Home Depot 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Maturities of Long-Term Debt are $513 million for fiscal 2006, $16 million for fiscal 2007, $300 million

for fiscal 2008, $1.0 billion for fiscal 2009, $1.0 billion for fiscal 2010 and $328 million thereafter.

As of January 29, 2006, the market values of the publicly traded 45⁄8% Senior Notes, 33⁄4% Senior Notes

and 53⁄8% Senior Notes were approximately $985 million, $976 million and $500 million, respectively.

The estimated fair value of all other long-term borrowings, excluding capital lease obligations, was

approximately $314 million compared to the carrying value of $312 million. These fair values were

estimated using a discounted cash flow analysis based on the Company’s incremental borrowing rate for

similar liabilities.

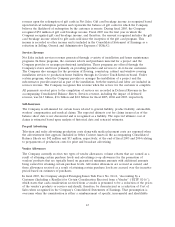

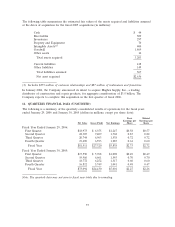

4. INCOME TAXES

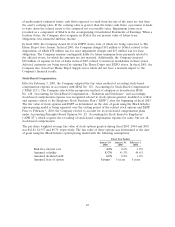

The components of Earnings before Provision for Income Taxes for fiscal 2005, 2004 and 2003 are as

follows (amounts in millions):

Fiscal Year Ended

January 29, January 30, February 1,

2006 2005 2004

United States $8,736 $7,508 $6,440

Foreign 546 404 403

Total $9,282 $7,912 $6,843

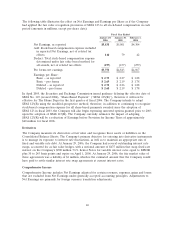

The Provision for Income Taxes consisted of the following (amounts in millions):

Fiscal Year Ended

January 29, January 30, February 1,

2006 2005 2004

Current:

Federal $3,394 $2,153 $1,520

State 507 279 307

Foreign 156 139 107

4,057 2,571 1,934

Deferred:

Federal (527) 304 573

State (111) 52 27

Foreign 25 (16) 5

(613) 340 605

Total $3,444 $2,911 $2,539

The Company’s combined federal, state and foreign effective tax rates for fiscal 2005, 2004 and 2003,

net of offsets generated by federal, state and foreign tax benefits, were approximately 37.1%, 36.8%

and 37.1%, respectively.

49