Holiday Inn 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A WINNING STRATEGY

We have made explicit choices regarding

the segments of the market in which we

wish to operate, ‘where we compete’,

and our basis of differentiation and

competition, ‘how we win’. These

decisions are underpinned by a rigorous

strategy setting process that is informed

by regular external research into

consumer preferences, developments

in the hotel and leisure sectors, and

economic and demographic trends.

The key elements of our strategy and

progress in its implementation are

reviewed annually by the Board.

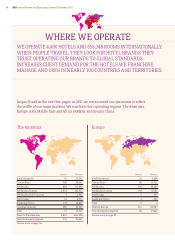

We are focused on operating hotels in

those geographies and market segments

that offer the greatest growth potential

and attractive long-term returns.

Our preferred business model favours

franchising our brands and managing

hotels rather than owning properties

which reduces capital intensity, allows

us to grow faster and provides a more

resilient business model.

We operate a portfolio of well-known

and distinctive brands that aim over

time to increase their appeal amongst

guests in our chosen market segments.

Our brands and their related

propositions continue to benefit from

sustained investment by the Group and

owners in the physical hotel environment

and customer service training. Based

on our insights into changing guest

preferences and emerging segments,

we will create and launch new brands

to allow us to win greater market share.

Our hotel operations are supported by

best-in-class demand delivery systems

and operational expertise that provide

scale benefits resulting in margin

improvement and better returns

for owners.

INVESTING BEHIND GROWTH

During the year, we invested $93 million

in growth capital expenditure. This

included a $12 million equity stake in

Summit Hotel Properties, Inc. in the US

with whom we have a hotel sourcing

agreement; $11 million in the joint venture

which will take Holiday Inn Express into

India; and $25 million in the joint venture

to develop a Hotel Indigo on the Lower

East side of Manhattan. We also spent

$101 million maintenance capital

expenditure in owned hotels and our

systems infrastructure to maintain our

leading position in the industry and drive

further growth. Investments in technology

included the further development of our

branded websites, applications for mobile

devices, new software tools to improve

pricing and hotel operations, new

distribution platforms and our central

sales and reservations capability.

GROWTH IN SYSTEM SIZE

During the year, we opened 241 hotels

and 44,265 rooms in our system and

signed a total of 356 hotels and 55,424

rooms into our pipeline reflecting the

strong preference amongst owners

for our brands. The tougher financing

climate in The Americas and Europe

increased the proportion of new signings

represented by conversions of existing

properties, whereas China, the Middle

East and Asia remained predominantly

new-build markets. We achieved modest

growth in system size of two per cent and

24 IHG Annual Review and Summary Financial Statement 2011

“A net gain in hotel rooms

coupled with industry-leading

RevPAR boosted our market

share. Fee-based margins

rose 4.9 percentage points to

40.6 per cent, creating capacity

for more investment in brand

quality and guest delivery.”

Tom Singer

Chief Financial Officer

FINANCE

We continue to pursue an asset-light business model focused on franchising our brands and

managing hotels rather than owning properties. Since 2003, we have sold nearly 200 hotels,

returned almost $6 billion to shareholders and built a fee-based income stream with proven

resilience – even during global recession. Our strategy is to create high-quality growth by

developing our brands and relationships to increase market share and improve our margins

and returns to owners. We invest our free cash flow to accelerate our growth in existing and

new emerging markets which offer attractive long-term prospects.