Home Depot 2005 Annual Report Download - page 53

Download and view the complete annual report

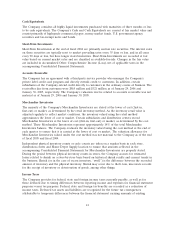

Please find page 53 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash Equivalents

The Company considers all highly liquid investments purchased with maturities of three months or less

to be cash equivalents. The Company’s Cash and Cash Equivalents are carried at fair market value and

consist primarily of high-grade commercial paper, money market funds, U.S. government agency

securities and tax-exempt notes and bonds.

Short-Term Investments

Short-Term Investments at the end of fiscal 2004 are primarily auction rate securities. The interest rates

on these securities are typically reset to market prevailing rates every 35 days or less, and in all cases

every 90 days or less, but have longer stated maturities. Short-Term Investments are recorded at fair

value based on current market rates and are classified as available-for-sale. Changes in the fair value

are included in Accumulated Other Comprehensive Income (Loss), net of applicable taxes in the

accompanying Consolidated Financial Statements.

Accounts Receivable

The Company has an agreement with a third-party service provider who manages the Company’s

private label credit card program and directly extends credit to customers. In addition, certain

subsidiaries of the Company extend credit directly to customers in the ordinary course of business. The

receivables due from customers were $865 million and $321 million as of January 29, 2006 and

January 30, 2005, respectively. The Company’s valuation reserve related to accounts receivable was not

material as of January 29, 2006 and January 30, 2005.

Merchandise Inventories

The majority of the Company’s Merchandise Inventories are stated at the lower of cost (first-in,

first-out) or market, as determined by the retail inventory method. As the inventory retail value is

adjusted regularly to reflect market conditions, the inventory valued using the retail method

approximates the lower of cost or market. Certain subsidiaries and distribution centers record

Merchandise Inventories at the lower of cost (first-in, first-out) or market, as determined by the cost

method. These Merchandise Inventories represent approximately 14% of the total Merchandise

Inventories balance. The Company evaluates the inventory valued using the cost method at the end of

each quarter to ensure that it is carried at the lower of cost or market. The valuation allowance for

Merchandise Inventories valued under the cost method was not material to the Company as of the end

of fiscal 2005 and fiscal 2004.

Independent physical inventory counts or cycle counts are taken on a regular basis in each store,

distribution center and Home Depot Supply location to ensure that amounts reflected in the

accompanying Consolidated Financial Statements for Merchandise Inventories are properly stated.

During the period between physical inventory counts in stores, the Company accrues for estimated

losses related to shrink on a store-by-store basis based on historical shrink results and current trends in

the business. Shrink (or in the case of excess inventory, ‘‘swell’’) is the difference between the recorded

amount of inventory and the physical inventory. Shrink may occur due to theft, loss, inaccurate records

for the receipt of inventory or deterioration of goods, among other things.

Income Taxes

The Company provides for federal, state and foreign income taxes currently payable, as well as for

those deferred due to timing differences between reporting income and expenses for financial statement

purposes versus tax purposes. Federal, state and foreign tax benefits are recorded as a reduction of

income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to temporary differences between the financial statement carrying amounts of existing

41