HP 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 12: Borrowings (Continued)

The maximum amount of commercial paper that HP may issue at any time through this program is

$10.4 billion less the total principal amount of all other outstanding commercial paper that HP has

issued. HP will be unable to issue commercial paper under the program after April 30, 2009. As of

October 31, 2008, HP had not issued any commercial paper under the CPFF program.

HP has a $2.9 billion five-year credit facility, expiring in May 2012. In February and July 2008, HP

entered into additional 364-day credit facilities of $3.0 billion and $8.0 billion, respectively.

Commitment fees, interest rates and other terms of borrowing under the credit facilities vary based on

HP’s external credit ratings. The credit facilities are senior unsecured committed borrowing

arrangements primarily to support the issuance of U.S. commercial paper. No amounts are outstanding

under the credit facilities. Under the terms of the July 2008 $8.0 billion 364-day credit facility, the

amount of credit available declines in an amount equal to the proceeds of any future issuance of

long-term debt by HP. On December 5, 2008, HP issued $2.0 billion of global notes under the 2006

Shelf Registration Statement, which resulted in a reduction in the amount of credit available under the

July 2008 credit facility to $6.0 billion.

HP also maintains uncommitted lines of credit from a number of financial institutions that are

available through various foreign subsidiaries. The amount available for use as of October 31, 2008 was

approximately $1.2 billion. Included in Other, including capital lease obligations, are borrowings that

are collateralized by certain financing receivable assets. As of October 31, 2008, the carrying value of

the assets approximated the carrying value of the borrowings of $6.1 million.

At October 31, 2008, HP had up to approximately $11.6 billion of available borrowing resources,

including $1.0 billion under the 2002 Shelf Registration Statement and approximately $10.6 billion

under other programs. HP also may issue an unlimited amount of additional debt securities, common

stock, preferred stock, depositary shares and warrants under the 2006 Shelf Registration Statement. HP

was unable to issue any additional securities under the 2002 Shelf Registration Statement as of

December 1, 2008.

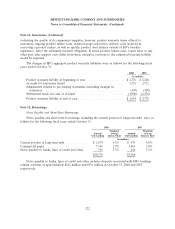

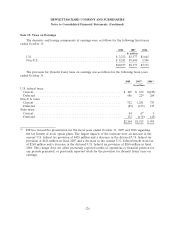

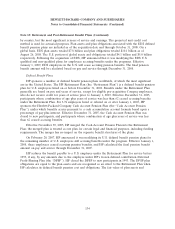

Aggregate future maturities of long-term debt at face value (excluding the fair value adjustment

related to SFAS 133 of $78 million and premium on debt issuance of $1 million) were as follows at

October 31, 2008:

2009 2010 2011 2012 2013 Thereafter Total

In millions

Aggregate future maturities of debt

outstanding including capital lease

obligations .................... $2,682 $1,068 $45 $2,061 $2,704 $1,711 $10,271

Interest expense on borrowings was approximately $467 million in fiscal 2008, $531 million in fiscal

2007, and $336 million in fiscal 2006.

125