Home Depot 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

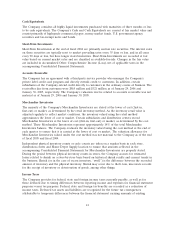

of undiscounted estimated future cash flows expected to result from the use of the asset are less than

the asset’s carrying value. If the carrying value is greater than the future cash flows, a provision is made

to write down the related assets to the estimated net recoverable value. Impairment losses were

recorded as a component of SG&A in the accompanying Consolidated Statements of Earnings. When a

location closes, the Company also recognizes in SG&A the net present value of future lease

obligations, less estimated sublease income.

In fiscal 2005, the Company closed 20 of its EXPO stores, four of which are being converted to The

Home Depot store format. In fiscal 2005, the Company charged $91 million to SG&A related to the

dispositions, of which $78 million was for asset impairment charges and $13 million was for lease

obligations. The Company remains contingently liable for future minimum lease payments related to

the affected stores, for which the amounts are not material. Additionally, the Company incurred

$29 million of expense in Cost of Sales in fiscal 2005 related to inventory markdowns in these stores.

Affected customers are being served by existing The Home Depot and EXPO stores. In fiscal 2005, the

Company also closed two Home Depot Supply stores which did not have a material impact to the

Company’s financial results.

Stock-Based Compensation

Effective February 3, 2003, the Company adopted the fair value method of recording stock-based

compensation expense in accordance with SFAS No. 123, ‘‘Accounting for Stock-Based Compensation’’

(‘‘SFAS 123’’). The Company selected the prospective method of adoption as described in SFAS

No. 148, ‘‘Accounting for Stock-Based Compensation – Transition and Disclosure’’ and accordingly,

stock-based compensation expense was recognized related to stock options granted, modified or settled

and expense related to the Employee Stock Purchase Plan (‘‘ESPP’’) after the beginning of fiscal 2003.

The fair value of stock options and ESPP as determined on the date of grant using the Black-Scholes

option-pricing model is being expensed over the vesting period of the related stock options and ESPP.

Prior to February 3, 2003, the Company elected to account for its stock-based compensation plans

under Accounting Principles Board Opinion No. 25, ‘‘Accounting for Stock Issued to Employees’’

(‘‘APB 25’’), which requires the recording of stock-based compensation expense for some, but not all,

stock-based compensation.

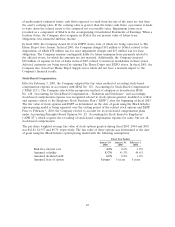

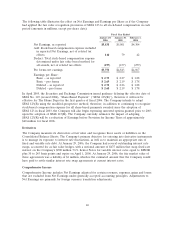

The per share weighted average fair value of stock options granted during fiscal 2005, 2004 and 2003

was $12.83, $13.57 and $9.79, respectively. The fair value of these options was determined at the date

of grant using the Black-Scholes option-pricing model with the following assumptions:

Fiscal Year Ended

January 29, January 30, February 1,

2006 2005 2004

Risk-free interest rate 4.3% 2.6% 3.0%

Assumed volatility 33.7% 41.3% 44.6%

Assumed dividend yield 1.1% 0.8% 1.0%

Assumed lives of option 5 years 5 years 5 years

45