Home Depot 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

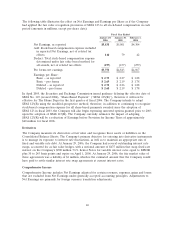

8. BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES

The reconciliation of basic to diluted weighted average common shares for fiscal 2005, 2004 and 2003

was as follows (amounts in millions):

Fiscal Year Ended

January 29, January 30, February 1,

2006 2005 2004

Weighted average common shares 2,138 2,207 2,283

Effect of potentially dilutive securities:

Stock Plans 996

Diluted weighted average common shares 2,147 2,216 2,289

Stock plans include shares granted under the Company’s employee stock plans as described in Note 5

to the consolidated financial statements. Options to purchase 55.1 million, 49.1 million and 67.9 million

shares of common stock at January 29, 2006, January 30, 2005 and February 1, 2004, respectively, were

excluded from the computation of Diluted Earnings per Share because their effect would have been

anti-dilutive.

9. COMMITMENTS AND CONTINGENCIES

At January 29, 2006, the Company was contingently liable for approximately $1.3 billion under

outstanding letters of credit issued for certain business transactions, including insurance programs, trade

and construction contracts. The Company’s letters of credit are primarily performance-based and are

not based on changes in variable components, a liability or an equity security of the other party.

The Company is involved in litigation arising from the normal course of business. In management’s

opinion, this litigation is not expected to materially impact the Company’s consolidated results of

operations or financial condition.

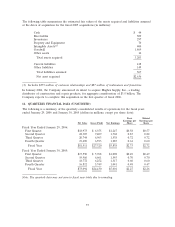

10. ACQUISITIONS

The following acquisitions completed by the Company were all accounted for under the purchase

method of accounting. Pro forma results of operations for fiscal 2005, 2004 and 2003 would not be

materially different as a result of these acquisitions and therefore are not presented.

In August 2005, the Company acquired National Waterworks, Inc., a leading distributor of products

used to build, repair and maintain water and wastewater transmission systems. The aggregate purchase

price of this acquisition was $1.4 billion.

The Company completed several other acquisitions during fiscal 2005, 2004 and 2003, primarily adding

professional service capabilities to Home Depot Supply. The total aggregate purchase price for

acquisitions, including National Waterworks, Inc., in fiscal 2005, 2004 and 2003 was $2.6 billion,

$729 million and $248 million, respectively. Accordingly, the Company recorded Cost in Excess of the

Fair Value of Net Assets Acquired related to the acquisitions of $1.9 billion, $554 million and

$231 million for fiscal 2005, 2004 and 2003, respectively, in the accompanying Consolidated Balance

Sheets.

56