Holiday Inn 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 IHG Annual Review and Summary Financial Statement 2011

SUMMARY REMUNERATION REPORT continued

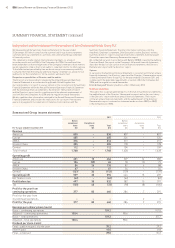

The measures used in the 2009/2011 cycle are set out in the table below:

Performance

measure

Threshold

performance

Maximum

performance

Threshold

vesting

Maximum

vesting Weighting

Maximum

award Outcome

TSR Growth equal to

the DJGH index

Growth exceeds the

index by 8% or more

20% 100% 66.7% 102.5% Growth exceeded

index by 7.9%

EPS Growth of 0%

per annum

Growth of 10%

per annum or more

0% 100% 33.3% 102.5% Growth of 2.5%

per annum

Total vesting

outcome

73.9% of maximum

award

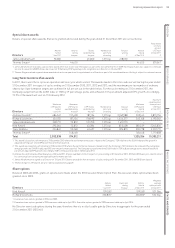

Performance graph

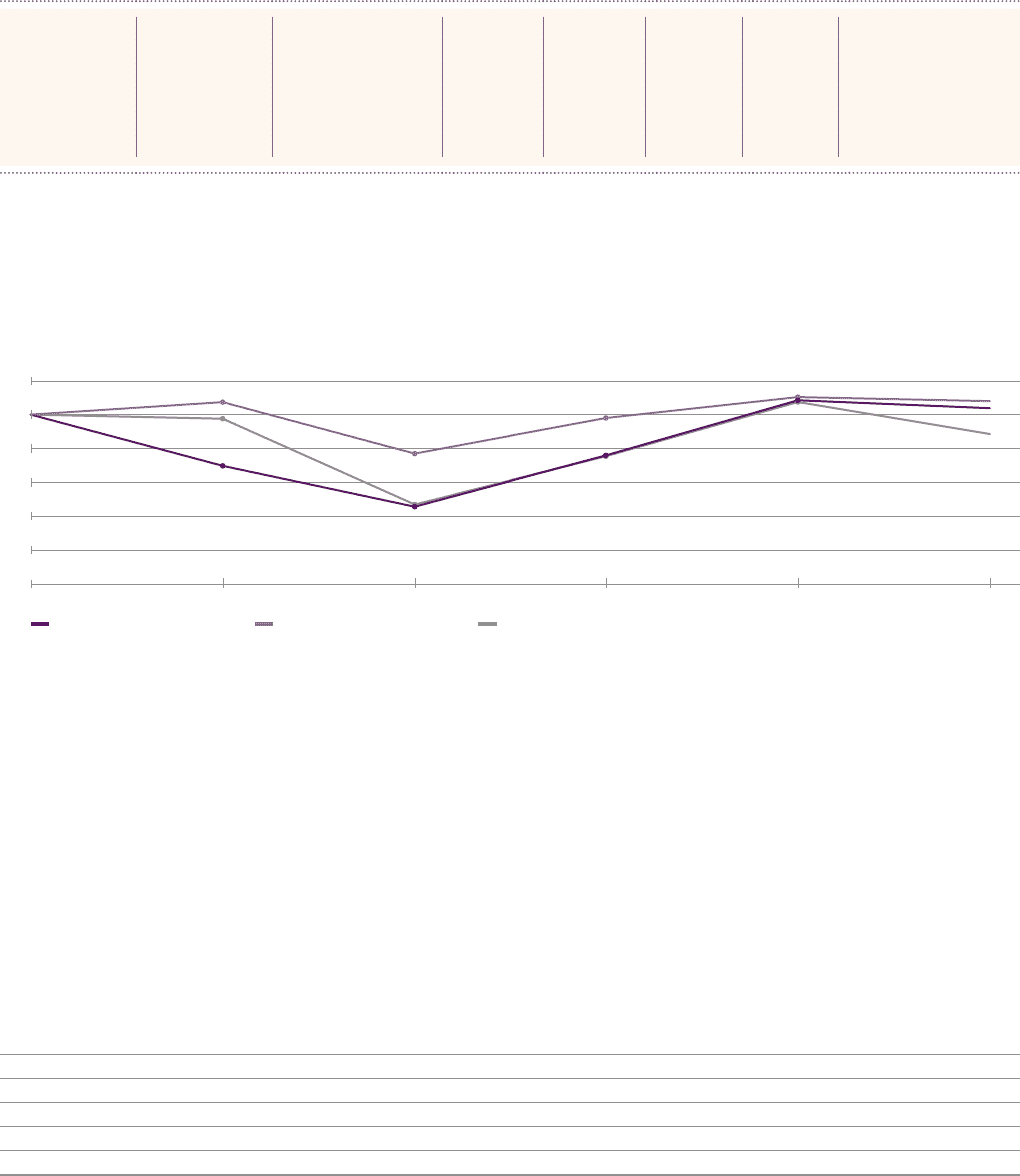

Throughout 2011, the Company was a member of the FTSE 100 index and, for remuneration purposes, used a TSR comparator group of

the DJGH index. Accordingly, the Committee has determined that these are the most appropriate market indices against which to test the

Company’s performance. The graph below shows the TSR performance of IHG from 31 December 2006 to 31 December 2011, assuming

dividends are reinvested, compared with the TSR performance achieved by the FTSE 100 index and the DJGH index. Over the five-year period,

IHG TSR performance increased by just under 4%. Over the last three years, it outperformed the FTSE 100 index and the DJGH index.

Total Shareholder Return: InterContinental Hotels Group PLC v FTSE 100 and v Dow Jones Global Hotels index

Source: Datastream

InterContinental Hotels Group PLC

total shareholder return index

FTSE 100

total shareholder return index

Dow Jones Global Hotels

total shareholder return index

31 Dec 201131 Dec 201031 Dec 200931 Dec 200831 Dec 200731 Dec 2006

120

108

104

89

100

80

60

40

20

0

Share ownership

Executive Directors are expected to hold twice their base salary in shares, or three times in the case of the Chief Executive. Executive

Directors are expected to hold all shares earned (net of any share sales required to meet personal tax liabilities) until their shareholding

requirement is achieved. The required number of shares are held by Richard Solomons and Kirk Kinsell.

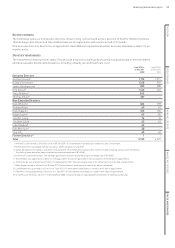

Non-Executive Directors

Non-Executive Directors are paid a fee which is agreed by the Board and the Chairman, taking into account fees paid in other companies

of a similar complexity. Higher fees are payable to the Senior Independent Director who chairs the Audit Committee and to the Chairmen

of the Remuneration and Corporate Responsibility Committees, reflecting the additional responsibilities of these roles.

Non-Executive Directors’ fee levels are reviewed annually. In the final quarter of 2011 an increase of approximately 2% for the Non-Executive

Directors was agreed from 1 January 2012 as shown below. This increase is broadly in line with anticipated salary increases for executive

and senior management employees across the wider organisation. The Chairman waived any right to an increase in respect of his fees

for 2012.

Fees at Fees at

1 Jan 2012 1 Jan 2011

Director Role £ £

David Webster Chairman 406,000 406,000

David Kappler Senior Independent Director and Chairman of Audit Committee 105,060 103,000

Luke Mayhew Chairman of Remuneration Committee 88,230 –

Jennifer Laing Chairman of Corporate Responsibility Committee 77,520 76,000

Others Non-Executive Director 66,300 65,000