HP 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

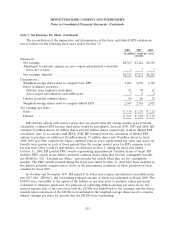

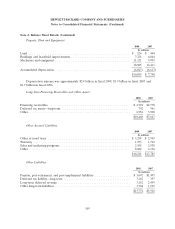

Note 3: Net Earnings Per Share (Continued)

The reconciliation of the numerators and denominators of the basic and diluted EPS calculations

was as follows for the following fiscal years ended October 31:

2008 2007 2006

In millions, except per share

amounts

Numerator:

Net earnings ............................................. $8,329 $7,264 $6,198

Adjustment for interest expense on zero-coupon subordinated convertible

notes, net of taxes .......................................377

Net earnings, adjusted ...................................... $8,332 $7,271 $6,205

Denominator:

Weighted-average shares used to compute basic EPS ................ 2,483 2,630 2,782

Effect of dilutive securities:

Dilution from employee stock plans ........................... 81 78 62

Zero-coupon subordinated convertible notes ....................388

Dilutive potential common shares .............................. 84 86 70

Weighted-average shares used to compute diluted EPS ............... 2,567 2,716 2,852

Net earnings per share:

Basic ................................................... $ 3.35 $ 2.76 $ 2.23

Diluted ................................................. $ 3.25 $ 2.68 $ 2.18

HP excludes options with exercise prices that are greater than the average market price from the

calculation of diluted EPS because their effect would be anti-dilutive. In fiscal 2008, 2007 and 2006, HP

excluded 54 million shares, 60 million shares and 130 million shares, respectively, from its diluted EPS

calculation. Also, in accordance with SFAS 123R, HP excluded from the calculation of diluted EPS

options to purchase an additional 28 million shares, 33 million shares and 48 million shares in fiscal

2008, 2007 and 2006, respectively, whose combined exercise price, unamortized fair value and excess tax

benefits were greater in each of those periods than the average market price for HP’s common stock

because their effect would be anti-dilutive. As disclosed in Note 2, during the fiscal year ended

October 31, 2008, HP granted PRU awards representing approximately 9 million shares at target. HP

includes PRU awards in the dilutive potential common shares when they become contingently issuable

per SFAS No. 128, ‘‘Earnings per Share,’’ and excludes the awards when they are not contingently

issuable. The PRU awards granted during the fiscal year ended October 31, 2008 have been included in

the dilutive potential common shares above as the performance conditions of those awards have been

satisfied for fiscal 2008.

In October and November 1997, HP issued U.S. dollar zero-coupon subordinated convertible notes

due 2017 (the ‘‘LYONs’’), the outstanding principal amount of which was redeemed in March 2008. The

LYONs were convertible at the option of the holders at any time prior to maturity, unless previously

redeemed or otherwise purchased. For purposes of calculating diluted earnings per share above, the

interest expense (net of tax) associated with the LYONs was added back to net earnings, and the shares

issuable upon conversion of the LYONs were included in the weighted-average shares used to compute

diluted earnings per share for periods that the LYONs were outstanding.

103