Holiday Inn 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Summary financial statement 41

OVERVIEW GREAT BRANDS HOW WE OPERATE WHERE WE OPERATE FACTS AND FIGURES

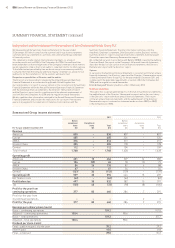

EUROPE RESULTS

Revenue and operating profit before

exceptional items increased by $79m

(24.2%) to $405m and by $26m (33.3%)

to $104m respectively.

Franchised revenue increased by $10m

(13.2%) to $86m and operating profit by

$10m (18.2%) to $65m. Growth was mainly

driven by royalties growth of 11.4%

reflecting RevPAR growth of 4.0%, together

with an increase in system size. Revenues

associated with new signings, relicensing

and terminations increased by $2m.

Managed revenue increased by $48m

to $118m (68.6%) and operating profit

increased by $9m to $26m (52.9%)

reflecting RevPAR growth of 5.5%,

together with the year-on-year benefit

of a $3m charge in 2010 with regard

to guarantee obligations for one hotel.

2011 also included revenue of $46m and

operating profit of $nil from two properties

which were converted from management

contracts to an operating lease structure

with the same characteristics as

management contracts.

In the owned and leased estate, revenue

increased by $21m (11.7%) to $201m and

operating profit increased by $11m (28.9%).

RevPAR growth of 10.9% benefited from

average daily rate growth of 10.3% across

the year. The InterContinental London

Park Lane and the InterContinental

Paris Le Grand delivered strong

year-on-year RevPAR growth of 7.3%

and 14.5% respectively.

AMEA RESULTS

Revenue and operating profit before

exceptional items increased by $3m (1.4%)

to $216m and by $2m (2.4%) to $84m

respectively. The region’s results were

adversely impacted by the political

instability throughout 2011 in the Middle

East, together with the natural disasters

in Japan and New Zealand.

Franchised revenue increased by $4m

(26.7%) to $19m and operating profit by

$4m (50.0%) to $12m. RevPAR in the

franchised estate grew by 1.7%. Excluding

Egypt, Bahrain and Japan, RevPAR grew

by 4.4%.

Managed revenue decreased by $4m

(2.6%) to $151m and operating profit

decreased by $1m (1.1%) to $87m. The

events of the Arab Spring together with

the natural disasters in Japan and New

Zealand had an estimated adverse impact

of $11m on the results, whilst there was

a further $4m adverse impact due to

changes to certain management contract

terms. Results did however benefit from a

liquidated damages receipt of $6m during

the year. RevPAR grew by 0.6% compared

to 2010 and by 5.7% excluding Egypt,

Bahrain and Japan.

In the owned and leased estate, revenue

increased by $3m (7.0%) to $46m and

operating profit increased by $1m (25.0%).

GREATER CHINA RESULTS

Revenue and operating profit before

exceptional items increased by $27m

(15.2%) to $205m and by $13m (24.1%)

to $67m respectively.

Managed revenue increased by $17m

(28.3%) to $77m and operating profit

increased by $13m (43.3%) to $43m.

Continued strong economic growth in

the region helped to drive RevPAR growth

of 10.3%. Excluding Shanghai, where

RevPAR growth was tempered by strong

comparatives due to the World Expo held

in May to October 2010, comparable

RevPAR grew by 17.4%. There was also

continued significant system size growth

for the managed estate in the region (14.2%

rooms growth in 2011 and 12.6% in 2010).

Owned and leased revenue increased

by $10m (8.6%) to $126m and operating

profit increased by $4m (12.1%) to $37m.

The InterContinental Hong Kong

generated RevPAR growth of 13.4%.

CENTRAL RESULTS

During 2011, net central costs increased

by $8m from $139m to $147m (5.8%).

The movement was primarily driven by

increased investment to support growth

in the business. Central revenue mainly

comprised technology fee income.

OTHER FINANCIAL ITEMS

Exceptional operating items totalled a net

gain of $35m. Exceptional gains included

$37m from the disposal of hotels, including

$29m profit on the sale of the Holiday Inn

Burswood, a UK VAT refund of $9m, $20m

net impairment reversals and a $28m

pension curtailment gain in relation to the

closure of the UK defined benefit pension

scheme. Exceptional charges included a

$22m litigation provision and $37m in

respect of the settlement of a prior period

commercial dispute in Europe.

Net financial expenses remained flat

at $62m as costs relating to the new

syndicated bank facility offset the impact

of lower levels of net debt.

The effective rate of tax was 24% (2010 26%).

Basic earnings per ordinary share in 2011

was 159.2¢, compared with 101.7¢ in 2010.

Adjusted earnings per ordinary share

was 130.4¢, against 98.6¢ in 2010.

The Board has proposed a final dividend

per ordinary share of 39.0¢ (24.7p). With

the interim dividend per ordinary share

of 16.0¢ (9.8p), the full-year dividend per

ordinary share for 2011 will total 55.0¢

(34.5p).

CAPITAL STRUCTURE AND LIQUIDITY

MANAGEMENT

During the year, $479m of cash was

generated from operating activities, with

the other key elements of the cash flow

being proceeds from the disposal of

hotels of $142m and capital expenditure

of $194m. Overall, net debt decreased by

$205m to $538m.

This Summary Financial

Statement was approved by the

Board on 13 February 2012 and

signed on its behalf by Tom Singer.

It does not contain sufficient

information to provide as complete

an understanding of the Group’s

results and state of affairs as that

provided in the Annual Report

and Financial Statements 2011.

That report may be obtained, free

of charge, by writing to IHG or

the Company’s Registrar, Equiniti

(contact details are provided on

page 57).

The auditors have issued an

unqualified report on the financial

statements containing no statement

under section 498(2) or 498(3) of the

Companies Act 2006. Information

concerning Directors’ emoluments

is shown on pages 48 to 55.