Home Depot 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

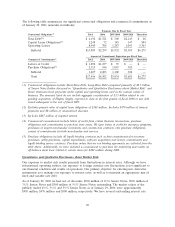

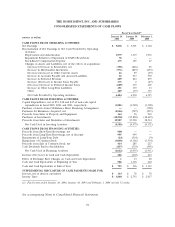

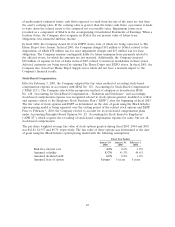

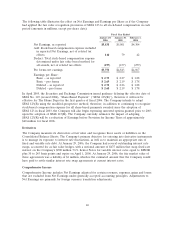

THE HOME DEPOT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Fiscal Year Ended(1)

January 29, January 30, February 1,

amounts in millions 2006 2005 2004

CASH FLOWS FROM OPERATING ACTIVITIES:

Net Earnings $ 5,838 $ 5,001 $ 4,304

Reconciliation of Net Earnings to Net Cash Provided by Operating

Activities:

Depreciation and Amortization 1,579 1,319 1,076

Impairment Related to Disposition of EXPO Real Estate 78 ——

Stock-Based Compensation Expense 175 125 67

Changes in Assets and Liabilities, net of the effects of acquisitions:

(Increase) Decrease in Receivables, net (358) (266) 25

Increase in Merchandise Inventories (971) (849) (693)

Decrease (Increase) in Other Current Assets 16 29 (49)

Increase in Accounts Payable and Accrued Liabilities 12 917 790

Increase in Deferred Revenue 209 263 279

Increase (Decrease) in Income Taxes Payable 175 2 (27)

(Decrease) Increase in Deferred Income Taxes (609) 319 605

Increase in Other Long-Term Liabilities 151 119 33

Other 189 (75) 135

Net Cash Provided by Operating Activities 6,484 6,904 6,545

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital Expenditures, net of $51, $38 and $47 of non-cash capital

expenditures in fiscal 2005, 2004 and 2003, respectively (3,881) (3,948) (3,508)

Purchase of Assets from Off-Balance Sheet Financing Arrangement —— (598)

Payments for Businesses Acquired, net (2,546) (727) (215)

Proceeds from Sales of Property and Equipment 164 96 265

Purchases of Investments (18,230) (25,890) (38,649)

Proceeds from Sales and Maturities of Investments 19,907 25,990 38,534

Net Cash Used in Investing Activities (4,586) (4,479) (4,171)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from Short-Term Borrowings, net 900 ——

Proceeds from Long-Term Borrowings, net of discount 995 995 —

Repayments of Long-Term Debt (24) (510) (9)

Repurchase of Common Stock (3,040) (3,106) (1,554)

Proceeds from Sale of Common Stock, net 414 285 227

Cash Dividends Paid to Stockholders (857) (719) (595)

Net Cash Used in Financing Activities (1,612) (3,055) (1,931)

Increase (Decrease) in Cash and Cash Equivalents 286 (630) 443

Effect of Exchange Rate Changes on Cash and Cash Equivalents 133 20

Cash and Cash Equivalents at Beginning of Year 506 1,103 640

Cash and Cash Equivalents at End of Year $ 793 $ 506 $ 1,103

SUPPLEMENTAL DISCLOSURE OF CASH PAYMENTS MADE FOR:

Interest, net of interest capitalized $ 114 $78$70

Income Taxes $ 3,860 $ 2,793 $ 2,037

(1) Fiscal years ended January 29, 2006, January 30, 2005 and February 1, 2004 include 52 weeks.

See accompanying Notes to Consolidated Financial Statements.

39