HP 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

LIQUIDITY

As previously discussed, we use cash generated by operations as our primary source of liquidity; we

believe that internally generated cash flows are generally sufficient to support business operations,

capital expenditures and the payment of stockholder dividends, in addition to a level of discretionary

investments and share repurchases. We are able to supplement this near-term liquidity, if necessary,

with broad access to capital markets and credit line facilities made available by various foreign and

domestic financial institutions.

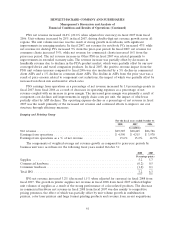

We maintain debt levels that we establish through consideration of a number of factors, including

cash flow expectations, cash requirements for operations, investment plans (including acquisitions),

share repurchase activities, and our overall cost of capital. Outstanding debt increased to $17.9 billion

as of October 31, 2008 as compared to $8.2 billion at October 31, 2007, bearing weighted-average

interest rates of 3.9% and 5.2%, respectively. Short-term borrowings increased to $10.2 billion at

October 31, 2008 from $3.2 billion at October 31, 2007. The increase in short-term borrowings was due

primarily to the net issuance of approximately $5.0 billion of our commercial paper, including

$9.9 billion of commercial paper issued to fund the acquisition of EDS, and the reclassification from

long-term to short-term debt, including $1.0 billion in global notes that will mature in June 2009,

$750 million in global notes that will mature in September 2009 and $700 million in senior notes that

will mature in October 2009. During fiscal 2008, we issued $40.0 billion and repaid $34.9 billion of

commercial paper. Long-term debt increased to $7.7 billion at October 31, 2008 from $5.0 billion at

October 31, 2007. The increase in long-term debt was due primarily to the issuance of an aggregate of

$3.0 billion in global notes in March 2008 and the assumption of $2.6 billion of debt in connection with

the EDS acquisition, the effect of which was offset by the repayment of $500 million in global notes at

maturity in March 2008, the repayment of $50 million of Series A Medium-Term Notes at maturity in

December 2007, the redemption of approximately $377 million in zero-coupon subordinated convertible

notes in March 2008 and the reclassifications from long-term to short-term debt. As of October 31,

2008, we had $6.1 million in total borrowings collateralized by certain financing receivable assets.

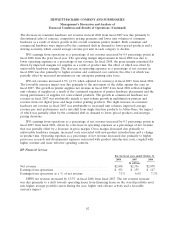

As of October 31, 2008, a significant portion of our outstanding debt is related to HPFS. We issue

debt in order to finance HPFS and as needed for other purposes, including acquisitions. HPFS has a

business model that is asset-intensive in nature and therefore we fund HPFS more by debt than we

fund our other business segments. At October 31, 2008, HPFS had approximately $8.1 billion in net

portfolio assets, which included short- and long-term financing receivables and operating lease assets.

See Note 12 to the Consolidated Financial Statements, which is incorporated herein by reference,

for additional information about our borrowings.

69