Holiday Inn 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 IHG Annual Review and Summary Financial Statement 2011

Introduction

There has been increased focus on executive pay during 2011.

We have looked to reflect as far as possible the transparency

sought by the UK Government. However, at the time of writing this

report, we await final detailed proposals.

We remain confident that IHG’s remuneration plans and outcomes

are aligned with the delivery of business performance and strategy

and that our approach is appropriate to attract and retain the talent

needed to build shareholder returns in this global business.

However, we also recognise the need to explain and justify clearly

the level of Executive Directors’ remuneration and how and why

bonuses and long-term incentives have been earned.

We continue to try to make this report easier to read and assess.

We have expanded the explanation of the strong link between

business strategy and Executive Directors’ remuneration. We have

also set out what we consider the best measure of the actual

remuneration for the year, being:

• the cash the Executive Directors received in salary and bonus

for 2011; plus

• the value of the deferred shares received for 2011 performance; plus

• the value of the 2009/2011 Long Term Incentive Plan (LTIP) award

triggered by performance for the three years up to and including 2011.

We believe these are the most relevant figures for shareholders

to focus on as they represent the remuneration generated by

employment and performance in the year.

Performance in 2011

The remuneration outcomes reflect strong results with the Board

recommending a final dividend which will deliver a 15% full-year

increase for shareholders.

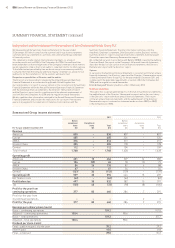

Key performance indicator growth (per annum)

2011 2010

Earnings before interest and tax (EBIT) +26.0% +22.6%

Three-year total shareholder return (TSR)* +29.8% +8.0%

Three-year adjusted earnings per share (EPS)* +2.5% +9.6%

* Annualised

Based on these results, 2011 Annual Bonus Plan (ABP) outcomes

consisted of a cash bonus of up to 86.5% of base salary, and an

award of deferred shares with a value of up to 86.5% of base salary,

which will vest after three years (subject to continued employment).

The 2009/2011 LTIP vested at 73.9% of maximum, representing

151.5% of base salary for Executive Directors who participated

in the full three-year cycle.

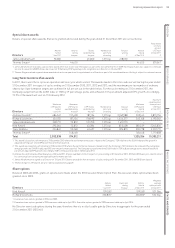

Changes to the Board

Richard Solomons succeeded Andrew Cosslett as Chief Executive

on 1 July 2011 and his annual base salary increased to £700,000

from this date. As Mr Solomons was previously an Executive

Director in his prior role as Chief Financial Officer and Head of

Commercial Development at IHG, his incentive arrangements

remained unchanged.

Andrew Cosslett retired from his position as Chief Executive,

and his contract of employment and directorship terminated, on

30 June 2011. There was no payment in respect of loss of office.

In accordance with the current plan rules, the Committee released

all ABP deferred shares upon retirement as there were no further

performance conditions that would affect the number of shares that

The Summary Remuneration Report is extracted from the full Remuneration Report contained in the Annual Report

and Financial Statements 2011, a copy of which is available on request and can be viewed on the Company’s website at

www.ihgplc.com/investors under financial library. The Remuneration Report will be put to the vote at the forthcoming

Annual General Meeting.

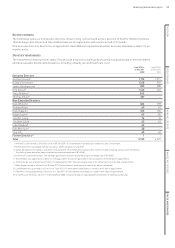

Remuneration in 2011

The maximum annual bonus under the ABP reverted to 200% of

base salary after temporary changes made in the preceding two

years to recognise the volatility of the economic environment.

There has been particular focus by the Remuneration Committee

(the Committee) in 2011 on the LTIP and the UK defined benefit

pension plan.

The maximum LTIP award remained at 205% of base salary having

been reduced in 2009 from 270% of base salary.

In the previous Remuneration report, we introduced two new

performance measures for the 2011 LTIP award to enhance

alignment of the plan to the Company’s strategy. These measures

will apply to the 2011/2013 LTIP cycle award, which will vest in 2014,

and subsequent awards; they are net rooms growth and like-for-like

revenue per available room (RevPAR) growth. Each of these

measures accounts for 25% of the LTIP weighting and are measured

relative to major competitors. Relative TSR will continue to account

for 50% of the LTIP weighting.

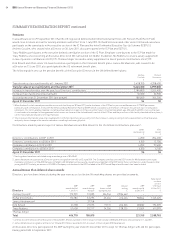

Following a review of the UK defined benefit pension plan, its closure

to future accruals with effect from 1 July 2013 was announced. Active

plan participants, including Richard Solomons, will be aligned with other

employees on a consistent defined contribution structure. From 1 July

2013, the value of defined benefit pensions on retirement will be linked

to inflation rather than to future salary increases. In line with other

employees, participating Executive Directors will not receive any cash

compensation for the impact this will have on their pension benefits.

As part of the consultation with employees and the plan trustees about

these changes, it was agreed that the Enhanced Early Retirement

Facility, which provides an option for plan members retiring with the

Company’s agreement to retire within five years of normal retirement

age on accrued benefits without reduction, would be retained.

The level of plan funding provides for this facility. The Committee

considered that the reduction in risk and expense achieved by

closing the defined benefit plan justified the cost of retaining this

facility for the existing active members of the plan.

Remuneration in 2012

Following the changes to the structure of the 2011 incentive plans,

the design and measures for the 2012 plans will remain effectively

unchanged. However, we have introduced Committee discretion to

claw back unvested share awards in exceptional circumstances.

During 2012 we will be revisiting the ABP structure to ensure it

continues to be designed optimally to drive and reward the annual

financial and individual performance required to deliver our

corporate strategy. We will report back on any outcomes next year.

SUMMARY REMUNERATION REPORT