Holiday Inn 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

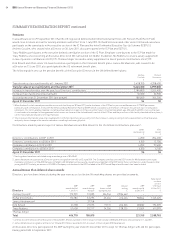

46 IHG Annual Review and Summary Financial Statement 2011

Activities of the Group

The principal activities of the Group are in hotels and resorts, with

franchising, management, ownership and leasehold interests in

over 4,400 establishments, with more than 658,000 guest rooms

in nearly 100 countries and territories around the world.

A review of the performance of the Group is contained in the

Chairman’s statement and the Chief Executive’s review on pages

3 to 5, the reviews presented on pages 6 to 39 and in the Summary

Financial Statement on pages 40 to 43.

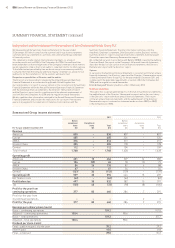

Results and dividends

The operating profit before exceptional items was $559m. An

interim dividend of 9.8p per share (16.0 cents per ADR) was paid on

7 October 2011. The Directors are recommending a final dividend

of 24.7p per share (39.0 cents per ADR) to be paid on 1 June 2012 to

shareholders on the Register of Members at close of business on

23 March 2012.

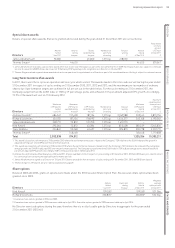

Share capital

At 31 December 2011, InterContinental Hotels Group PLC’s

(the Company) issued share capital consisted of 290,548,089

ordinary shares of 1329⁄47p each. There are no special control rights

or restrictions on transfer attaching to these ordinary shares.

During the year, no awards or grants over shares were made that

would be dilutive of the Company’s ordinary share capital.

Share repurchases

No shares were purchased or cancelled under the authority

granted by shareholders at the Annual General Meeting held on

27 May 2011. The share buyback authority remains in force until

the Annual General Meeting in 2012, and a resolution to renew the

authority will be put to shareholders at that Meeting.

Substantial shareholdings

The Company had been notified, in accordance with the Disclosure

and Transparency Rules of the UK Financial Services Authority, of

the following significant holdings of voting rights in its ordinary

shares:

At At

31 December 13 February Nature of

2011 2012 interest

Southeastern Asset Management, Inc. 14.01% 14.01% Indirect

Cedar Rock Capital Limited 5.07% 5.07% Direct

BlackRock, Inc. 5.02% 5.02% Indirect

Capital Research and 5.02% 5.02% Indirect

Management Company

Legal & General Group plc 3.96% 3.96% Direct

Directors

Biographical details of current Board members are shown on

pages 44 and 45. Executive Directors have service contracts and

Non-Executive Directors have letters of appointment.

The Board may exercise all the powers of the Company. The Group

maintains insurance cover for and has provided indemnities to all of

its directors and officers, as permitted by the Companies Act 2006.

Details of the beneficial share interests of Directors who were on

the Board at the year end are shown below.

31 December 2011

InterContinental Hotels Group PLC

ordinary shares

Executive Directors

Kirk Kinsell1 109,547

Tracy Robbins 43,108

Thomas Singer –

Richard Solomons 252,166

Non-Executive Directors

Graham Allan2 12,000

David Kappler 1,400

Jennifer Laing 3,373

Jonathan Linen3 7,34 3

Luke Mayhew 2,000

Dale Morrison –

David Webster 35,828

Ying Yeh –

1 108,910 ordinary shares and 637 American Depositary Receipts.

2 2,000 ordinary shares and 10,000 American Depositary Receipts.

3 Held in the form of American Depositary Receipts.

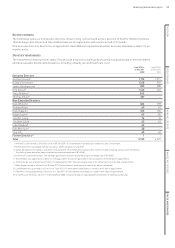

Employees

IHG directly employed an average of 7,956 people worldwide during

2011, whose costs are borne by the Group. When the whole IHG

estate is taken into account, approximately 345,000 people are

employed globally across IHG’s brands. The Group is committed

to providing employees with equality of opportunity, without

discrimination. Great emphasis is placed on employee

communications, particularly on matters relating to the Group’s

business and its performance.

Charitable and political donations

During the year, the Group donated $2,040,000 in support of

community initiatives and charitable causes. This figure includes

contributions from IHG employees and guests. No payments were

made for political purposes.

Auditors

The Directors confirm that they have taken steps to make themselves

aware of relevant audit information. None of the Directors is aware

of any relevant audit information which has not been disclosed to

the auditors.

The reappointment of Ernst & Young LLP as auditors of the

Company will be put to members at the Annual General Meeting.

Annual General Meeting

The Notice of the Annual General Meeting to be held at 11.00am on

Friday, 25 May 2012 is contained in a circular sent to shareholders

at the same time as this Annual Review.

Going concern

At the end of 2011, the Group was trading significantly within its

banking covenants and debt facilities. IHG’s fee-based model and

wide geographic spread means that it is well placed to manage

through uncertain times.

The financial statements for the year ended 31 December 2011

have therefore been prepared on the going concern basis.

SUMMARY DIRECTORS’ REPORT