HP 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

HPFS earnings from operations as a percentage of net revenue increased by 0.5 percentage points

in fiscal 2008 from fiscal 2007 due primarily to a decrease in operating expenses as a percentage of net

revenue and increased margin on end-of lease activity, the effect of which was offset by higher bad debt

expenses and lower portfolio margins due to higher operating leases in the portfolio asset mix. The

operating expense decrease as a percentage of revenue is driven by a higher rate of increase in

revenues relative to operating expenses due to higher operating lease mix of the portfolio and

continued cost controls.

HPFS net revenue increased by 12.4% in fiscal 2007 from fiscal 2006. The net revenue increase

was due primarily to operating lease growth and higher end-of-lease activity. The financing lease

growth and increased used equipment sales, to a lesser extent, also contributed to the revenue growth.

HPFS earnings from operations as a percentage of net revenue decreased by 0.5 percentage point

in fiscal 2007 from fiscal 2006 due primarily to a decrease in gross margin, which was partially offset by

a decrease in operating expense as a percentage of net revenue. The gross margin decrease was driven

primarily by increased bad debt expenses and lower bad debt recoveries, as well as lower margins on

leases and used equipment sales. The decline in operating expenses as a percentage of net revenue was

due to continued cost controls.

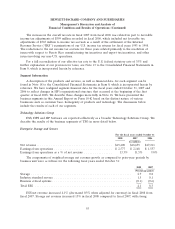

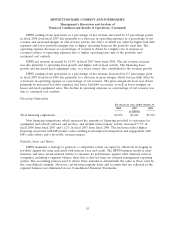

Financing Originations

For the fiscal years ended October 31

2008 2007 2006

In millions

Total financing originations ............................. $4,872 $4,441 $3,994

New financing originations, which represent the amounts of financing provided to customers for

equipment and related software and services, and include intercompany activity, increased 9.7% in

fiscal 2008 from fiscal 2007 and 11.2% in fiscal 2007 from fiscal 2006. The increases reflect higher

financing associated with HP product sales resulting from improved integration and engagement with

HP’s sales efforts and a favorable currency impact.

Portfolio Assets and Ratios

HPFS maintains a strategy to generate a competitive return on equity by effectively leveraging its

portfolio against the risks associated with interest rates and credit. The HPFS business model is asset-

intensive and uses certain internal metrics to measure its performance against other financial services

companies, including a segment balance sheet that is derived from our internal management reporting

system. The accounting policies used to derive these amounts is substantially the same as those used by

the consolidated company. However, certain intercompany loans and accounts that are reflected in the

segment balances are eliminated in our Consolidated Financial Statements.

63