Home Depot 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.upholstery cleaning franchisor. Chem-Dry has nearly 4,000 franchises worldwide, including 2,500 in the

U.S.

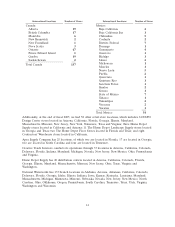

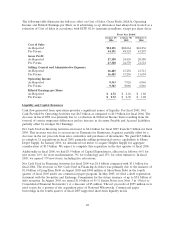

We opened 179 new stores in fiscal 2005, including five relocations, and closed 22 stores, bringing our

total store count at the end of fiscal 2005 to 2,042 compared to 1,890 at the end of fiscal 2004. As of

the end of fiscal 2005, 191 of our stores were located in Canada and Mexico compared to 161 at the

end of fiscal 2004. In fiscal 2005, we closed 20 of our EXPO Design Center (‘‘EXPO’’) stores, four of

which are being converted to The Home Depot store format. We recorded $91 million of asset

impairment and lease obligation charges in Selling, General and Administrative Expense in fiscal 2005

related to the disposition of our interest in the underlying real estate and store conversions.

Additionally, we recorded $29 million of expense in Cost of Sales related to inventory markdowns in

fiscal 2005. Affected EXPO customers are being served by existing The Home Depot and EXPO

stores. In fiscal 2005, we also closed two Home Depot Supply stores which did not have a material

impact on our financial results. In fiscal 2005, we increased our offerings on www.homedepot.com to

over 30,000 products; the site now averages 3 million hits per week. Additionally, we launched two

unique direct-to-customer brands: 10 Crescent Lane (www.10CrescentLane.com) and Paces Trading

Company (www.PacesTrading.com) which offer quality home d´

ecor and lighting options, respectively,

through innovative new catalogs and e-commerce sites.

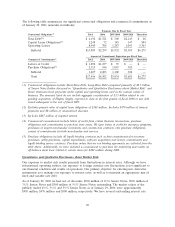

We have expanded our business by capturing a growing share of the professional residential,

commercial and heavy construction markets, which operate under Home Depot Supply. As part of this

expansion in fiscal 2005, we completed 18 acquisitions that operate under Home Depot Supply,

including National Waterworks, Inc. (‘‘National Waterworks’’), the nation’s leading distributor of

products used to build, repair and maintain water and wastewater transmission systems, and Williams

Bros. Lumber Company, a leading supplier of lumber and building materials. In total for fiscal 2005,

we completed 21 acquisitions and the total cash paid for businesses acquired in fiscal 2005 was

$2.5 billion. In January 2006, we announced our intent to acquire Hughes Supply, Inc. (‘‘Hughes

Supply’’ NYSE ‘‘HUG’’), a leading distributor of construction and repair products. We expect to

complete this acquisition in the first quarter of fiscal 2006.

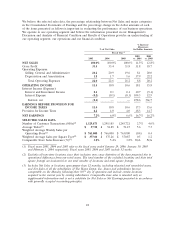

We generated $6.5 billion of cash flow from operations in fiscal 2005. We used this cash flow to fund,

in part, $3.9 billion in capital expenditures, $2.5 billion for acquisitions and $3.9 billion of dividends

and share repurchases. At the end of fiscal 2005, our long-term debt-to-equity ratio was 9.9%,

reflecting the August 2005 issuance of $1.0 billion of 45⁄8% Senior Notes due August 15, 2010. Our

return on invested capital (computed on beginning long-term debt and equity for the trailing four

quarters) was 22.4% compared to 21.5% for fiscal 2004, a 90 basis point improvement.

21