Holiday Inn 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ended the year with 658,348 rooms in our

system. We expect net system growth of

between two and three per cent in 2012.

CONTINUED RECYCLING OF CAPITAL

Franchised and managed hotels now

account for 74 per cent and 25 per cent,

respectively, of our system size with the

balance attributable to the remaining

11 owned hotels.

During the year we sold four hotels:

Hotel Indigo San Diego, Staybridge

Suites Cherry Creek, Holiday Inn

Atlanta-Gwinnett Place and Holiday Inn

Express Essen, and our joint venture

interest in Holiday Inn Burswood for

over $140 million – 22 per cent above net

book value – and retained management

or franchise agreements on each.

Staybridge Suites Cherry Creek and

Holiday Inn Atlanta-Gwinnett Place were

sold to Summit Hotel Properties, Inc.,

which will spend $2.5 million on

improvements.

SUPPORTIVE LONG-TERM TRENDS

We continue to out-perform with revenue

per available room (RevPAR) growth in

the year of 6.2 per cent compared to

5.9 per cent for the global industry. Global

room demand exceeded pre-recession

levels, breaking new records in the US

– our biggest market – since March.

Coupled with low supply growth, this

helped to boost both room night

occupancy and rate.

In the short-term, the future rate of growth

in the global economy – particularly in

the Eurozone – is uncertain. Looking to

the long-term, the prospects for the

sector remain bright due to supportive

trends including growing affluence in

many parts of the world, increased

urbanisation in developing economies,

growth in air travel, and changing

demographics.

STRONG BALANCE SHEET

In November, we completed the early

refinancing of our committed bank facility

given that the corporate lending markets

continue to be challenging. The new

five-year $1.07 billion facility demonstrated

our bank syndicate’s confidence in the

business and complements a £250 million

bond issued in 2009. At the end of 2011,

the new facility remained substantially

undrawn providing us with the ability

to continue to invest in the development

of the business and deal with any

economic downturn.

more on the web: www.ihgplc.com How we operate 25

OVERVIEW GREAT BRANDS HOW WE OPERATE WHERE WE OPERATE FACTS AND FIGURES

Glenn Squires

2012 Chairman

IHG Owners Association

For information on the

IHG Owners Association,

go to www.owners.org

2011 will always be noted as the year

the IHG Owners Association changed

its name. From IAHI, the Owners’

Association to IHG Owners Association.

While that change may not look

significant from the outside, to the

leaders of this organisation and to our

IHG partners, it signifies our partnership

in a way that our old name did not.

Our new name reflects our representation

of IHG brands across the globe. The

former name stood for International

Association of Holiday Inns, and since

the mid-1980s, we have represented

more than just that one brand. Now our

name reflects the breadth of work the

Association fosters on behalf of all

owners. We are deeply grateful to

Bill DeForrest, our immediate past

chairman, for his passion to move our

rebranding forward.

Reflecting on the past year, I see it as a

year of strengthened alignment with IHG

to better serve our owners. Our volunteer

leaders and our IHG partners operate

from a shared foundation of mutual

respect and a shared understanding

that our decisions have real impact

for every hotel and owner worldwide.

We are aligned to improve return on

investment and the value of our assets

while growing shareholder value.

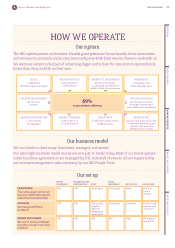

Aligning our global view

‘Where we compete’

Appropriate business model

Relevant consumer segments

Best developed and emerging markets

‘How we win’

Portfolio of preferred brands

Best-in-class delivery

Talented people

…achieved through strategic priorities

Growing our core business in the largest

markets where scale really counts, and also in

key global gateway cities and resort destinations

Seeking opportunities to leverage our scale

in new business areas

Profitable market share

Progressive margins

Sustainable investment

Responsible business

With a portfolio of preferred brands in the best developed and emerging markets,

our talented people are focused on delivering Great Hotels Guests Love and executing a clear

set of priorities to achieve our Vision of becoming one of the great companies of the world…