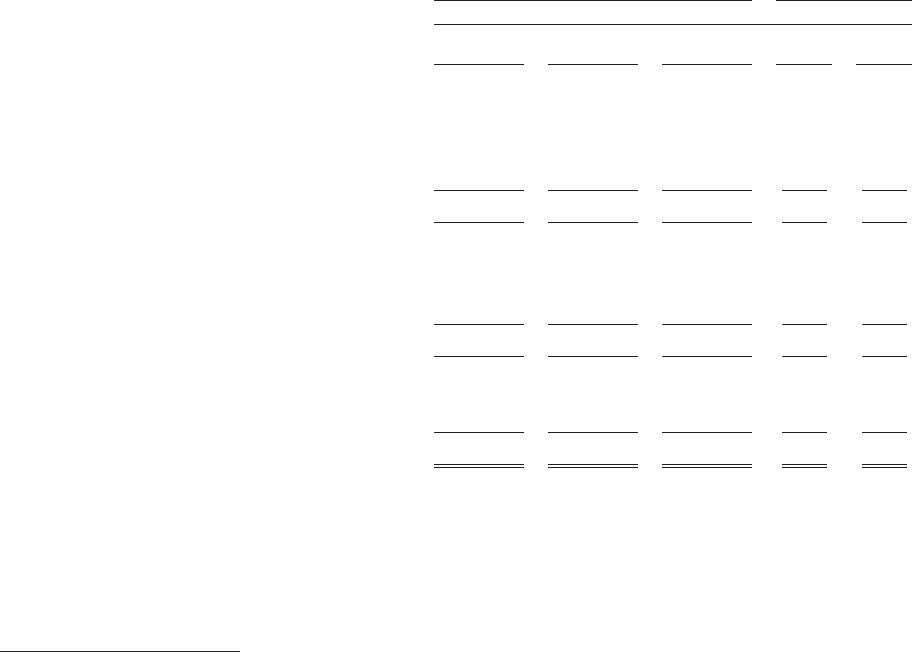

% Increase

(Decrease)

% of Net Sales In Dollar Amounts

Fiscal Year(1)

2005 2004

2005 2004 2003 vs. 2004 vs. 2003

NET SALES 100.0% 100.0% 100.0% 11.5% 12.8%

Gross Profit 33.5 33.4 31.8 11.8 18.7

Operating Expenses:

Selling, General and Administrative 20.2 20.9 19.6 8.1 20.0

Depreciation and Amortization 1.8 1.7 1.6 17.9 22.2

Total Operating Expenses 22.0 22.6 21.2 8.8 20.2

OPERATING INCOME 11.5 10.8 10.6 18.1 15.8

Interest Income (Expense):

Interest and Investment Income 0.1 0.1 0.1 10.7 (5.1)

Interest Expense (0.2) (0.1) (0.1) 104.3 12.9

Interest, net (0.1) — — 478.6 366.7

EARNINGS BEFORE PROVISION FOR

INCOME TAXES 11.4 10.8 10.6 17.3 15.6

Provision for Income Taxes 4.2 4.0 4.0 18.3 14.7

NET EARNINGS 7.2% 6.8% 6.6% 16.7% 16.2%

SELECTED SALES DATA

Number of Customer Transactions (000s)(2) 1,329,873 1,295,185 1,245,721 2.7% 4.0%

Average Ticket(2) $ 57.98 $ 54.89 $ 51.15 5.6 7.3

Weighted Average Weekly Sales per

Operating Store(2) $ 763,000 $ 766,000 $ 763,000 (0.4) 0.4

Weighted Average Sales per Square Foot(2) $ 377.01 $ 375.26 $ 370.87 0.5 1.2

Comparable Store Sales Increase (%)(3) 3.8% 5.4% 3.8% N/A N/A

(1) Fiscal years 2005, 2004 and 2003 refer to the fiscal years ended January 29, 2006, January 30, 2005

and February 1, 2004, respectively. Fiscal years 2005, 2004 and 2003 include 52 weeks.

(2) Excludes all non-store locations since their inclusion may cause distortion of the data presented due to

operational differences from our retail stores. The total number of the excluded locations and their total

square footage are immaterial to our total number of locations and total square footage.

(3) Includes Net Sales at locations open greater than 12 months, including relocated and remodeled stores,

and Net Sales of all the subsidiaries of The Home Depot, Inc. Stores and subsidiaries become

comparable on the Monday following their 365th day of operation and include certain locations

acquired in the current year by existing subsidiaries. Comparable store sales is intended only as

supplemental information and is not a substitute for Net Sales or Net Earnings presented in accordance

with generally accepted accounting principles.

22