Holiday Inn 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW GREAT BRANDS HOW WE OPERATE WHERE WE OPERATE FACTS AND FIGURES

Summary remuneration report 49

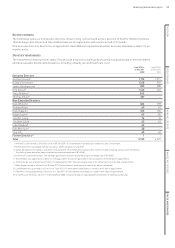

could potentially vest; as a result 155,657 shares vested on 1 July

2011. Mr Cosslett continues to be eligible for a pro-rated vesting of

his outstanding LTIP awards, which will be determined at the end of

the relevant plan cycles, subject to performance conditions being

achieved. In addition, Mr Cosslett received a pro-rated cash award

under the 2011 ABP based on actual performance results at

year end.

When Mr Cosslett ceased pensionable service on 30 June 2011, his

accrued pension entitlement was £177,800 per annum before cash

commutation. In line with the terms of the plan, he commuted part of

this for a lump sum and immediately drew the remainder as pension.

Thomas Singer was appointed Chief Financial Officer on

26 September 2011. Mr Singer’s annual base salary is £540,000

and his incentives are in line with IHG’s remuneration policy for

Executive Directors. Mr Singer did not participate in the 2011 ABP.

In order to secure his recruitment, IHG agreed to compensate

Mr Singer for incentives from his previous employer that he had

to forgo, and the Committee approved the following one-off

arrangements which apply to Mr Singer only:

• a cash payment of £480,000 to be paid in March 2012; and

• a restricted award of 46,635 shares which vests on 27 September

2012, one year from the date of grant. These shares will be

forfeited if Mr Singer leaves the Company before the vesting date.

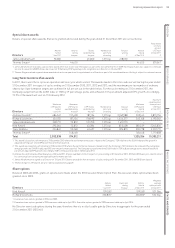

Business strategy and remuneration

IHG’s remuneration approach is designed to support and reflect

the delivery of business strategy by:

• attracting and retaining high-quality executives in an environment

where compensation is based on global market practice;

• aligning rewards for executives with the achievement

of business performance targets, strategic objectives and

returns to shareholders;

• supporting equitable treatment between members of the same

executive team; and

• facilitating global assignments and relocation.

IHG’s remuneration structure for senior executives places a strong

emphasis on performance-related reward. The Committee believes

that it is important to reward management, including the Executive

Directors, for targets achieved, provided those targets are stretching.

Business strategy is the driver of our reward structure.

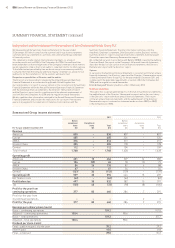

We show below how IHG’s Vision and strategy directly link to the

current measures used in IHG’s incentive plans.

There are no performance conditions attached to these one-off

arrangements and the awards are not pensionable. However, it is

expected that all shares that vest will be held by Mr Singer until he

meets the expected shareholding set out on page 52.

In addition, to ensure immediate alignment to the long-term

performance of IHG, pro-rated awards were made for the 2010/2012

LTIP cycle and the 2011/2013 LTIP cycle of 137% and 154% of salary

respectively. Vesting of these awards is subject to the results of the

performance conditions for the relevant plan cycle.

As part of his recruitment terms, it was agreed that Mr Singer would

not have a salary review until April 2013.

Kirk Kinsell (formerly President, Europe, Middle East and Africa)

succeeded James Abrahamson as President, The Americas

following Mr Abrahamson’s resignation from IHG on 13 June 2011.

In accordance with his termination arrangements, all of

Mr Abrahamson’s outstanding deferred share awards under the ABP

and unvested LTIP awards lapsed and he relinquished all rights to an

annual bonus in respect of the 2011 ABP. No remuneration changes

were made for Mr Kinsell as a result of his new appointment.

Tracy Robbins was promoted to the Board on 9 August 2011. Her

annual base salary following promotion was increased to £400,000.

However, as an Executive Committee member since joining IHG,

Ms Robbins’ incentive arrangements remained unchanged.

GREAT HOTELS GUESTS LOVE

WHERE WE COMPETE

Growing our core business in the largest markets where scale really

counts, and also in key global gateway cities and resort destinations

Seeking opportunities to leverage our scale in new business areas

HOW WE WIN

Profitable market share

Progressive margins

Sustainable investment

Responsible business

NET ROOMS GROWTH

Supports our business model, segment and market

strategies to grow system size over three years

EBIT

Provides annual focus on earnings growth driven

by core operating inputs, namely rooms growth,

RevPAR, royalty fees and profit margins

LIKE-FOR-LIKE RevPAR GROWTH

Reflects the sustainable power of our brands,

scale and experience, and engaged workforce

Focuses growth on quality rooms in key markets

INDIVIDUAL OVERALL PERFORMANCE RATING

Provides annual focus on key performance objectives

and leadership competencies for the role:

Best-in-class delivery – growth and other targets

Talented people – employee engagement survey results

Preferred brands – brand performance targets

Responsible business – adoption of Green Engage

VISION & STRATEGY REWARD MEASURES

TOTAL SHAREHOLDER RETURNS

Aligned with our Vision to become one of the world’s great companies

LTIP measures ABP measures

GREAT HOTELS GUESTS LOVE

…achieved through strategic priorities