HP 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

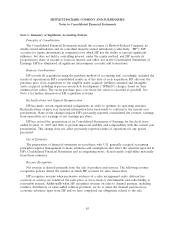

Note 1: Summary of Significant Accounting Policies (Continued)

SFAS No. 123 (revised 2004) ‘‘Share-Based Payment’’ (‘‘SFAS 123R’’). HP recognizes these

compensation costs net of an estimated forfeiture rate, and recognizes compensation cost for only those

shares expected to vest on a straight-line basis over the requisite service period of the award, which is

generally the option vesting term of four years. HP estimated the forfeiture rate based on its historical

experience for fiscal grant years where the majority of the vesting terms have been satisfied.

HP adopted the alternative transition method provided in the Financial Accounting Standards

Board Staff Position No. FAS 123(R)-3, ‘‘Transition Election Related to Accounting for Tax Effects of

Share-Based Payment Awards’’ (‘‘FSP 123R-3’’) for calculating the tax effects of stock-based

compensation pursuant to SFAS 123R. The alternative transition method includes simplified methods to

establish the beginning balance of the additional paid-in capital pool (‘‘APIC pool’’) related to the tax

effects of employee stock-based compensation, and to determine the subsequent impact on the APIC

pool and Consolidated Statements of Cash Flows of the tax effects of employee stock-based

compensation awards that are outstanding upon adoption of SFAS 123R. See Note 2 for a further

discussion on stock-based compensation.

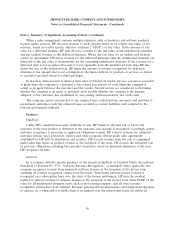

Foreign Currency Transactions

HP uses the U.S. dollar predominately as its functional currency. Assets and liabilities

denominated in non-U.S. dollars are remeasured into U.S. dollars at current exchange rates for

monetary assets and liabilities, and historical exchange rates for nonmonetary assets and liabilities. Net

revenue, cost of sales and expenses are remeasured at average exchange rates in effect during each

period, except for those net revenue, cost of sales and expenses related to the previously noted balance

sheet amounts, which HP remeasures at historical exchange rates. HP includes gains or losses from

foreign currency remeasurement in net earnings. Certain foreign subsidiaries designate the local

currency as their functional currency, and HP records the translation of their assets and liabilities into

U.S. dollars at the balance sheet dates as translation adjustments and includes them as a component of

accumulated other comprehensive income (loss).

Retirement and Post-Retirement Plans

HP has various defined benefit, other contributory and noncontributory retirement and

post-retirement plans. In addition, HP has assumed additional retirement and post-retirement plans in

connection with its acquisition of Electronic Data Systems Corporation (‘‘EDS’’) in August 2008. HP

generally amortizes unrecognized actuarial gains and losses on a straight-line basis over the remaining

estimated service life of participants. The measurement date for all HP plans is September 30 for fiscal

2008 and fiscal 2007. The measurement date for all EDS plans for fiscal 2008 is October 31. See

Note 15 for a full description of these plans and the accounting and funding policies, which is

incorporated herein by reference.

Recent Pronouncements

As previously reported in HP’s 2007 Annual Report on Form 10-K, HP recognized the funded

status of its benefit plans at October 31, 2007 in accordance with the recognition provisions of

Statement of Financial Accounting Standards (‘‘SFAS’’) No. 158, ‘‘Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans—An Amendment of Financial Accounting Standards

Board (‘‘FASB’’) Statements No. 87, 88, 106 and 132(R)’’ (‘‘SFAS 158’’). In addition to the recognition

92