Home Depot 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

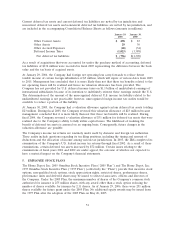

Current deferred tax assets and current deferred tax liabilities are netted by tax jurisdiction and

noncurrent deferred tax assets and noncurrent deferred tax liabilities are netted by tax jurisdiction, and

are included in the accompanying Consolidated Balance Sheets as follows (amounts in millions):

January 29, January 30,

2006 2005

Other Current Assets $ 298 $83

Other Assets 29 30

Other Accrued Expenses (60) (34)

Deferred Income Taxes (1,023) (1,388)

Net deferred tax liabilities $ (756) $(1,309)

As a result of acquisitions that were accounted for under the purchase method of accounting, deferred

tax liabilities of $132 million were recorded in fiscal 2005 representing the difference between the book

value and the tax basis of acquired assets.

At January 29, 2006, the Company had foreign net operating loss carry-forwards to reduce future

taxable income of certain foreign subsidiaries of $5 million, which will expire at various dates from 2009

to 2015. Management has concluded that it is more likely than not that these tax benefits related to the

net operating losses will be realized and hence no valuation allowance has been provided. The

Company has not provided for U.S. deferred income taxes on $1.1 billion of undistributed earnings of

international subsidiaries because of its intention to indefinitely reinvest these earnings outside the U.S.

The determination of the amount of the unrecognized deferred U.S. income tax liability related to the

undistributed earnings is not practicable; however, unrecognized foreign income tax credits would be

available to reduce a portion of this liability.

At January 30, 2005, the Company had a valuation allowance against certain deferred tax assets totaling

$23 million. During fiscal 2005, the Company reversed this valuation allowance of $23 million because

management concluded that it is more likely than not that these tax benefits will be realized. During

fiscal 2004, the Company reversed a valuation allowance of $31 million for deferred tax assets that were

realized due to the Company’s ability to fully utilize capital losses. The likelihood of realizing the

benefit of deferred tax assets is assessed on an ongoing basis. Consequently, future changes in the

valuation allowance are possible.

The Company’s income tax returns are routinely under audit by domestic and foreign tax authorities.

These audits include questions regarding its tax filing positions, including the timing and amount of

deductions and the allocation of income among various tax jurisdictions. In 2005, the IRS completed its

examination of the Company’s U.S. federal income tax returns through fiscal 2002. As a result of these

examinations, certain deferred tax assets increased by $72 million. Certain issues relating to the

examinations of fiscal years 2001 and 2002 are under appeal, the outcome of which is not expected to

have a material impact on the Company’s financial statements.

5. EMPLOYEE STOCK PLANS

The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan (‘‘2005 Plan’’) and The Home Depot, Inc.

1997 Omnibus Stock Incentive Plan (‘‘1997 Plan’’) (collectively the ‘‘Plans’’) provide that incentive stock

options, non-qualified stock options, stock appreciation rights, restricted shares, performance shares,

performance units and deferred shares may be issued to selected associates, officers and directors of

the Company. Under the 2005 Plan, the maximum number of shares of the Company’s common stock

authorized for issuance is 255 million shares, with any award other than a stock option reducing the

number of shares available for issuance by 2.11 shares. As of January 29, 2006, there were 251 million

shares available for future grant under the 2005 Plan. No additional equity awards may be issued from

the 1997 Plan after the adoption of the 2005 Plan on May 26, 2005.

51