HP 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

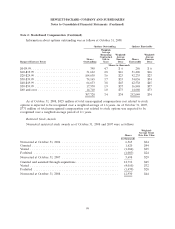

Note 2: Stock-Based Compensation (Continued)

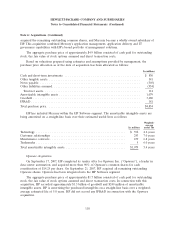

The details of restricted stock awards granted and assumed through acquisitions were as follows:

2008 2007 2006

Weighted- Weighted- Weighted-

Average Grant Average Grant Average Grant

Date Fair Date Fair Date Fair

Shares Value Shares Value Shares Value

In thousands In thousands In thousands

Granted and assumed

through acquisitions:

Restricted stock ....... 1,393 $46 1,469 $43 1,492 $32

Restricted stock units . . 11,319 $45 151 $45 33 $30

12,712 $45 1,620 $44 1,525 $32

In fiscal 2008, approximately 11 million restricted stock units with a weighted-average grant date

fair value of $45 were assumed through the acquisition of EDS.

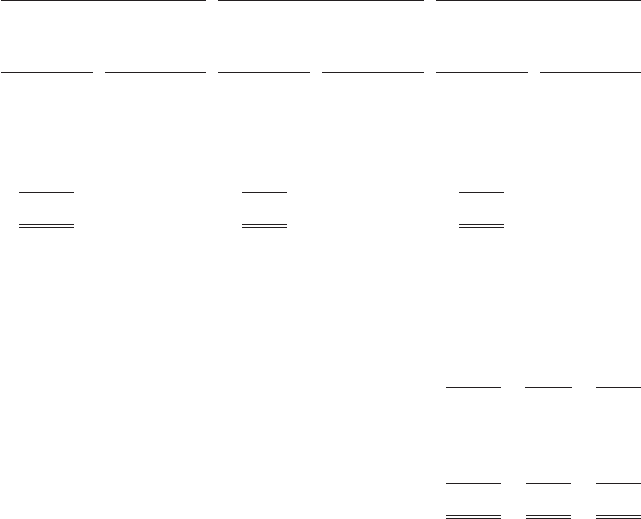

The details of non-vested restricted stock awards at fiscal year end were as follows:

2007

2008 Shares 2006

In thousands

Nonvested at October 31:

Restricted stock ............................................ 2,835 4,763 5,492

Restricted stock units ........................................ 10,095 935 873

12,930 5,698 6,365

As of October 31, 2008, there was $263 million of unrecognized stock-based compensation expense

related to nonvested restricted stock awards. That cost is expected to be recognized over a weighted-

average period of 1.2 years. As of October 31, 2007, there was $83 million of unrecognized stock-based

compensation expense related to nonvested restricted stock awards. That cost is expected to be

recognized over a weighted-average period of 1.0 years.

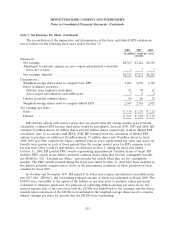

Performance-based Restricted Units

HP estimated the fair value of a target PRU share using the Monte Carlo simulation model, as the

TSR modifier contains a market condition. The estimated fair value of each target share for the

current year was $40.21. The estimated fair value of a target share for the second and third years of the

three-year performance period will be determined when the cash flow performance goal is set for each

of the next two annual performance periods and the expense will be amortized over the remainder of

the three-year performance period. The estimated expense, net of forfeitures, is based on the Monte

Carlo fair value and is updated for the achievement of the cash flow performance goal for that year at

the end of each reporting period.

100