Home Depot 2005 Annual Report Download - page 64

Download and view the complete annual report

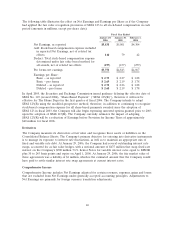

Please find page 64 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under the Plans, as of January 29, 2006, the Company had granted incentive and non-qualified stock

options for 192 million shares, net of cancellations (of which 110 million had been exercised). Incentive

stock options and non-qualified stock options are priced at the fair market value of the Company’s

stock on the date of the grant and typically vest at the rate of 25% per year commencing on the first

anniversary date of the grant and expire on the tenth anniversary date of the grant. The Company

recognized $133 million, $86 million and $40 million of stock-based compensation expense in fiscal

2005, 2004 and 2003, respectively, related to stock options granted, modified or settled and expense

related to the ESPP after the beginning of 2003 (see Note 1 under the caption ‘‘Stock-Based

Compensation’’).

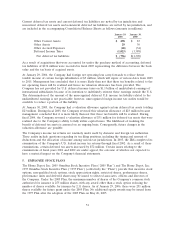

Under the Plans, as of January 29, 2006, the Company had issued 6 million shares of restricted stock

with a weighted average grant date value of $35.76 per share net of cancellations (the restrictions on

741,000 shares have lapsed). Generally, the restrictions on the restricted stock lapse according to one of

the following schedules: (1) the restrictions on 25% of the restricted stock lapse upon the third and

sixth year anniversaries of the date of issuance with the remaining 50% of the restricted stock lapsing

upon the associate’s attainment of age 62, or (2) the restrictions on 100% of the restricted stock lapse

at 3 or 5 years. The fair value of the restricted stock is expensed over the period during which the

restrictions lapse. The Company recorded stock-based compensation expense related to restricted stock

of $32 million, $22 million and $13 million in fiscal 2005, 2004 and 2003, respectively.

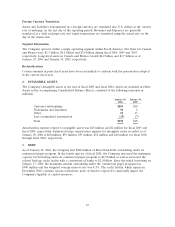

The Company maintains two employee stock purchase plans (U.S. and non-U.S. plans). The plan for

U.S. associates is a tax-qualified plan under Section 423 of the Internal Revenue Code. The non-U.S.

plan is not a Section 423 plan. The ESPPs allow associates to purchase up to 152 million shares of

common stock, of which 117 million shares (adjusted for subsequent stock splits) have been purchased

from inception of the plans. Prior to July 1, 2004, shares under the ESPPs were purchased at a price

equal to the lower of 85% of the stock’s fair market value on the first day or the last day of the

purchase period. Beginning July 1, 2004, the purchase price of shares under the ESPPs was equal to

85% of the stock’s fair market value on the last day of the purchase period. These shares were

included in the pro forma calculation of stock-based compensation expense included in Note 1 under

the caption ‘‘Stock-Based Compensation.’’ During fiscal 2005, 3 million shares were purchased under

the ESPPs at an average price of $33.72 per share. Under the outstanding ESPPs as of January 29,

2006, employees have contributed $10 million to purchase shares at 85% of the stock’s fair market

value on the last day (June 30, 2006) of the purchase period. The Company had 35 million shares

available for issuance under the ESPPs at January 29, 2006.

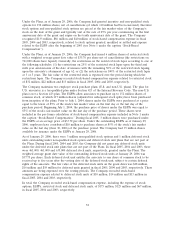

As of January 29, 2006, there were 3 million non-qualified stock options and 1 million deferred stock

units outstanding under non-qualified stock option and deferred stock unit plans that are not part of

the Plans. During fiscal 2005, 2004 and 2003, the Company did not grant any deferred stock units

under the deferred stock unit plans that are not part of the Plans. In fiscal 2005, 2004 and 2003, there

were 461,000, 461,000 and 635,000 deferred stock units, respectively, granted under the Plans. The

weighted average grant date value of the outstanding deferred stock units at January 29, 2006 was

$37.75 per share. Each deferred stock unit entitles the associate to one share of common stock to be

received up to five years after the vesting date of the deferred stock unit, subject to certain deferral

rights of the associate. The fair value of the deferred stock units on the grant dates was $18 million,

$16 million and $19 million for deferred units granted in fiscal 2005, 2004 and 2003, respectively. These

amounts are being expensed over the vesting periods. The Company recorded stock-based

compensation expense related to deferred stock units of $10 million, $14 million and $13 million in

fiscal 2005, 2004 and 2003, respectively.

In total, the Company recorded stock-based compensation expense, including the expense of stock

options, ESPPs, restricted stock and deferred stock units, of $175 million, $125 million and $67 million,

in fiscal 2005, 2004 and 2003, respectively.

52