HP 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

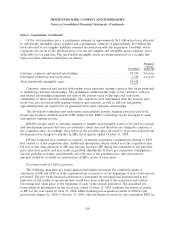

Note 6: Acquisitions (Continued)

Of the total purchase price, a preliminary estimate of approximately $4.5 billion has been allocated

to amortizable intangible assets acquired and a preliminary estimate of approximately $1.9 billion has

been allocated to net tangible liabilities assumed in connection with the acquisition. Goodwill, which

represents the excess of the purchase price over the net tangible and intangible assets acquired, is not

deductible for tax purposes. The amortizable intangible assets are being amortized on a straight line

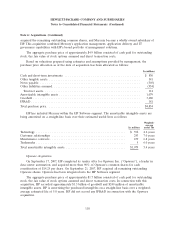

basis over their estimated useful lives as follows:

Weighted-

average

In millions useful life

Customer contracts and related relationships .......................... $3,199 8.0 years

Developed technology and trade name ............................... 1,349 4.6 years

Total amortizable intangible assets .................................. $4,548

Customer contracts and related relationship assets represent existing contracts that relate primarily

to underlying customer relationships. The preliminary estimated fair value of the customer contracts

and related relationships represents the sum of the present value of the expected cash flows

attributable to those customer relationships. The cash flows were determined from the revenue and

profit forecasts associated with existing contracts and renewals, as well as add-ons and growth

opportunities that are expected to be generated from these customer relationships.

The developed technology and trade name assets include patents, business processes and tools,

proprietary business methods and the EDS family brand. EDS’s technology can be leveraged to assist

and improve existing services.

IPR&D charges relate to amounts assigned to tangible and intangible assets to be used in research

and development projects that have no alternative future use and therefore are charged to expense at

the acquisition date. Accordingly, the portion of the purchase price allocated to in-process research and

development was charged to expense in HP’s fiscal quarter ended October 31, 2008.

HP has evaluated and continues to evaluate certain pre-acquisition contingencies relating to EDS

that existed as of the acquisition date. Additional information, which existed as of the acquisition date

but was at that time unknown to HP, may become known to HP during the remainder of the purchase

price allocation period, and may result in goodwill adjustments. If these pre-acquisition contingencies

become probable in nature and estimable after the end of the purchase price allocation period,

amounts would be recorded for such matters in HP’s results of operations.

Pro forma results for EDS acquisition

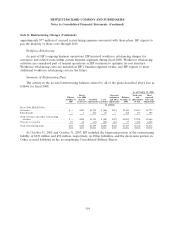

The following unaudited pro forma financial information presents the combined results of

operations of HP and EDS as if the acquisition had occurred as of the beginning of each of the periods

presented. The pro forma financial information is presented for informational purposes and is not

indicative of the results of operations that would have been achieved if the acquisition and related

borrowings had taken place at the beginning of each of the periods presented. The unaudited pro

forma financial information for the fiscal year ended October 31, 2008 combines the historical results

of HP for the year ended October 31, 2008, which includes post-acquisition results of EDS for the

period from August 26, 2008 to October 31, 2008, with the historical results for pre-acquisition EDS for

108