Home Depot 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

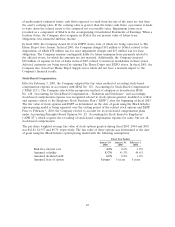

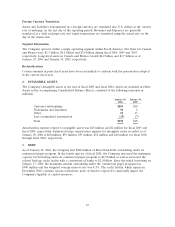

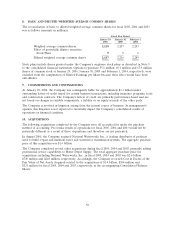

The following table illustrates the effect on Net Earnings and Earnings per Share as if the Company

had applied the fair value recognition provisions of SFAS 123 to all stock-based compensation in each

period (amounts in millions, except per share data):

Fiscal Year Ended

January 29, January 30, February 1,

2006 2005 2004

Net Earnings, as reported $5,838 $5,001 $4,304

Add: Stock-based compensation expense included

in reported Net Earnings, net of related tax

effects 110 79 42

Deduct: Total stock-based compensation expense

determined under fair value based method for

all awards, net of related tax effects (197) (237) (279)

Pro forma net earnings $5,751 $4,843 $4,067

Earnings per Share:

Basic – as reported $ 2.73 $ 2.27 $ 1.88

Basic – pro forma $ 2.69 $ 2.19 $ 1.78

Diluted – as reported $ 2.72 $ 2.26 $ 1.88

Diluted – pro forma $ 2.68 $ 2.19 $ 1.78

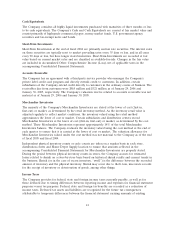

In April 2005, the Securities and Exchange Commission issued guidance delaying the effective date of

SFAS No. 123 (revised 2004), ‘‘Share-Based Payment’’ (‘‘SFAS 123(R)’’), therefore it will now be

effective for The Home Depot in the first quarter of fiscal 2006. The Company intends to adopt

SFAS 123(R) using the modified-prospective method, therefore, in addition to continuing to recognize

stock-based compensation expense for all share-based payments awarded since the adoption of

SFAS 123 in fiscal 2003, the Company will also begin expensing unvested options granted prior to 2003

upon the adoption of SFAS 123(R). The Company currently estimates the impact of adopting

SFAS 123(R) will be a reduction of Earnings before Provision for Income Taxes of approximately

$40 million for fiscal 2006.

Derivatives

The Company measures its derivatives at fair value and recognizes these assets or liabilities on the

Consolidated Balance Sheets. The Company’s primary objective for entering into derivative instruments

is to manage its exposure to interest rate fluctuations, as well as to maintain an appropriate mix of

fixed and variable rate debt. At January 29, 2006, the Company had several outstanding interest rate

swaps, accounted for as fair value hedges, with a notional amount of $475 million that swap fixed rate

interest on the Company’s $500 million 53⁄8% Senior Notes for variable interest rates equal to LIBOR

plus 30 to 245 basis points and expire on April 1, 2006. At January 29, 2006, the fair market value of

these agreements was a liability of $1 million, which is the estimated amount that the Company would

have paid to settle similar interest rate swap agreements at current interest rates.

Comprehensive Income

Comprehensive Income includes Net Earnings adjusted for certain revenues, expenses, gains and losses

that are excluded from Net Earnings under generally accepted accounting principles. Adjustments to

Net Earnings are primarily for foreign currency translation adjustments.

46