HP 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

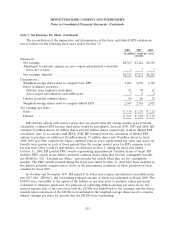

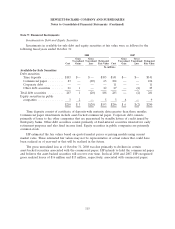

Note 7: Goodwill and Purchased Intangible Assets (Continued)

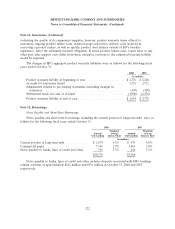

Estimated future amortization expense related to finite-lived purchased intangible assets at

October 31, 2008 was as follows:

Fiscal year: In millions

2009 ................................................................ $1,495

2010 ................................................................ 1,326

2011 ................................................................ 1,027

2012 ................................................................ 833

2013 ................................................................ 692

Thereafter ............................................................ 1,167

Total ................................................................ $6,540

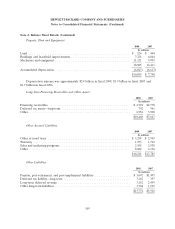

Note 8: Restructuring Charges

Fiscal 2008 Restructuring Plan

In connection with the acquisition of EDS on August 26, 2008, HP’s management approved and

initiated a restructuring plan to streamline the combined company’s services business and to better

align the structure and efficiency of that business with HP’s operating model. The restructuring plan is

expected to be implemented over the next four years and will include changes to the combined

company’s workforce as well as changes to corporate overhead functions, such as real estate, IT and

procurement. As part of the restructuring plan, HP expects to eliminate approximately 24,700 positions.

In the fourth quarter of fiscal 2008, HP recorded a liability of approximately $1.8 billion related to

the restructuring plan. Approximately $1.5 billion of the liability was associated with pre-acquisition

EDS and was recorded to goodwill, and the remaining approximately $0.3 billion was associated with

HP and was recorded as a restructuring charge. The liability consisted mainly of severance costs, costs

to vacate duplicate facilities and costs associated with early termination of certain contractual

obligations. As of October 31, 2008, approximately 2,300 positions had been eliminated.

HP expects the restructuring costs to be paid out through 2012 with the majority paid out by the

end of fiscal 2009. In future quarters, HP expects to record an additional charge of approximately

$280 million related to severance costs for approximately 2,700 employees and the cost to vacate

duplicate facilities.

All restructuring costs associated with pre-acquisition EDS are reflected in the purchase price of

EDS in accordance with EITF 95-3, ‘‘Recognition of Liabilities in Connection with a Purchase Business

Combination.’’ These costs are subject to change based on the actual costs incurred. Changes to these

estimates could increase or decrease the amount of the purchase price allocated to goodwill.

Prior Fiscal Year Plans

Restructuring plans initiated in fiscal years 2007, 2005, 2003, 2002 and 2001 are substantially

complete, although HP records minor revisions to previous estimates as necessary. During fiscal 2008,

HP recorded a net charge of $24 million due primarily to adjustments for severance and facilities costs

associated with these prior-year plans. As of October 31, 2008, there was a remaining balance of

113